This article reviews the data from the latest weekly sentiment survey I conduct over on Twitter.

The survey measures respondents’ equity and bond positioning/view – differentiating between whether the view is bullish or bearish for technical or fundamental reasoning. The latest results show a decisive move to the bullish side for equities and bearish side for bonds – with the net-bearish investor sentiment on bonds reaching a historical record – driven by a big shift in bond fundamentals sentiment.

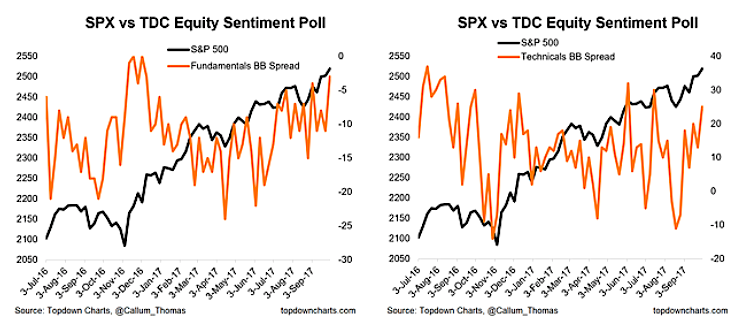

Looking at the net-bulls for “fundamentals” and “technicals” the fundamentals spread moved to the highest point since December last year for equities, with technicals bulls also moving higher.

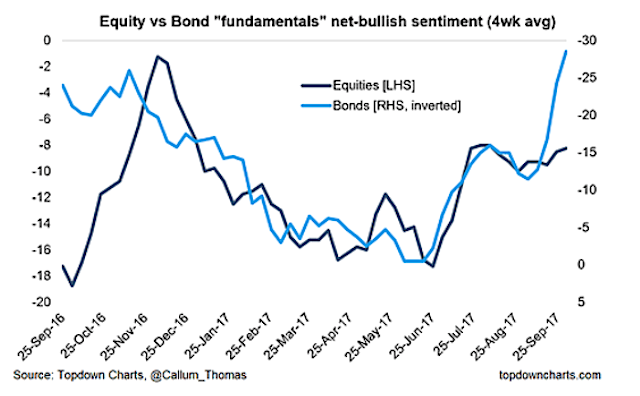

Importantly, and most interestingly, the move in fundamentals sentiment was consistent with the (albeit much larger) move in bond fundamentals sentiment. There has been a big move to the bearish side for bond fundamentals, with the net-bulls reading for bond fundamentals reaching a record low in the wake of the Fed’s QT announcement.

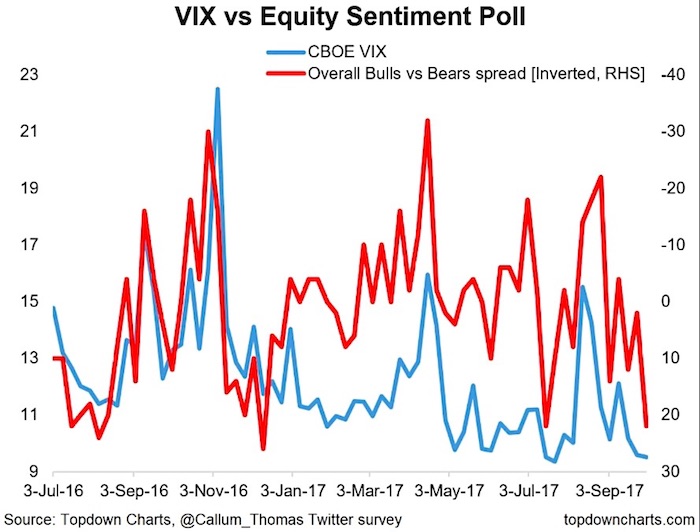

The broad improvement in equity sentiment and consistent move in bonds has coincided with new lows in the VIX. Indeed, while it might seem like good news, it’s often when sentiment looks the best that the short-term outlook is the worst for stocks. You can see on the final chart that surges in bullish sentiment have often coincided with troughs in the VIX, whether it’s complacency or confidence this is an important pattern to note, and lines up with the discussion in the latest S&P500 #ChartStorm.

Fundamental net-bulls have moved to the highest point since December last year, and technicals bulls have likewise made a big move up since the low point in August.

Bond fundamentals bears have surged, equities have yet to follow in step – so it’s likely an element of Fed QT weighing on sentiment (note bond sentiment is inverted in that chart).

Looking at the chart of overall net-bulls vs the VIX, a familiar and perhaps ominous pattern can be seen…

Twitter: @Callum_Thomas

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.