We are watching natural gas prices very closely right now. The technical picture makes a strong case to expect a reversal and summer rally soon.

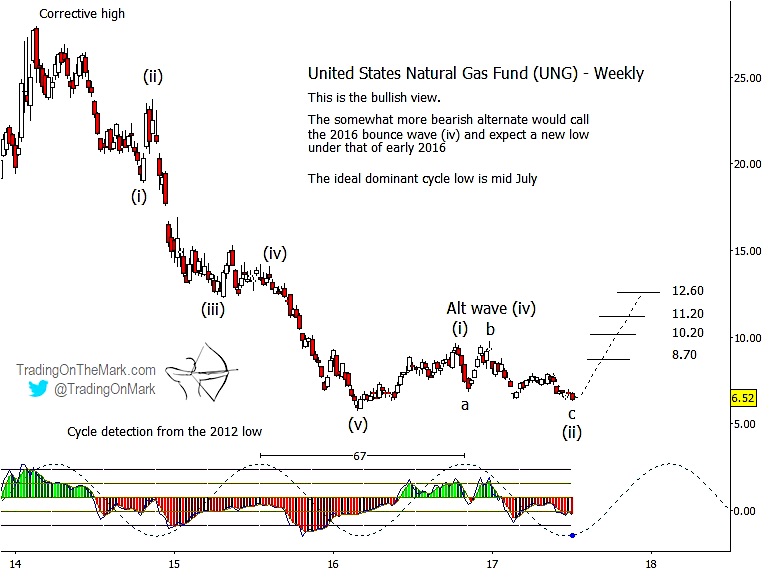

Here we use the chart of United States Natural Gas Fund (NYSEARCA:UNG) to show the two competing scenarios we’re monitoring.

As of this writing, price is still maintaining a higher low compared to 2016. However, the dominant 67-week price cycle suggests price should find support soon. Consistent with the cycle and with what is currently a higher low, the most likely Elliott wave pattern suggests price is near the conclusion of downward wave (ii) and ready to embark on a strong upward wave (iii).

We are also monitoring a similar pattern in crude oil futures, which we discuss frequently on our website with both weekly and intraday perspectives.

Natural Gas Set To Bounce: Two Scenarios For A Summer Rally

Main scenario: If UNG stays above the 2016 low and rallies to overcome the first resistance area near 8.70, that would be a signal to the patient trader that the low probably represented a wave (ii) and the rally a wave (iii). If not already long, a trader might then watch for a good entry opportunity and have reasonable confidence in aiming for the higher resistance targets.

Alternate scenario: On the other hand, even if UNG makes a new low nearby, it may not stay down for long. In addition to the cycle low, which is projected to be near the middle of July, an alternate wave count would allow the a lower low to represent the end of downward wave (v) of the larger impulse. The result would still be a rally, but it might not be able to overcome initial resistance near 8.70 and 10.20 on the first attempt.

Natural Gas summer rally? Here’s what to watch…

Readers should also keep in mind a third scenario that could complicate the picture and throw some traders off the trade. If UNG maintains its higher low but fails to overcome the first and/or second resistance levels, then the higher low we see now might represent a truncated wave (v) of the larger downward impulse. In that case traders would see the same initial signals we described in our first scenario, but price might behave as we described in our second scenario.

Even so, the truncation idea can’t be confirmed except in hindsight. The implication is that traders need to monitor price as it contends with the lower resistance levels.

There are a lot of good trades to catch this summer. Keep up with the turns by following us on Twitter @TradingOnMark and on facebook. Thanks for reading.

The author does not have a position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.