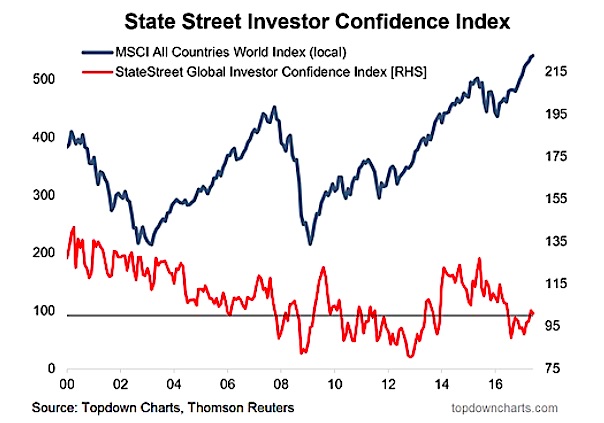

The latest State Street Investor Confidence Index [SSICI] readings show a relative ambivalence among global institutional investors.

As a reminder, the index “provides an objective, quantitative measure of global risk tolerance of the world’s sophisticated investors”. As such, it brings in additional info vs the more mainstream retail and advisory investor surveys.

At a global level the index fell -1.6pts to 101 in June, which points to global institutional investors still making allocations to equities in aggregate (readings over 100 mean rising allocations to equities). This follows a period of de-risking.

American institutional investors are the only ones above 100, at 102.2 in June. Clearly there is still a sense of skepticism among large investors as global equity markets make new highs vs a number of latent risks in the background.

ALSO READ: Small Caps CAPE Valuations Getting Lofty

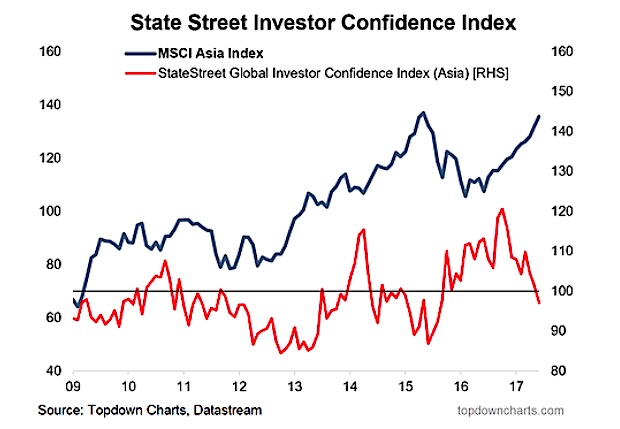

Probably the most interesting data point in the June numbers was for Asian institutional investors. The Asia index dropped -4.4pts to 97.1 – the lowest reading since around mid-2015, and down substantially from the peak late last year. As the chart below suggests, there’s likely an element of profit taking and portfolio rebalancing. But it is worth pointing out that in the past the Asian SSICI appears to have served as a rough leading indicator for the MSCI Asia Index.

The global SSICI moved slightly above the 100 point as it appears institutional investors have capitulated in the face of solid momentum in global equities.

The Asian SSICI appears to have some value as a leading indicator. As such it is arguably sounding a cautionary tone at this point, and any further run down will add conviction to that.

For more and deeper insights on the global markets, good charts, and actionable investment ideas you may want to check out my Weekly Macro Themes – our institutional service. Thanks for reading.

Twitter: @Callum_Thomas

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.