Last week we took a look at interest rate sensitive sectors to kick off our mini-series on core income. In our second edition of the of this series we examine the Commodity sectors: Energy (NYSEARCA:XLE) and Materials (NYSEARCA:XLB) both of which are very sensitive to economic conditions.

These sectors tend to outperform during the late stages of an economic expansion, which happens to be where we are right now so pay close attention.

This in-depth analysis should help raise some thought on how to position for weeks and months ahead.

Recently, our analytical team at Connected Wealth independently reviewed all of our sector and position weights, agnostic of the benchmark and of current allocations, in an attempt to mitigate the behavioral biases that all investors suffer from. This exercise is an integral part of our culture and it shows up today in our commodities analysis.

Note that this post was written with Chris Kerlow.

ENERGY

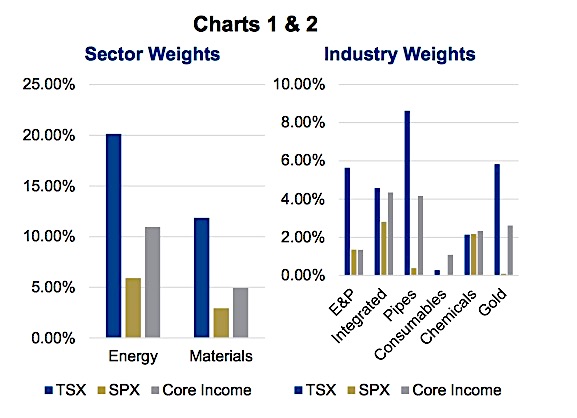

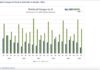

The second largest sector in the S&P TSX certainly demands a lot of attention (Charts 1 & 2).

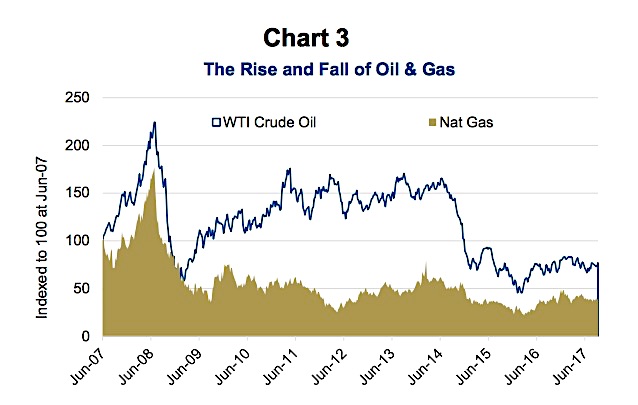

The Energy complex fuels economic growth in mid-western provinces and has been the most important sectoral bet over the past decade, as we have seen crude oil and natural gas prices on a roller coaster ride (Chart 3).

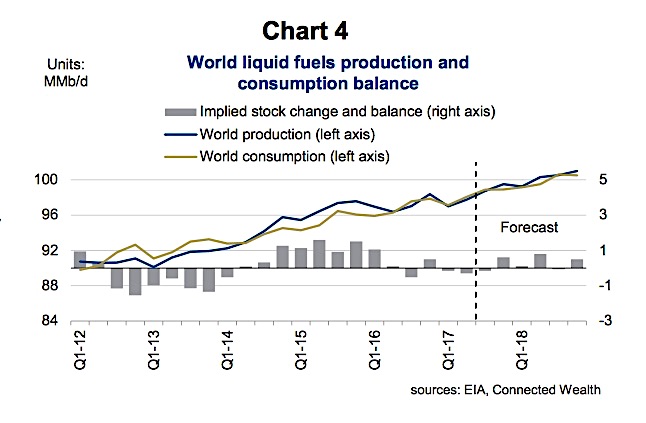

We continue to observe significant rebalancing taking place (Chart 4); production and consumption of oil are roughly equal, according to the EIA.

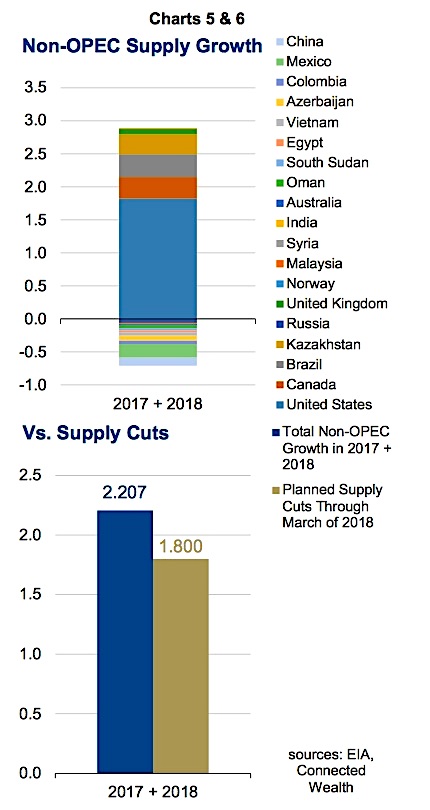

Gains made by production cuts and extensions made by OPEC are being offset by growth and efficiency gains by U.S. shale producers (Charts 5 & 6). Despite this, inventories remain extremely elevated based on historical levels.

From a long-term perspective, the lack of investment over the trailing few years should lead to an inventory reduction given the sustained growth in demand. The further out you look, the higher the possibility of a changing energy that favors cleaner energy sources over combusting fossil fuels.

Near-term catalysts have tended to be the impetus of short- term energy price movements. Rhetoric surrounding the upcoming OPEC meetings in November is starting to rise, with the latest rumor being a small extension to further cuts. Anything more could propel us into the $50s, but other potential and unforeseen circumstances loom that could bring us quickly back to the mid to low $40s. We tend to be buyers near the bottom of that range and sellers near the top, depending on the individual price movements in the stocks.

We have a sanguine outlook for Energy-related commodities in the near term and remain largely defensively positioned, staying underweight in the sector. Large integrated oil companies and pipelines tend to be core holdings for us at this point of the cycle.

continue reading on the next page…