Stock Market Futures Trading Considerations For December 4, 2017

The S&P 500 (INDEXSP:.INX) and Nasdaq (INDEXNASDAQ:.IXIC) are rallying higher on Monday morning. In the commentary below I break down both futures indices along with crude oil.

Note that you can access today’s economic calendar with a full rundown of releases.

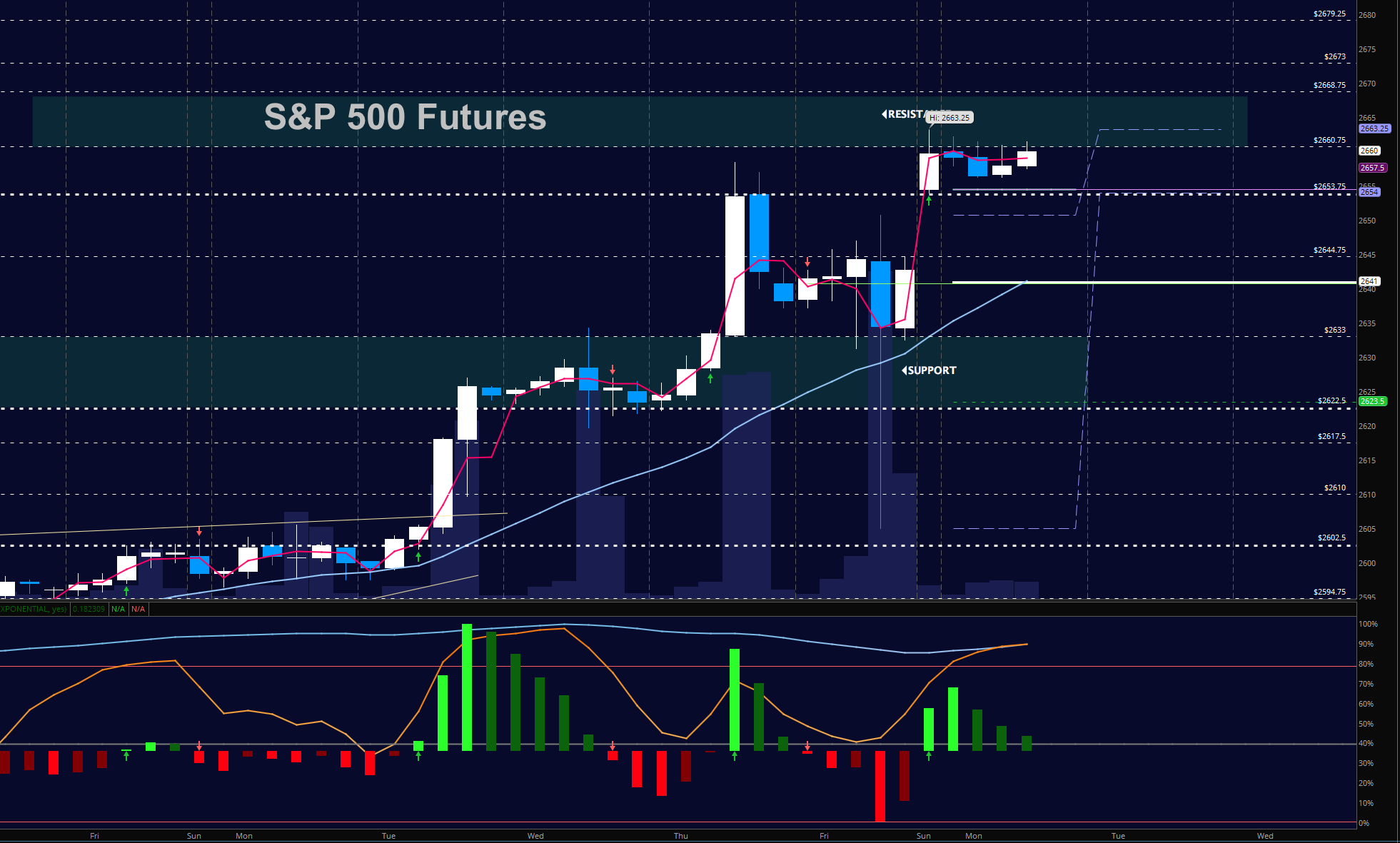

S&P 500 Futures

Range expansions show breakouts continuing as a premarket test of the breakout level near 2653. We should continue to fade off new highs and hold lows, but the charts look quite extended in short-term so they need a rest. As long as new support holds near 2633, we should have bullish action continue overall. If we fade below that, an intraday bearish motion could follow but buyers continue to be rewarded by engaging at deep support. The bullets below represent the likely shift of trading momentum at the positive or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen above a positive retest of 2653.5

- Selling pressure intraday will likely strengthen with a failed retest of 2644.5

- Resistance sits near 2653.5 to 2660.5, with 2668.5 and 2679.25 above that.

- Support holds between 2650.5 and 2641, with 2633.5 and 2622.5 below that.

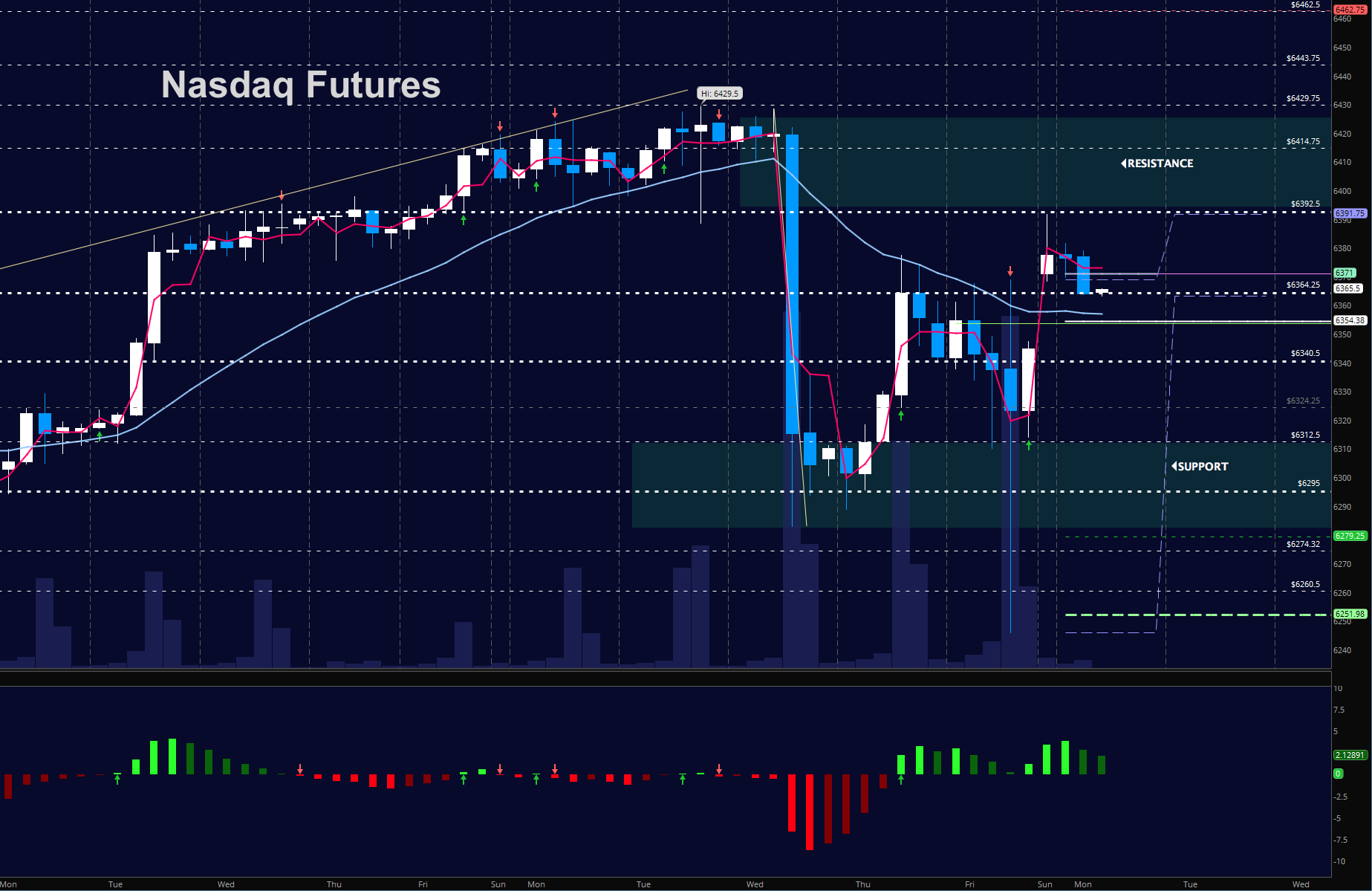

NASDAQ Futures

Nasdaq weakness continues relative to the other indices but undercurrents are still somewhat bullish as traders try to recover from the dip last week. Support tests near 6312 will now tell the tail as well as a failure to hold 6360. Deep dips will still find buyers. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 6378.5

- Selling pressure intraday will likely strengthen with a failed retest of 6347.5

- Resistance sits near 6378.5 to 6391.5 with 6414.75 and 6429.75 above that.

- Support holds near 6340.5 and 6324.75, with 6296.25 and 6252.5 below that.

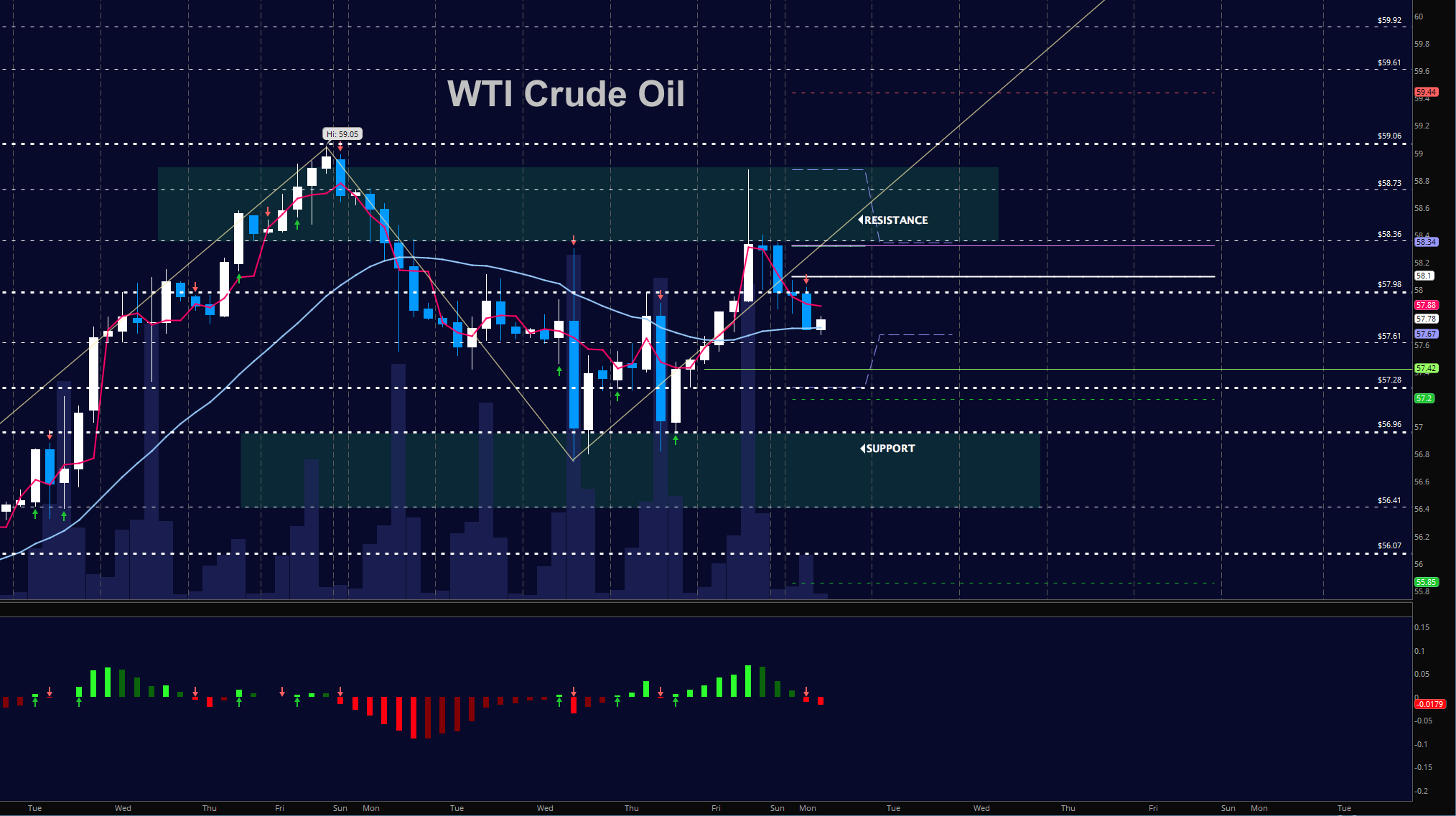

WTI Crude Oil

Oil traders are trapping price in a congestion zone from 56.98 to 58.36. The level near 57.65 seems to be gathering steam as support. We should resume the move upward, with a support that needs to hold near 57 to keep the premise of further upside intact. The bigger undercurrent is still bullish but currently weakening. The bullets below represent the likely shift of trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 58.12

- Selling pressure intraday will strengthen with a failed retest of 57.4

- Resistance sits near 57.98 to 58.12, with 58.36 and 58.78 above that.

- Support holds near 57.53 to 57.2, with 56.96 and 56.37 below that.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.