The put ratio spread is generally considered a neutral options trading strategy, although it has the ability to make a profit in up, down and sideways markets. For more, check out my ultimate guide to trading Put Ratio Spreads.

Yes, it can make money no matter which way the market goes, the key is the timing!

This trading strategy involves buying a number of put options and selling more put options further out-of-the-money. It involves naked options so may not be available or appropriate for all investors as there is unlimited risk on the downside.

Watch the video below for full details on how to trade put ratio spreads as well as 3 example trades. Some Highlights:

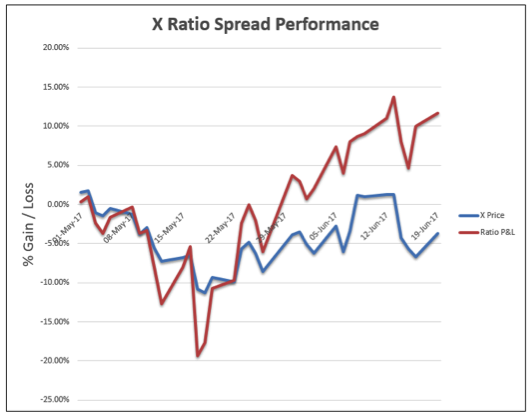

- X Ratio Spread +$350 or 11.69% as the stock went -3.70%

- X Ratio Spread +$450 or 7.65% as the stock went -3.70%

- OIH Ratio Spread +$630 or 14.58% as the stock went -7.61%

Trade safe and thanks for reading!

Twitter: @OptiontradinIQ

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.