S&P 500 Short-Term Outlook (2-3 Days): MILDLY BULLISH

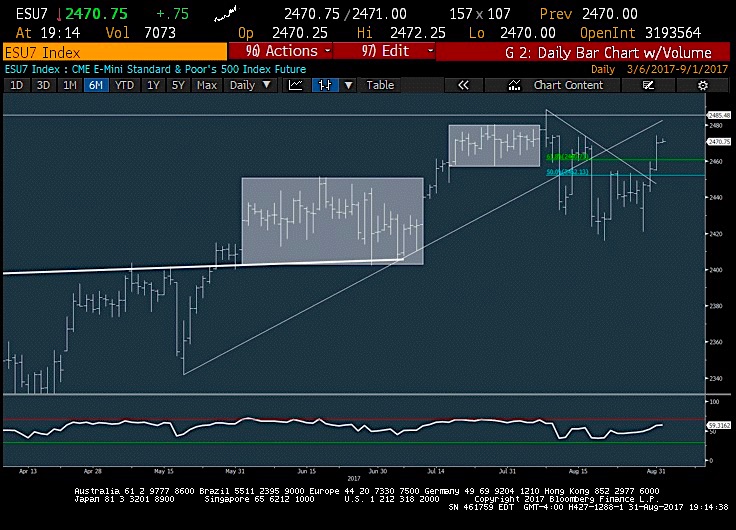

The S&P 500 (INDEXSP:.INX) is getting a bit extended here and nearing key resistance as we start September. However, a push into early next week looks possible before any stalling out, and despite the extent of Thursday’s rise, the S&P 500 has not yet reached resistance in either price or time.

To review, the move back above 2455 (on a closing basis) turned the trend back to bullish. This suggests an upward bias in the next few days. UNDER 2455 is not expected before a push up to 2480.

Technical Thoughts

The near-term trend remains bullish as part of an intermediate-term pattern where momentum is weakening despite prices having held up above trendline support from last Winter’s lows. While the short-term plan shows equities still trending a bit higher into early September, we have to be on the lookout for signs of Technology stalling along with the S&P 500 up near 2485-90 and then reversing next week.

The rally thus far has lacked the real breadth thrust which was thought to be necessary to gain real conviction in this move. Despite the move in Technology and Healthcare, the latter being more convincing, others like Financials have not followed suit to join this move to new highs, or even to exceed the minor downtrend in place. Furthermore, many Sector ETF patterns such as what’s seen in the Industrials (NYSEARCA:XLI) and Consumer Discretionary (NYSEARCA:XLY) are not hitting new all-time highs, but have trended sideways in range-bound consolidation since May.

Overall, after a sharp rally which HAS helped daily momentum turn positive, prices are now nearing critical peaks while weekly momentum remains negatively sloped. That’s the key worry along with breadth deterioration heading into September. But technology holds the key to all, in my opinion, along with FANG stocks and AAPL given its weight in the indices. Keeping a close eye on these stocks should help decipher the major averages going forward.

The rally over the last few days helped the S&P 500 close out the month almost exactly unchanged, while the NASDAQ finished up over 1%. The S&P 500 has now rallied 50 points or nearly 3% in just about 3 days time. The US Dollar has shown some signs of trying to stabilize, while Treasury yields have bounced a bit. However, until both of these turn up more meaningfully, the gold rally very well might continue a bit longer over the next couple weeks, with targets up near 1350.

Thanks for reading.

If you are an institutional investor and have an interest in seeing timely intra-day market updates on my private twitter feed, please follow @NewtonAdvisors. Also, feel free to send me an email at info@newtonadvisor.com regarding how my Technical work can add alpha to your portfolio management process.

Twitter: @MarkNewtonCMT

Author has positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.