Investing Highlights & 4Q 2017 Insights:

- Downshift in Inflation Provides Fed with Room to Maneuver

- Global Economic Rebound Gets New Lease on Life

- Seasonal Headwinds May Be Less Severe This Year

- Relative Trends Show International Leadership

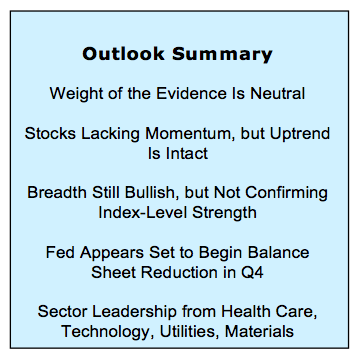

While the weight of the evidence is currently neutral and counseling caution into 4Q 2017, the up-trend that emerged off of the early 2016 stock market lows remains intact. And the S&P 500 (INDEXSP:.INX) recently made all-time highs. So while risks have risen since mid-year and stocks may be overdue for a stock market pullback, we have yet to see the sort of deterioration which typically presages periods of protracted weakness.

4Q 2017 Investing Outlook Summary

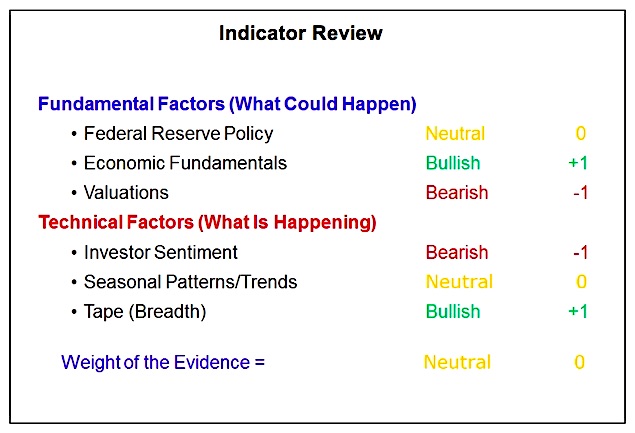

For now however, there is also little evidence that upside momentum for stocks is returning and the underlying trend is prepared to re-assert itself. In many ways the fundamentals and technicals tell the same story. The underlying trends (in terms of the economy and the broad market) are positive, but optimism (measured by sentiment and valuations) has become excessive. This shows up in our indicator review (below) and weighs a bit near-term in this 4Q 2017 investing outlook.

With this backdrop, Fed policy and seasonal patterns (both currently seen as neutral) may get heightened scrutiny. The continued lack of inflation is giving providing the Fed with the opportunity to continue to normalize policy at a measured pace. Seasonal patterns are getting plenty of attention right now as we move into a notoriously difficult part of the annual calendar for stocks and the specter of previous year’s ending in “7” (think, 1987) provides a lens through which investors can express their current concerns. As we will discuss, the lack of volatility in the first half of the 2017 and strong breadth coming into this seasonally weak period argue for a more modest pullback than might otherwise be expected. The bottom line is that while there are risks aplenty, from our vantage point, the evidence in hand is more consistent with a message of increased caution rather than one of immediate concern.

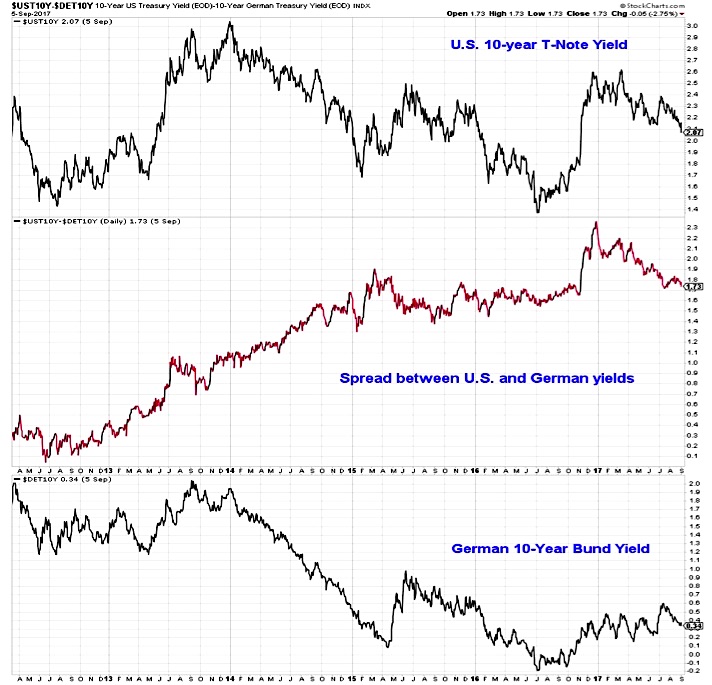

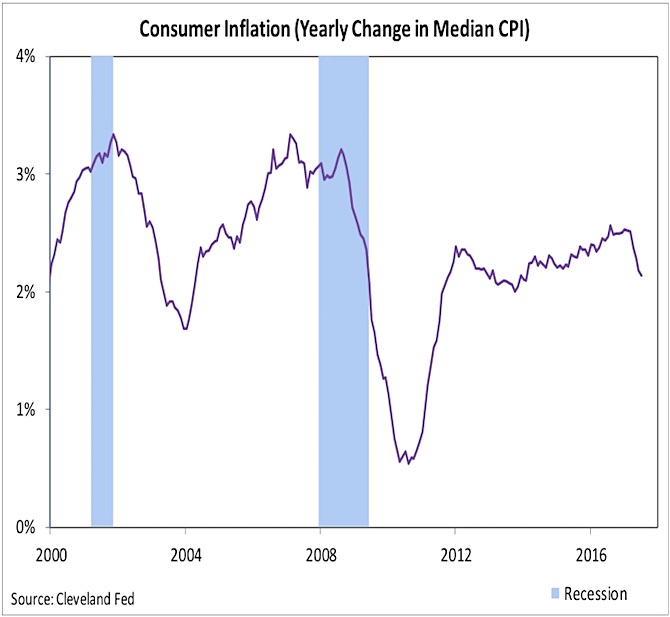

Federal Reserve Policy is still neutral. The Fed appears set to begin to draw down its balance sheet in the fourth quarter, but the timing of the next interest rate hike is up in the air. Recent comments from Fed officials have argued for a wait-and-see approach. They suggest that without an uptick in inflation, further rate hikes could be delayed (expectations had been for a 25 basis point hike in December). The bond market seems to be endorsing this approach by the Fed. 10-Year Treasury Bond Yield (INDEXCBOE:TNX) has moved lower since peaking near 2.6% earlier this year. While short-term rates and inflation expectations impact bond yields, yields on foreign bonds do as well. As such, investors may want to keep a close eye on the ECB (in addition to the Fed).

While global growth is improving and commodity prices are moving higher (more on this in a moment), the bond market for now seems pre-occupied with the recent decline in inflation. After drifting higher for several years, the yearly change in the median CPI (as calculated by the Cleveland Fed) has turned lower in 2017. Despite evidence of consumer and small business optimism, there are clearly still distortions in the labor market (specifically, the job-skill mismatch and the opioid epidemic) that are keeping wage growth contained and providing a lid on inflation. While the providing the Fed the opportunity to proceed at a gradual pace, these distortions reduce overall economic growth and are a societal headwind.

Economic Fundamentals remain bullish. The rebound in economic growth is global in nature, with most countries in expansion mode. The recovery is strong as well as broad. The JP Morgan Global Purchasing Managers’ Index in July moved to its highest level since 2011. Within this recovery the U.S. is actually just a middle-of-the-pack performer. Growth out of Europe continues to surprise to the upside and international trade continues to expand.

Supporting a positive view on the global economy has been strength in industrial commodities. Copper gets plenty of attention in this regard but it is not alone in showing strength. A number of commodities have made new multi-year highs in 2017. Copper is trading at its highest level since 2014, Zinc has moved to its highest level since 2007, and Palladium is as high as it has been since 2001.

Market Valuations & Sentiment

Even with the improving economic growth fueling an improved earnings backdrop, Valuations remain bearish. Given the divergence between price and fundamentals, earnings will have to move ahead of price to relieve valuations pressures. It is encouraging, however, that the recovery in earnings is being driven by better top-line results. Importantly, market valuations speak to risk and elevated valuations suggest an elevated risk environment (an important point given that many measures of volatility suggest placidity bordering on moribundity). In other words, even as corporate results are improving and stock market volatility has declined, risks remain elevated.

Sentiment is bearish as optimism remains elevated. While short-term measures of sentiment show some degree of pessimism, the more stable surveys suggest optimism remains a headwind for stocks.

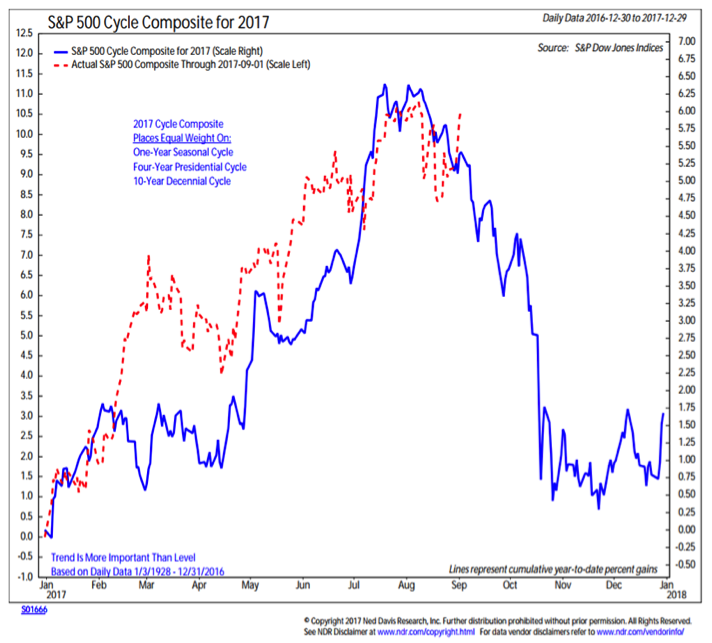

Seasonal Patterns are neutral. The cycle composite for 2017 suggests a significant increas in risk as we move toward the fourth quarter. This pattern, coupled with evidence of perceived excesses elsewhere in the financial system has some investors expecting the worst this fall. We see a few factors, contingent on actual behavior in the stock market in 2017 as mitigating some of these concerns.

In years where first half weakness has been muted, second half drawdowns have been below average and the year-end rallies have been stronger.

continue reading on the next page…