S&P 500 Trading Considerations For December 13, 2017

The S&P 500 (INDEXSP:.INX) is holding support levels as traders prepare for the Federal Reserve’s rate announcement. Buyers are in control but momentum is weakening. In the commentary below I break down the trading setups for S&P 500 and Nasdaq futures indices along with crude oil.

You can access today’s economic calendar with a full rundown of releases.

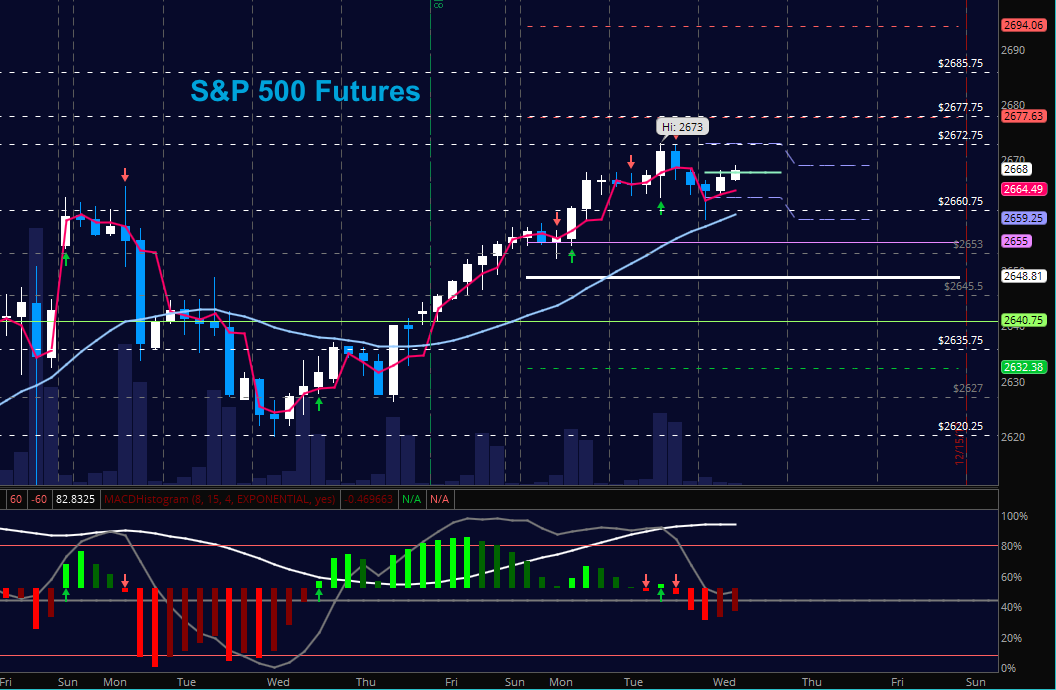

S&P 500 Futures

Fed meeting ends today with a press release at 2:30pm eastern. More new highs yesterday but a fade into higher support greets us in the morning trading. Buyers have power and continue the march up under momentum that is a bit weaker than yesterday. Support now sits near 2660 with 2653 below that. The bullets below represent the likely shift of trading momentum at the positive or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 2667.75

- Selling pressure intraday will likely strengthen with a failed retest of 2654.5 (countertrend)

- Resistance sits near 2667.75 to 2673, with 2677.75 and 2685.5 above that.

- Support holds between 2655.5 and 2648.25, with 2641.5 and 2635.5 below that.

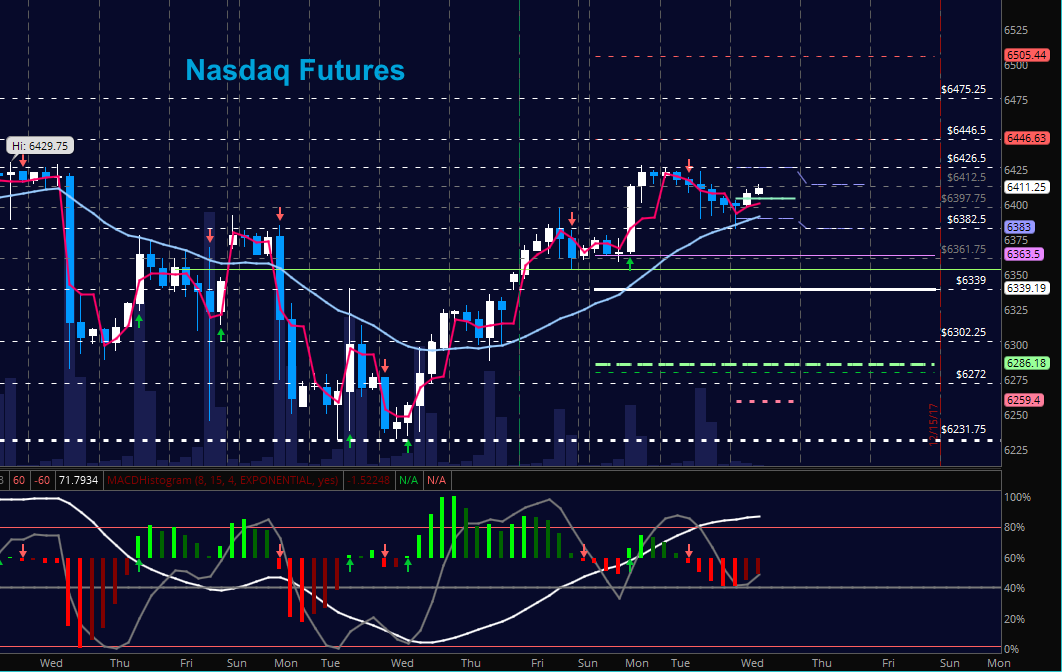

NASDAQ Futures

This chart faded off the highs in an example of potential trapped buyers leaving this one. Support tests in the early morning took us to the breakout levels near 6382.5 before buyers returned to force us back into congestion of the 6408 region. Formations are still messy but bullish overall. Deep fades should bring value players to the table. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 6412.5

- Selling pressure intraday will likely strengthen with a failed retest of 6380.5

- Resistance sits near 6414.5 to 6425.5 with 6448.25 and 6475.75 above that.

- Support holds near 6400.5 and 6383.75, with 6361.75 and 6339.75 below that.

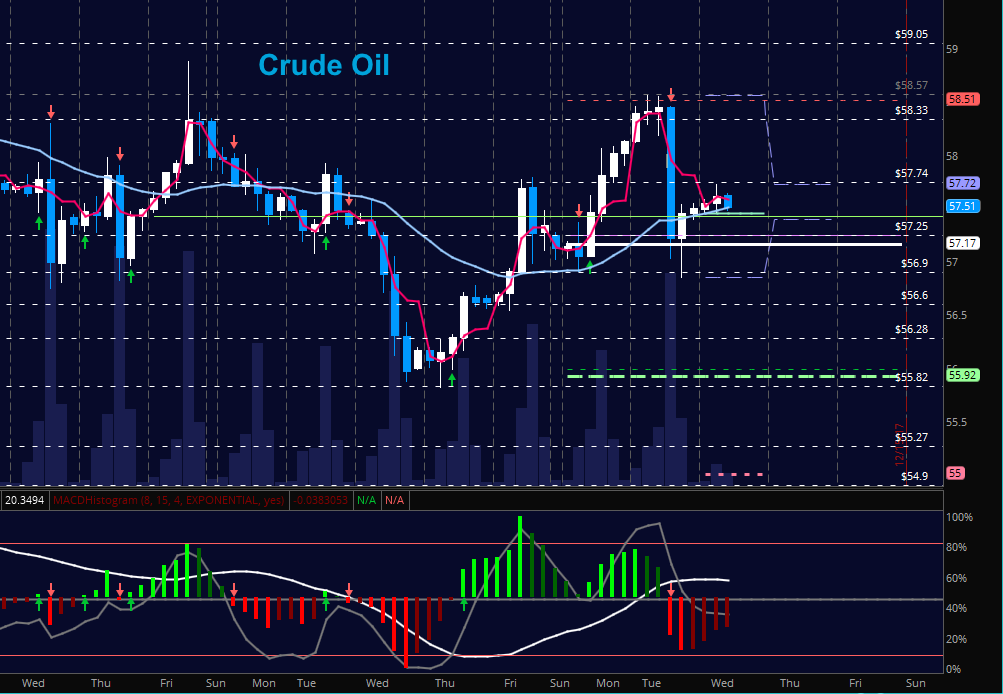

WTI Crude Oil

Sharp dips were expected under the momentum present (see yesterday’s post) with likely recovery in the bullish environment. Momentum is still messy and we struggle here at resistance near 57.7. The bullets below represent the likely shift of trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 57.9

- Selling pressure intraday will strengthen with a failed retest of 56.9

- Resistance sits near 57.8 to 58.37, with 58.8 and 59.06 above that.

- Support holds near 57.04 to 56.9, with 56.6. and 56.28 below that.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.