Here’s a quick update for traders as we head into the weekend.

Note that the S&P 500 (INDEXSP:.INX) is enjoying new all-time highs as buyers give the market another push higher.

Economic Data

CPI came in at 0.0% vs 0.1% – a bit light. Retail sales headline came in at -0.2% vs -0.1%. But after stripping out Auto/Gas sales, it came in at -0.2% vs 0.2% expected. Inflation data (or LACK of inflation) remains a concern. Maybe Yellen’s Dovish stance was correct. Treasuries are rallying with yields pulling back a bit.

U.S. Equity Market

Bank earnings are coming in fairly positive on both the top and bottom lines, though Net interest margin is a bit lower than expected for JPM. Treasury bonds are showing fractional gains, with limited movement out of WTI crude oil, Gold, and the US Dollar. Emerging markets (NYSEARCA:EEM) are providing an assist to U.S. and global equities, breaking out and exceeding the entire downtrend line from 2011.

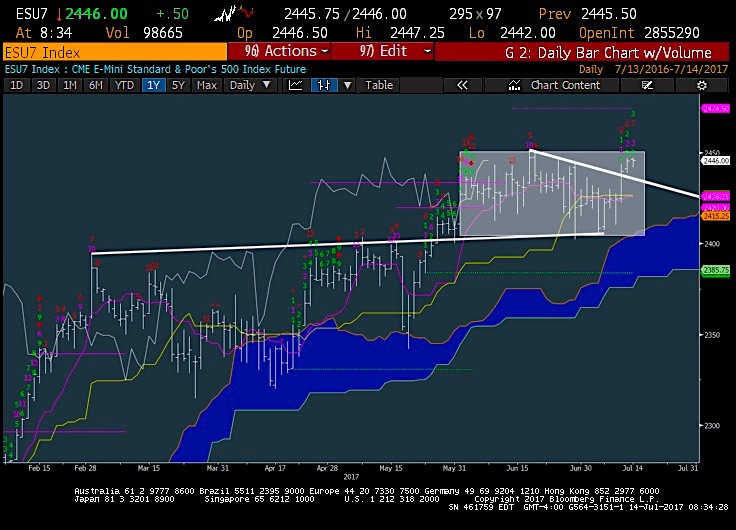

S&P 500 Futures

S&P 500 futures will need to get over mid-June highs 2451 which should allow for a push higher toward 2475.

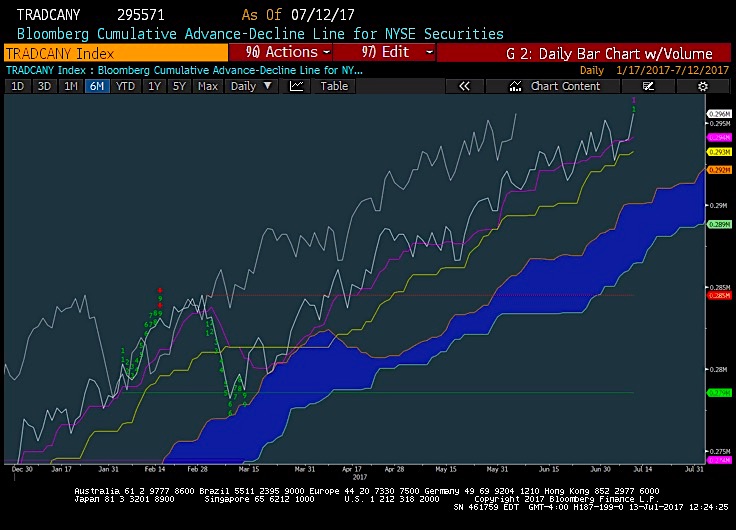

NYSE Advance Decline Line

ADVANCE/DECLINE has moved back at new all-time highs. This is a positive sign for traders.

If you are an institutional investor and have an interest in seeing timely intra-day market updates on my private twitter feed, please follow @NewtonAdvisors. Also, feel free to send me an email at info@newtonadvisor.com regarding how my Technical work can add alpha to your portfolio management process. Thanks for reading.

Twitter: @MarkNewtonCMT

Author has positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.