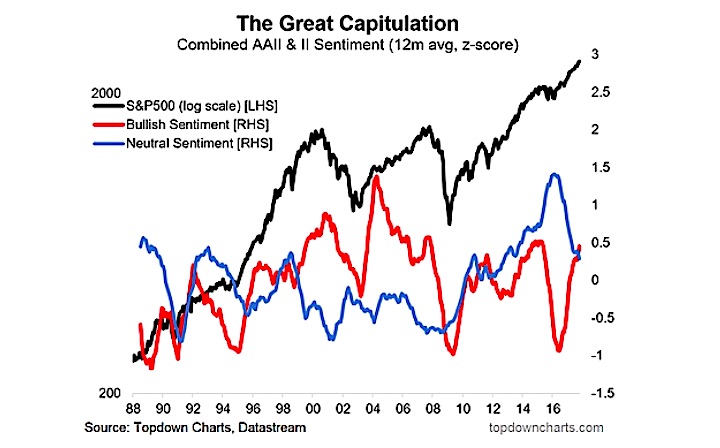

Investors have shown a steady capitulation toward the bullish side of the ledger… whether it is bulls getting more bullish, neutral folks becoming bullish, or bears turning less bearish.

These things happen in strong bull markets where stock price continually rise. Just look at the past 12-18 months on the S&P 500 (INDEXSP:.INX).

Here’s a quote from my recent post on euphoria and bullish sentiment in the marketplace:

Funny things can happen when you mix human psychology with greed and constant stimulus. The seemingly straight-line march upward in the S&P 500 has triggered a rise in bullish sentiment as a great migration is underway from neutral sentiment to bullish sentiment.

This is reflective in the chart below… less neutral, more bullish.

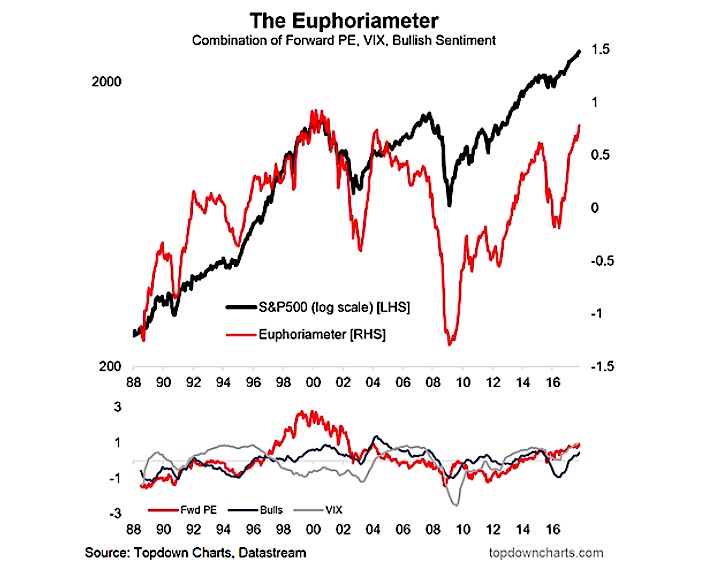

Note that the TopDown Charts “Euphoriameter” is hitting its highest levels since the Dot-Com bubble.

Rising bullishness leads to rising confidence… which leads to higher expectations. When the market fails to meet those expectations, we will see a deeper correction.

Twitter: @Callum_Thomas

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.