U.S. Equities are attempting to stabilize this morning after a big downdraft yesterday. Meanwhile, European equities are playing catchup.

The metals are jumping this morning with big pops in Iron Ore, Gold, and Silver. Gold prices (NYSEARCA:GLD) should find some resistance here – cash resistance is around $1310.

The near-term trend for the S&P 500 (NYSEARCA:SPY) remains DOWN and the price damage yesterday in both the Financials Sector (NYSEARCA:XLF) and Transports Sector (NYSEARCA:IYT) suggests that the market could be soft into next week before any rally.

Longer-term trends at this point remain intact, so this appears to be a short-term pullback only. That said, the patterns on many US Sector ETFs are beginning to show “POTENTIAL” topping formations. For now, just largely consolidation since May… but patterns look increasingly poor and top-like heading into the fall. Examples include Sector ETF’s: XLF, XLI, XLY, XLV, XLP. These will all have to be watched carefully, in my opinion.

Price support sits at 2427, followed by 2412 and 2385-90 (that latter looks unlikely for today). On the flip side, UNDER 2440 keeps the trend negative and this is today’s first area of PIVOT. It’s tough to argue that the lows are in – the next 2-3 days will be important.

Stay tuned.

CHART Spotlight

Gold – The precious metal is breaking out over prior highs to its highest level for 2017. Gold should run up to around $1310… then reassess.

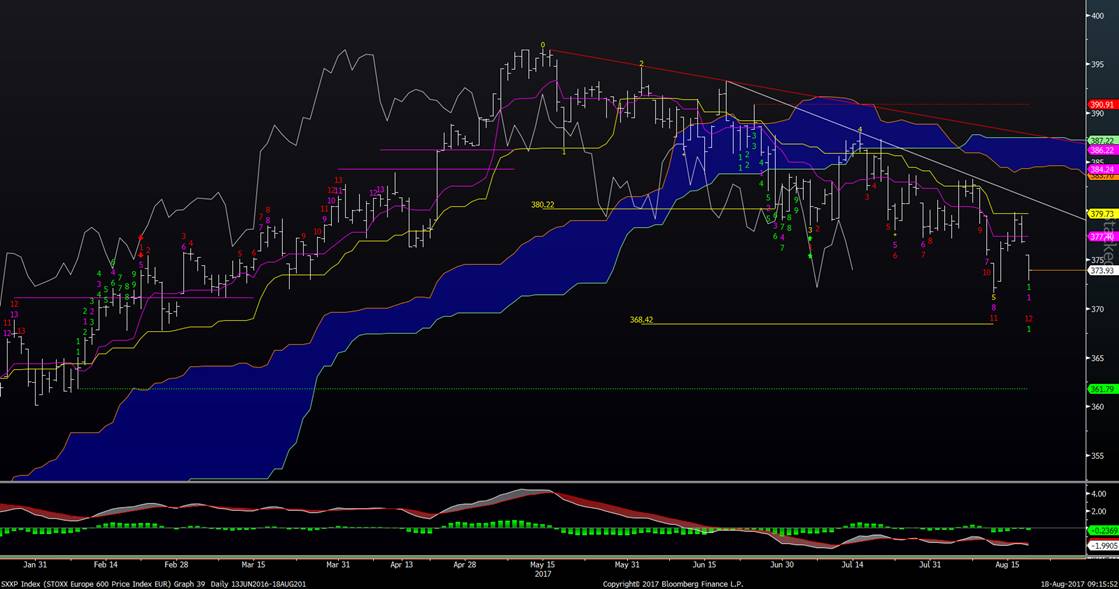

Europe – European stocks are catching up to US yesterday… but a more methodical decline than US. Europe appears to have peaked in May.

Thanks for reading and good luck out there.

If you are an institutional investor or a serious trader/investor and have an interest in seeing timely intra-day market updates, please check out my site, Newton Advisors.

Twitter: @MarkNewtonCMT

Author has positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.