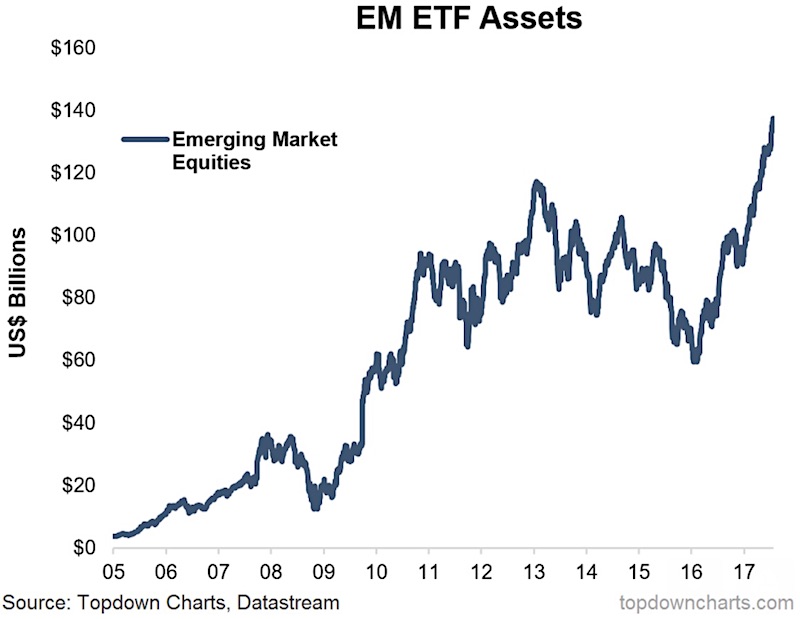

A curious chart was staring me in the face as I went through my excel models pressing ‘refresh’ on the data feeds.

The chart showed the assets under management of the formerly unloved Emerging Markets Equity ETF (NYSEARCA:EEM) surging – doubling over the past year – to a record high.

If that doesn’t get your attention then you’ve probably lost the passion!

The chart and the following statistical soup comes from my latest weekly report.

Dedicated emerging market equity ETF Assets Under Management (AUM) has roughly doubled over the past year to a record high.

Going to the question in the title, are Emerging Markets equities actually underallocated?

There’s a couple of angles to this question and it’s a leading question because I’ve looked at the numbers. So here’s 5 facts about Emerging Markets equity allocations:

- The share of EM and developing countries of global GDP = 58%

- The share of EM equities a % of global market capitalization = 14%

- The allocation to EM equities in the MSCI ACWI = 8%

- Dedicated EM funds as a % of all ETF AUM = 6%

- Dedicated EM funds as a % of all mutual fund AUM = 2%

It’s interesting to note the disparity between EM as a % of global market cap in contrast to Emerging Markets as a % of global GDP, let alone the other stats.

But even looking across the other stats presents an interesting picture. The weight in ACWI (All Countries World Index) is about half of global market cap representation, and the market share of dedicated EM funds is smaller yet.

Strictly speaking you could make an argument that Emerging Markets is underallocated on some of the stats above. Having said that, the increase in Emerging Markets ETF AUM has been heroic and whenever you see a surge in assets like that, regardless of over/underallocation, it makes you stop to think…

ALSO READ: NAFTA Equity Markets Offer Different Risks/Rewards

Twitter: @Callum_Thomas

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.