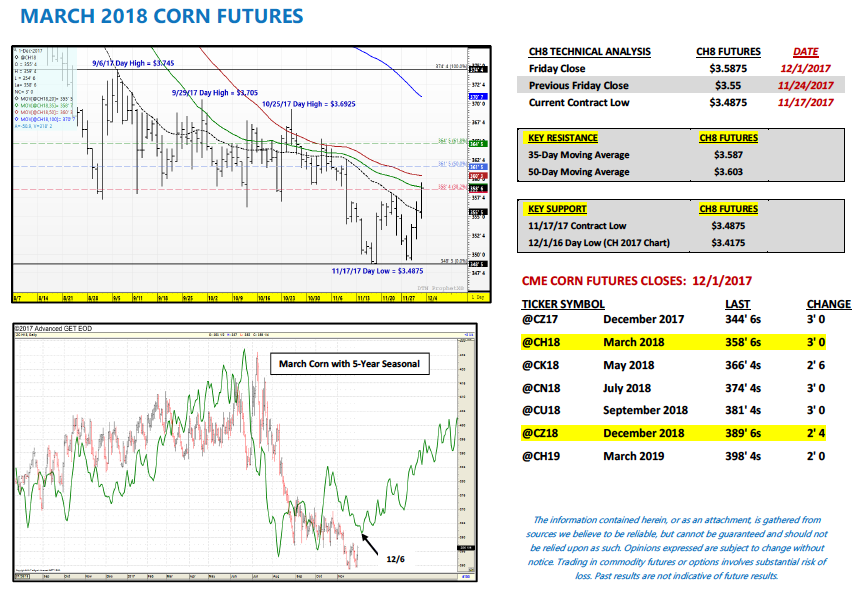

U.S. March corn futures are showing some signs of life… but is this simply a relief bounce from oversold conditions?

Prices rose last week, giving bulls some breathing room. But they will need to change the fundamental picture for an rally to have staying power.

Let’s discuss what’s happening in the corn market and review the week ahead.

Weekly review, news, and highlights for the week ahead – December 4

- Monday’s Weekly Crop Progress report showed the U.S. corn harvest improving to 95% complete as of November 26th, which compares to 98% a year ago and the 5-year average of 98%. HOWEVER three of the top twelve U.S. corn producing states still had at least 14% or more of their state corn harvests yet to be completed. Michigan was 84% harvested versus its 5-year average of 88% (suggesting 400,000 corn acres remained unharvested based on the USDA’s June 30th Planted Acreage estimates). Ohio was 87% harvested versus its 5-year average of 96% (455,000 acres unharvested). And Wisconsin was 81% harvested versus its 5-year average of 90% (769,500 acres unharvested). Therefore those 3-states combined still had approximately 1.6 million corn acres needing to be picked with the calendar rapidly approaching the first week of December. That said this should still not be considered an insurmountable task given the extended forecast. Sharply above-normal temperatures have been offered for the Upper Midwest through December 7th with daytime highs in several sections of Wisconsin approaching the upper 40’s during that timeframe.

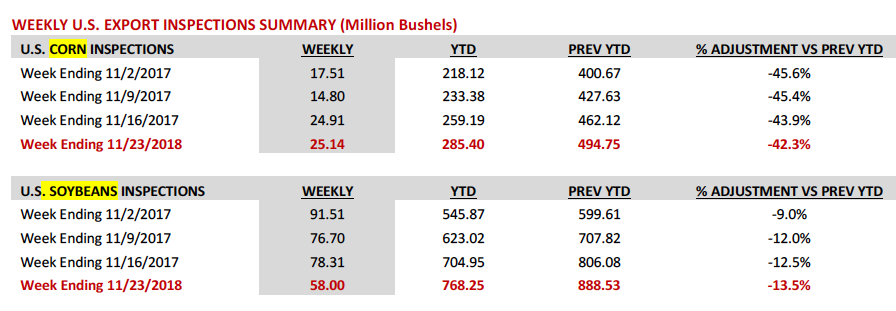

- U.S. corn export inspections were 25.1 million bushels for the week ending 11/23/17. This represented the highest weekly total for the month of November; however it did very little relative to closing the gap on crop year-to-date corn inspections versus 2016/17. U.S. corn export inspections remain more than 40% behind 2016/17 (-209.35 million bushels).

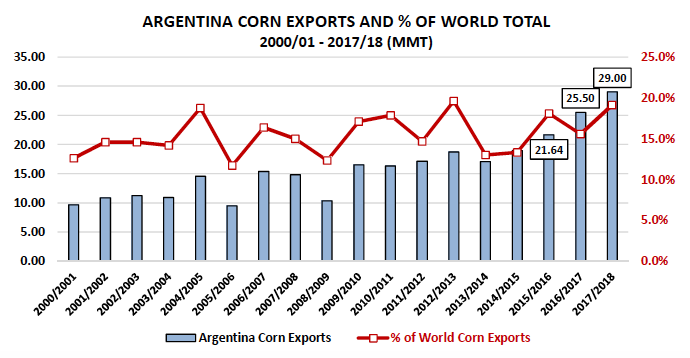

- Rain was added this week for some of the dryer sections of Argentina, however the extended forecast still offered a return to dry conditions mixed with mild temperatures. What is the significance of Argentina in the world corn/soybean market? Argentina is the world’s 3rd largest corn exporter at 29 MMT (2017/18-USDA estimate) trailing only Brazil at 34 MMT and the U.S. at 48.9 MMT. They are also the 3rd largest soybean exporter in the world; however in soybeans the spread between Argentina and the U.S. and Brazil is much wider. In November the USDA estimated 2017/18 Argentine soybean exports at 8 MMT versus 65 MMT for Brazil and 61.24 MMT for the U.S. Argentina is still in the process of planting its 2017/18 corn and soybean crops so this is something the market will continue to monitor. Cordoba and Santa Fe specifically account for a substantial percentage of total Argentine corn production.

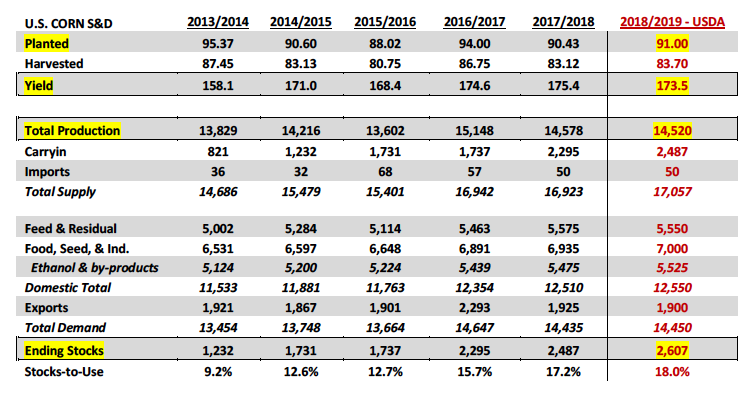

- On Tuesday the USDA’s Office of the Chief Economist released its U.S. corn and soybean “baseline” S&D forecasts for 2018/19. U.S. corn planted acreage was forecasted at 91 million acres, up 570,000 acres from 2017/18. A trend-line yield estimate of 173.5 bushel per acre was then applied for total production of 14.52 billion bushels. This resulted in 2018/19 U.S. corn ending stocks of 2.607 billion bushels (+120 million versus 2017/18) and a stocks-to-use ratio of 18%. The USDA also forecasted 2018/19 U.S. soybean planted acreage of 91 million acres versus 90.21 million in 2017/18.

The market had largely been expecting to see a planted acreage increase in corn; however I’m not sure traders were fully prepared to see U.S. corn ending stocks over 2.6 billion bushels. What the carryout clearly reflected was the USDA’s less than favorable view of U.S. corn demand growth moving forward, which is something I’ve been alluding to for the last several weeks. The USDA estimated 2018/19 U.S. corn demand at 14.45 billion, just 15 million bushels higher than 2017/18.

Overall, higher planted acreage in 2018/19, massive carryin stocks, and stagnant demand all equate to a corn market with a low ceiling from now until at least next April/May barring a major weather issue in South America during that timeframe.

March 2018 Corn Futures Short-Term Outlook:

March corn futures managed to close higher on the week; however stopped right at the 35-day moving average of $3.587 Friday afternoon. The higher weekly close seems to be primarily a function of Managed Money buying. Friday’s Commitment of Traders report showed money managers buyers of 13,703 contracts week-on-week. As of Tuesday’s close (11/28) the Managed Money short had been reduced to -196,763 contracts versus -230,556 contracts two weeks prior. I see the current “rally” as nothing more than Managed Money short covering. The long-term corn fundamentals remain overwhelming negative. Topside resistance should come in the form of the 50-day moving average at $3.603 early next week.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

Data References:

- USDA United States Department of Ag

- EIA Energy Information Association

- NASS National Agricultural Statistics Service