In the midst of a decade-long “drought”, grain prices may finally be perking up…

During the commodities boom 10 years ago, among the darlings among speculators were the grains. However, like any market that becomes the object of such investor exuberance, grain prices soon withered.

They have spent the better part of the decade since in a steady decline. There have been a number fits and starts along the way, though. And while each of the prior price spikes has been a head fake, another attempt is underway at the moment.

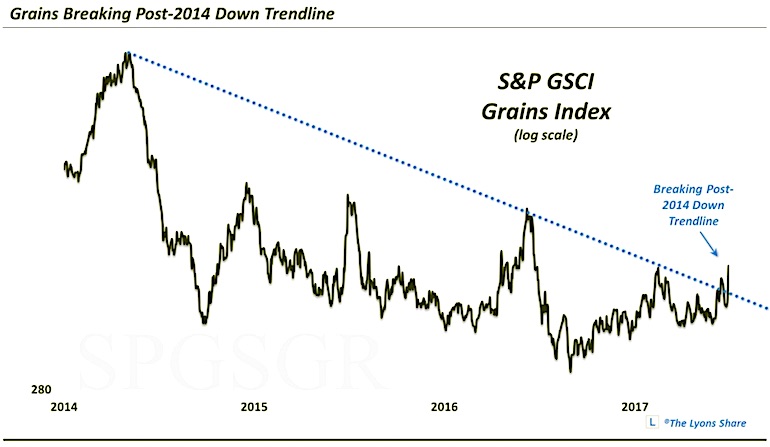

Obviously there is much work to do in order to reverse the longer-term trend, however, the S&P GSCI Grains Index is seemingly breaking an important line of near-term resistance in the form of the post-2014 Down trendline (on a logarithmic scale).

S&P GSCI Grains Index Chart

So will this trend break finally lead to a long-awaited, more durable bounce in grains? Or is it destined to be just another fakeout?

There’s a lot riding on this breakout… or could it be a fakeout? Will this move higher see follow through. You can catch more of my in-depth work on the grains over on The Lyons Share.

Thanks for reading.

Twitter: @JLyonsFundMgmt

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.