U.S. March corn futures closed down 6 cents per bushel week on week, finishing at 3.53.

Bulls still have some breathing room off the lows but they will need to change the fundamental backdrop for any further upside to develop.

Let’s discuss what’s happening in the corn market and review the week ahead.

Weekly review, news, and highlights for the week ahead – December 11

- U.S. corn export inspections were 23.1 million bushels for the week ending 11/30/17. Last year during the same week U.S. corn inspections totaled 46.6 million bushels. Crop year-to-date corn inspections improved to 309.4 million bushels versus 541.4 million bushels in 2016/17 (-43% versus last crop year). Next Tuesday, December 12th, the USDA will release its December 2017 WASDE report. Traders will be waiting to see if the USDA lowers its 2017/18 U.S. corn export estimate of 1,925 million bushels, which surprisingly was raised 75 million bushels in the November report. U.S. corn inspections and sales continue to trail the pace necessary to achieve the USDA’s current export forecast. In fact as of the end of November, 2017/18 U.S. corn export sales are tracking nearly identical to the pattern established in 2014/15. For what it’s worth 2014/15 U.S. corn exports totaled 1,867 million bushels.

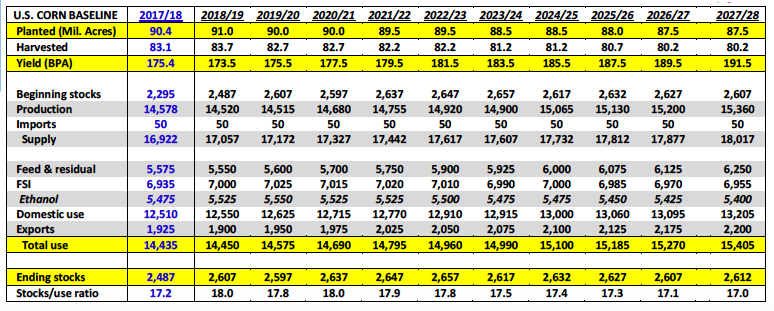

- Upon further review the USDA’s “BASELINE” U.S. Corn S&D forecast through 207/28, which was released last week, highlighted once again several real challenges going forward for Corn Bulls (full S&D is below). Some key takeaways:

- The USDA does expect there to be some contraction in planted acreage beginning in 2019/20; with acreage eventually falling to 87.5 million by 2026/27. I’ve been suggesting for quite some time that the current U.S. corn demand profile no longer necessitates 90+ million corn acres.

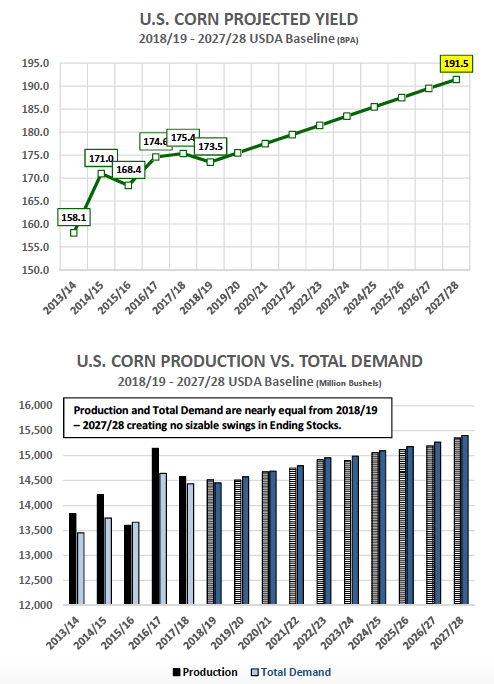

- The USDA remains optimistic on U.S. corn yields continuing to improve. They are projecting a national corn yield of 191.5 bushels per acre by 2027/28. Who can dispute this possibility following 4-consecutive crop years of U.S. corn yields averaging 172.4 BPA? If anything I believe an argument could be made that the USDA is being conservative at 191.5 bpa by 2027/28.This crop year, more than any other over the last four, has shown just how durable the corn plant has become relative to its ability to optimize yield potential even under less than ideal summer growing conditions.

- The USDA did not offer a U.S. corn ending stocks estimate below 2.597 billion bushels at any point from 2018/19 – 2027/28. This was without question the biggest blow to Corn Bulls. What this reinforced was the USDA’s view that future demand growth will be extremely limited. In fact the USDA actually projected U.S. corn-ethanol demand decreasing to 5.4 billion bushels by 2027/28, which would be 75 million bushels less than the current crop year (2017/18).

Therefore my overall assessment on the USDA’s Baseline S&D forecast is this… even with future planted acreage reductions, the continued improvement in U.S. corn yields is expected to fully offset total U.S. corn demand increases (production = demand). This in turn creates an environment where U.S. corn ending stocks are essentially able to roll forward at nearly the same level.

What’s the perceived market impact on corn futures prices? This suggests that if the U.S. corn market is to experience a future Bullish “shock” to ending stocks it will likely stem from a supply-side variable (sharply below-trend U.S. corn yield). That said, given the size of 2017/18 U.S. corn crop has already largely been determined, traders will now have until approximately April 2018 before they really concern themselves with the prospects for the 2018/19 U.S. corn crop. This then is likely to lead to narrow, range-bound markets with historically low price ceilings for the next several months.

CH8 March Corn Futures Short-Term Trading Outlook:

March corn futures closed down 6-cents per bushel week-on-week, finishing at $3.52 ¾ on Friday afternoon. Corn futures continue to face steep, overhead price resistance due to burdensome supplies, as well as, the lack of a compelling export market. The one bright spot for Corn Bulls was the EIA reporting a new record high weekly U.S. ethanol production figure of 1.108 MMbpd for the week ending 12/1/2017. However strong corn-ethanol demand alone isn’t likely to trigger short-term rallies over key price resistance with U.S. corn ending stocks still sitting comfortably at a 30-year high of 2.487 billion bushels. Thus far the 35-day moving average in March corn futures at $3.573 has proven itself a stopper on upward recovery attempts. I look for that pattern to continue into next week. Thanks for reading.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

Data References:

- USDA United States Department of Ag

- EIA Energy Information Association

- NASS National Agricultural Statistics Service