“I know you think you understand what you thought I said but I’m not sure you realize that what you heard is not what I meant” – Alan Greenspan

On July 12, 2017 in her semiannual testimony to Congress, Janet Yellen stated the following: “the Federal Funds rate would not have to rise all that much further to get to a neutral policy stance.”

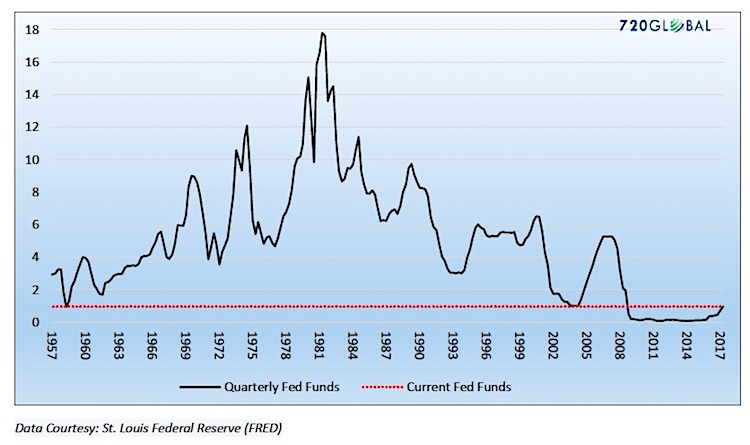

Currently the target for the Federal Funds rate is a range of 1.00-1.25%, having been raised four times since December 2015. Despite the increase from the zero level that persisted for seven years following the Great Financial Crisis, it is still at microscopic levels as shown below.

Per Janet Yellen’s comment, the “neutral policy stance” is another way of saying that the Fed funds rate is appropriate or near appropriate given current and expected future economic conditions. Said differently, Janet Yellen is admitting what 720Global has been saying for years – the economy has been stagnant, is stagnating and will continue to stagnate.

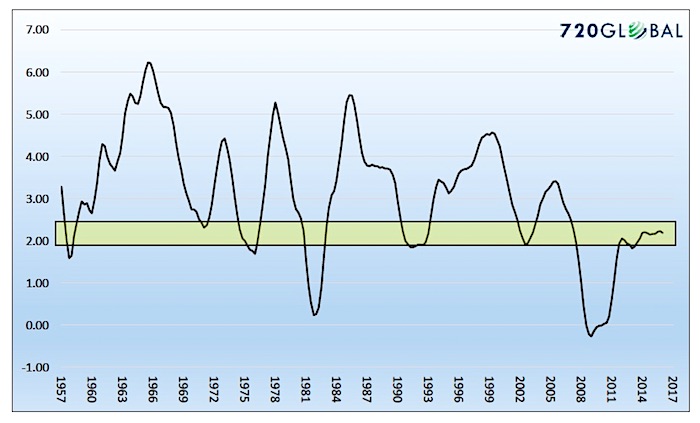

If we assume that Yellen is referring to a range of 1.25-1.75% as an appropriate Fed Funds rate, based on statistical analysis of data since 1955, we forecast that real GDP growth rate is likely to average somewhere between 2.00-2.50% for the foreseeable future. For perspective, the graph below plots the range of expected GDP growth vs historical secular (3-year average) GDP growth. In years past, such a slow rate of growth (highlighted in yellow) was considered nearly recessionary.

A similar analysis comparing Yellen’s “neutral” Fed funds rate versus inflation (CPI) yields inflation expectations of approximately 1.75%. Again, such an inflation rate is emblematic of a stagnant economy.

We are gratified that Janet Yellen is finally coming around to our perspective and only sorry that it has taken her the entirety of her tenure to do so. Unfortunately, the levels of growth to which she conceded in this testimony imply further challenges for the economy due to the large debt overhang, weak fundamentals supporting overvalued financial markets and higher risks of recession.

ALSO READ: The Consequences Of Federal Reserve Inflation Targeting

Summary

Today’s comments are not a revelation. The Fed is currently forecasting long term economic growth of 1.90%. Those trading on hope and momentum are translating her message as a green light to buy stocks because the Fed will remain ultra-accommodative. While it is nice some see a silver lining in her message, one must remember that equity valuations are perched at levels that imply tremendous economic and earnings growth. If what Yellen is saying is true, equity holders are grossly overpaying for a stream of future earnings that will most certainly be disappointing.

Conversely, the message in Yellen’s testimony is bond friendly. In fact, we argue that continued stagnation and weak price growth could result in even lower yields than those we have seen over the past five years.

Thanks for reading.

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.