The Q3 2017 13F filings have been released showing hedge fund positions. Using Whale Wisdom’s excellent suite of tools I am able to customize a list of my 50 favorite hedge funds and then look for common buy/sell activity throughout the quarter.

These are hedge funds with fairly high concentration, lower turnover, strong track records, and out of the box thinking with quality investments. A method to find some of the smartest funds is simple back-testing, looking at some of the top performing growth stocks and then finding funds that were early holders of the names and continue to hold.

For this research post, I found a few less popular stocks seeing buying activity across five or more of my top 50 funds from the Q3 2017 13F filings.

Note that the charts and graphics are from company presentations.

O’Reilly Auto (NASDAQ:ORLY)

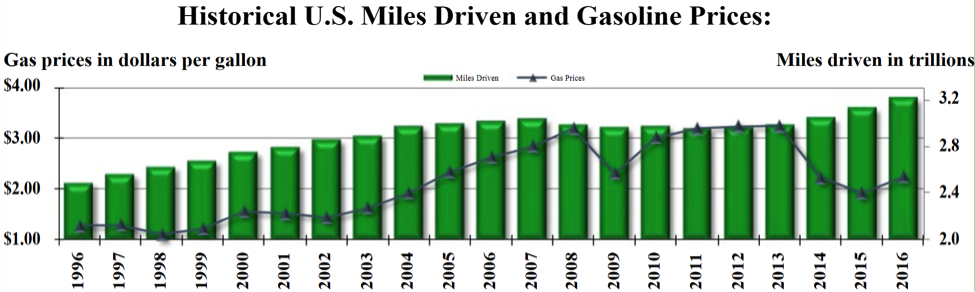

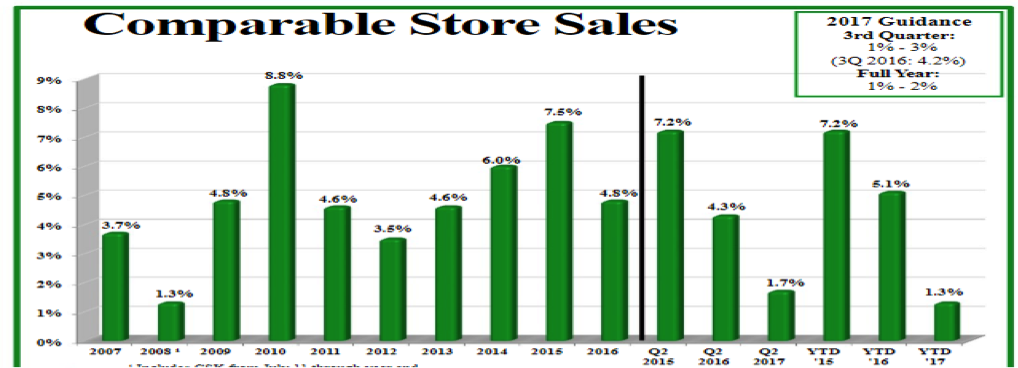

O’Reilly Auto (ORLY) is an $18.15B retailer of automotive parts and accessories trading 16.45X Earnings, 2.04X Sales and 21.1X FCF. ORLY shares are -22% YTD as concerns remain regarding competitive threats from Amazon (AMZN), but a recent earnings report from Advanced Auto (AAP) that missed on sales and comps saw shares react 20% higher, a positive signal for the industry, and ORLY shares initially traded sharply lower on earnings but closed the day positive. ORLY is targeting 4.5-5.5% annual revenue growth the next two years, and 10% EPS growth. It has 4,934 stores in 47 states and opened 105 new stores this year. Comps have weakened from +5.1% in 2016 to +1.3%, but margins are improving. Total Miles Driven remains the #1 industry driver, and lower gasoline prices and stronger employment have caused that number to rise since 2013. Average vehicle ages have also steadily risen to new highs as well. The automotive aftermarket is a $277B market and the DIY segment is more consolidated while the Do-It-For-Me (DIFM) is highly fragmented. Its rewards program and Omni-Channel efforts are positive growth drivers. ORLY is a top operator that is taking market share and providing solid growth.

Weather could provide a boost to Q4 projections and ORLY faces easier comps in the first half of next year. Vulcan Value, Abrams Capital, Akre Capital, Polen, Capital, and Blue Ridge Capital were notable buyers of ORLY in Q3.

FleetCor Tech (NYSE:FLT)

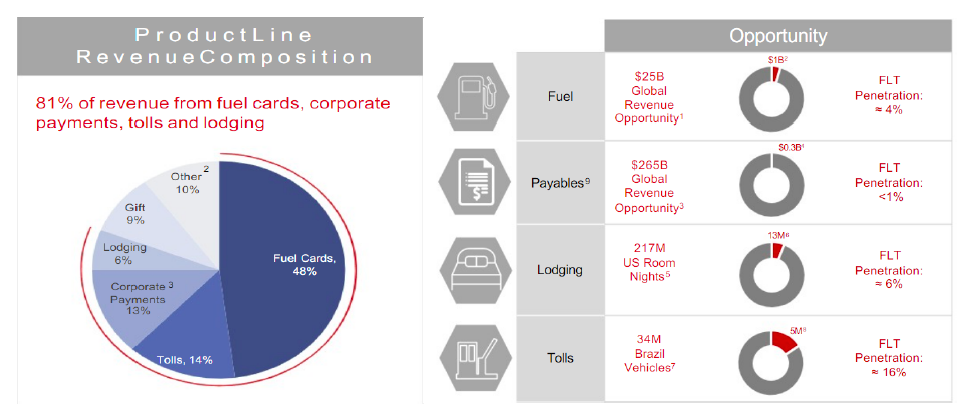

FleetCor Tech (FLT) is a $16.1B provider of fuel cards and other payment solutions trading 18.4X Earnings, 7.47X Sales, and 24.6X FCF. FLT is coming off a 2016 that saw its growth collapse (but still 7.6%/9.8% revenue/EPS), and in 2017 responding with 22.7% revenue growth and 22% EPS growth. FLT sees double digit revenue and EPS growth the next two years as well. FLT gets 37% of revenues International and does 3B transactions per year with 800,000+ customers. Its payment target markets are Fuel (Business Fleets), Payables, Tolls, and Lodging. More than 90% of its revenues are recurring, it has low customer concentration, high margins, and low capex requirements. Its growth opportunity is see is adding more customers, gaining more share of the wallet spend, and expanding to new geographies. It currently has very low penetration rates in all its major markets. FLT has also successfully done acquisitions over the years and continues to win new deals, a recent one with Wal-Mart.

FleetCor Tech (FLT) deserves a premium valuation and is a name set for further multiple expansion as the macro headwinds from 2015/2016 dissipate. Maverick Capital, Viking Global, Tiger Global, Melvin Capital, Criterion Capital, Kensico Capital, and Steadfast Capital were among the many buyers of FLT in Q3.

Zayo Group (NYSE:ZAYO)

ZAYO is an $8.5B bandwidth infrastructure solutions Company trading 57.4X Earnings, 3.62X Sales and 67.7X FCF. ZAYO posted 27.8% revenue growth in 2018 and projects 18% growth for 2018, coming off a quarter with bookings and gross installs at record levels. Growth in streaming video, cloud, and big data analytics will continue to drive investments into ZAYO’s products. ZAYO previously announced it would explore options to unlock value, including becoming a REIT. ZAYO gets 55% of revenues from enterprise & content, and 45% from carriers and wireless, a leading consolidator in the Fiber & Data Center space. Earlier this yea###3#r Crown Castle (CCI) bought Lightower Fiber Networks, which provided a comp for ZAYO. Highline Capital, Sachem Head, Millennium, Cadian Capital, and JANA Partners were among the notable buyers of ZAYO in Q3, a few activists, undoubtedly looking at the REIT conversion or push for a sale method of unlocking value.

Vantiv (NYSE:VNTV)

Vantiv (VNTZ)is a $12.3B electronic payment processing Company trading 18.45X Earnings, 3.15X Sales and 18.7X FCF. VNTV did a massive $10.4B acquisition of Worldpay earlier this year. Merchant Services is its largest segment while Financial Institution Services also a contributor. Its key drivers for making money are # of transactions and the $ amount of sales volume as it receives a fee, and VNTV has industry leading margins, has increased its market share steadily the last 5 years, and does 25B annual transactions. A key concern with VNTV is the slowing of organic growth, though much of the focus now from investors is the pending Worldpay deal providing VNTV a substantial international presence and boosting its e-commerce business, likely to close in early 2018. Third Point, Lone Pine, Sachem Head, Tourbillon, Steadfast, and Two Sigma were notable top buyers of VNTV in Q3.

Guidewire (NYSE:GWRE)

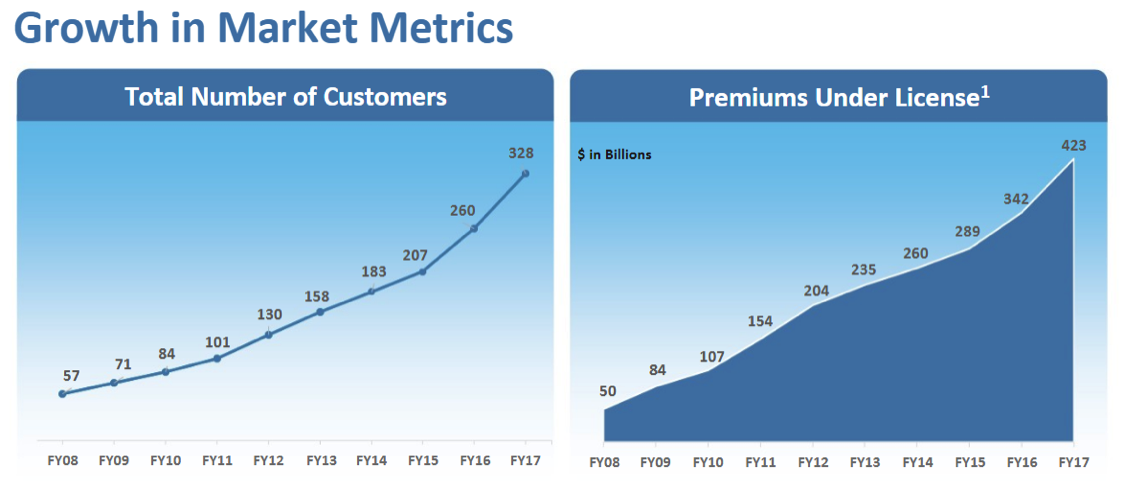

Guidewire (GWRE) is a $5.95B provider of cloud-based software to the P&C Insurance industry, trading 8.7X EV/Sales and 43.6X FCF. GWRE grew revenues 21.2% in 2017 and sees 21.7% growth in 2018 while EPS set to jump 30% each of the next two years. The industry is rapidly changing and P&C leaders are spending a lot of capital on technology. Its main products are Policy-Center (+21% FY17 Growth), Billing-Center (+19% FY17 Growth), and Claim-Center (+10% FY17 Growth). GWRE is seeing explosive growth in data & digital products, but remains just 34% of its installed base. It operates in a massive market with low penetration, which leaves a lot of opportunity for growth. Its InsuranceNow Cloud suite launched in Q2 and is off to a strong start.

International revenues are currently 22% with potential to reach 50%, and GWRE has ample room for more customer wins. Hitchwood Capital, Wasatch Advisors, Two Sigma, and Renaissance Tech were notable buyers of GWRE in Q3.

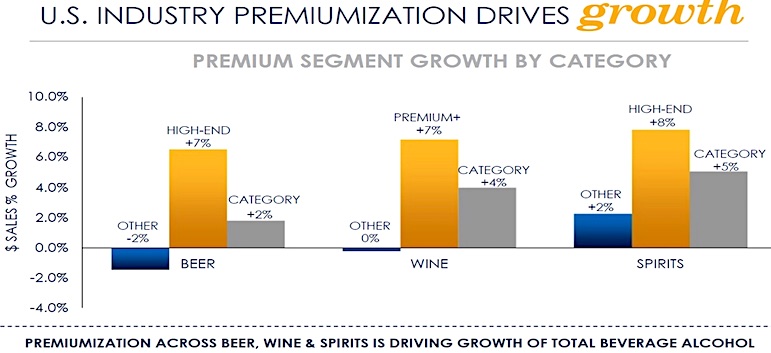

Constellation Brands (NYSE:STZ)

Constellation Brands (STZ) is a $42.5B global leader in the beer, wine and spirits industry trading 23.6X Earnings, 5.7X Sales, and 120.65X FCF. STZ grew revenues 12% and EPS 24.5% last year and sees steady growth ahead, often making acquisitions, and is ready for another deal considering its pursuit earlier this year of Brown Forman (BF.B). In a struggling consumer packaged goods space, beverage & alcohol remains a growth leader, especially the premium segment. STZ is the leader in high-end US beer and imported beers, also the World’s leading premium wine company. Corona, Svedka, Modelo, and Ballast Point are some of its many key brands. STZ continues to take market share, makes smart acquisitions, and expands distribution, an excellent company with strong management. Soroban Capital, Melvin Capital, Maverick Capital, Lone Pine Capital, and Egerton Capital were notable top buyers of STZ in Q3.

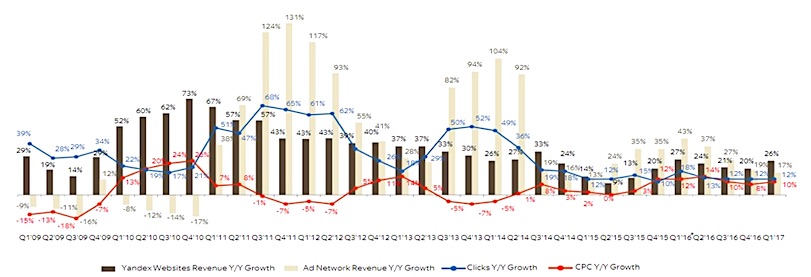

Yandex (NASDAQ:YNDX)

Yandex (YNDX) is a $10.5B leader in Russia for Internet services and also offers various Tech services as well as a ride-hailing business that recently did a deal with Uber. YNDX trades 27.65X Earnings, 7X Sales and 71X FCF and seeing 20%+ annual revenue growth while EPS growth projected to surge 64.5% in 2018. Search continues to drive most of its revenues, but the E-Commerce, Taxi, and Classifieds businesses are emerging growth factors. YNDX is seeing market share gains in the Android market, and Taxi is expected to be earnings accretive in 2019. YNDX is also seeing better than expected margins. Point-72, Maplelane Capital, Jericho Capital, and Melvin Capital were notable top buyers of YNDX in Q3.

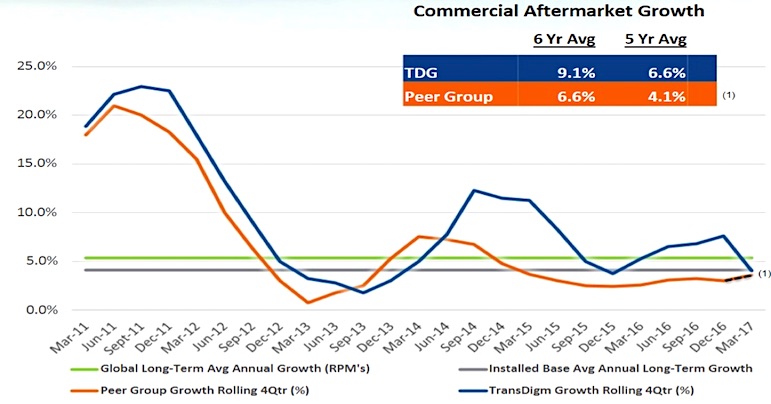

TransDigm (NYSE:TDG)

TransDigm (TDG) is a $13.85B maker of aircraft components trading 18X Earnings, 3.95X Sales and a strong history of double digit revenue growth, but seeing normalizing back to 5.5% in 2018 and 2019 while EPS growth 7-12%. TDG gets 33% of revenues from Defense, 30% Commercial OEM, and 37% Commercial Aftermarket. TDG has a consistent history of strong growth and margin expansion, and has used acquisitions to fuel productivity and cost improvements. TDG is coming off a quarter in which it provided better than expected EBITDA margin guidance, and has plenty of dry powder to continue its acquisitive ways. TDG is a unique company with a history of paying special dividends from its strong FCF performance, and 90% of its sales are proprietary. Darsana Capital, Altarock, Millennium, and Tremblant Capital were notable buyers of TDG in Q3.

Check out more of my investing research and options trading ideas over at OptionsHawk. Thanks for reading.

Twitter: @OptionsHawk

The author has a position in YNDX at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.