In my conversations with clients a common topic of interest is that of US high yield credit spreads.

Indeed, it’s almost the opposite issue of the stock market – if you think S&P 500 (NYSEARCA:SPY) PE ratios are too high, you probably also think that US High Yield credit spreads are also too low or too tight.

But what is “too low” or too tight? And from a timing standpoint, how should we think about it?

I discussed this issue in depth in the latest weekly macro themes report, and it is a running topic due to its importance for active asset allocators.

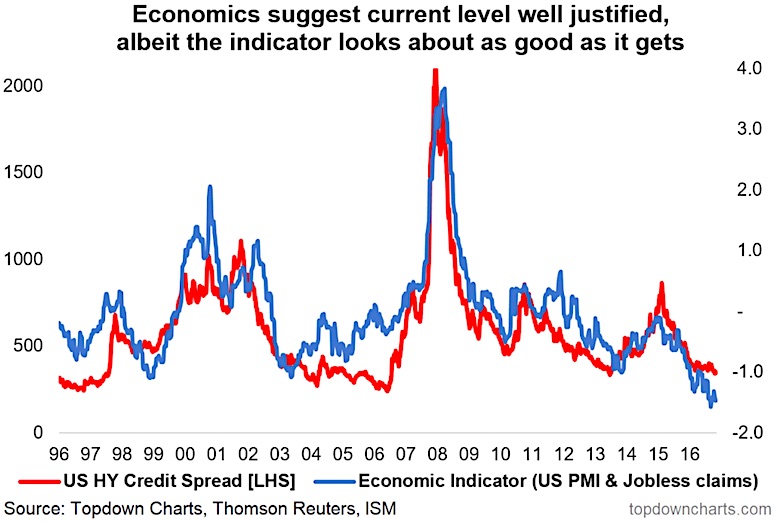

The chart of interest: US High Yield credit spreads vs the economic cycle indicator. In short, this chart says credit spreads basically should be low because the cycle is good at this point.

The chart shows one of about half a dozen indicators we track on US High Yield (HY) credit spreads. Much like equities, it’s not enough to say an asset class is overvalued (or that credit spreads are too low). From a practical standpoint you need a framework or set of indicators which incorporate multiple variables such as the economic cycle indicator which is shown in this article.

At this point the economic cycle indicator (a combination of the PMI and jobless claims) is pointing to solid economic fundamentals and if anything is pointing to lower spreads! The time to get worried about spreads being too low is when this indicator starts to turn.

The other time to get worried is when other indicators point to caution, for example the credit managers index, the Fed loan officer survey (due out this week – expect some insights from this in the upcoming weekly report!), inflation expectations, bank CDS, Fed rates, and the VIX among others. While there are a couple of “orange lights” (vs the green light in this chart), from a timing or practical standpoint there’s nothing yet to suggest impending doom for US HY credit.

That said, our view is neutral, at best, on US High Yield credit – it’s one question about tactical/timing decisions, but the biggest question is are you being adequately compensated for taking on credit risk at a time when the credit risk premium is so low?

What’s your view on US High Yield Credit Spreads? And how do you approach the issue?

Twitter: @Callum_Thomas

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.