Kimberly Clark Corp (NYSE:KMB)

Bullish Options Action Focuses on Margin Expansion, M&A

Below is an example of the format for OptionsHawk 2017 2H Open Interest Report. For more detailed analysis of 60 stocks with 2H catalysts, check out: OptionsHawk 2H17 OI Report.

Kimberly Clark Corp. (KMB) $130.80 – Consumer Goods – Personal Products

Fundamental Snapshot: The $47.2B personal care Company trades 19.5X Earnings, 2.59X Sales, and 26X FCF with a 2.97% dividend yield. Some of its key brands include Scott, Pull-Ups, Kleenex, Kotex, Depend, and Huggies. Kimberly Clark (KMB) has seen revenues flat to lower since 2011 while EPS has climbed and forecasted for 4% growth this year and 6-7% each of the next two years forward. At 12.3X EV/EBITDA, KMB screens cheap to the 13.6X average for peers P&G (PG), Clorox (CLX), Colgate (CL) and Edgewell (EPC), while having strong FCF, and an impressive 32% ROIC. KMB does lag peers with its margins, which leaves room for operational improvements.

In Q1 the company saw organic sales down 1%, but achieved strong cost savings to boost margins. Kimberly Clark is targeting $400M+ in cost savings in 2017 and is focused on China, Eastern Europe and Latin America for growth opportunities. KMB is shareholder friendly with a long history of raising dividends and buying back stock. The company is large, but could be an ideal takeover target for Kraft-Heinz (KHC) which is looking to get into the personal care space, room for synergies and operational improvements to drive value creation.

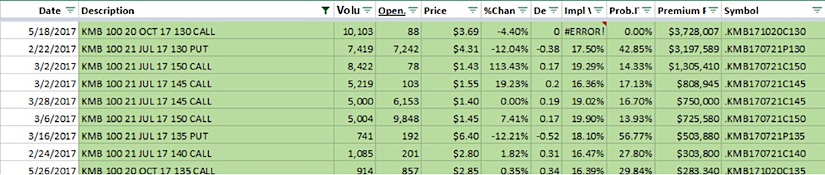

Open Interest, Volatility, and Skew: Kimberly Clark’s 30 day Implied Volatility (IV) is at 15.9% and compares to a 52-week range of 12.1% to 22.1%. Options are pricing in a 10.7% move over the next 7 months, and total put/call open interest ratio is at 0.461. KMB’s 30 day IV Skew at -7.2% compares to a 52-week average of +10.5%, very bullish with inverted skew structure. Notable positions are shown below via OptionsHawk Open Interest Database, a lot of upside calls in July open interest and a large buy of 10,000 October $130 calls in a stock replacement on 5-18. KMB has also seen some smaller buys of OTM October calls.

Analyst Notes: Analysts have an average target of $133 on shares with a high of $151 and low of $121. BAML rates shares Neutral with a $137 target, citing price competition accelerating and a slowing core North America market, but a more stable Emerging Markets backdrop, competitive yield, and low relative valuation. Jefferies, Deutsche Bank, JP Morgan and most of the Street are at Hold ratings.

Technical View: On the chart, KMB shares have a strong long-term trend, recently pulling back to touch the 200 day MA and retest its flag breakout from October 2015 at the $118 level. Shares held support and now have push higher, forming a monthly bull flag, looking to clear resistance at $135 and make a run to $150. Weekly RSI held the key 50 level and MACD is nearing a bullish crossover after shares held the weekly cloud, a coiled weekly chart looking for a catalyst to run higher.

Seasonality: KMB shares have seen seasonal weakness in Q3 with a 5 year average return of -1.85%, while October-November has seen strength with a 5 year average return of +5.89%.

Ownership Trends: Institutional ownership fell 1.42% in Q1 filings with 118 funds taking new positions, 417 adding, 69 closing out and 555 reducing. Short interest is low at 2.3% of the float, but has climbed recently to a 3 year high. KMB last saw insider buying in October 2016 at $113.59/share and October 2015 at $119.15/share.

Catalyst: M&A; Cost Savings/Margin Expansion; Portfolio Changes; Buybacks

My Optimal Strategy: Long the KMB October $135/$150 Call Spread at $2.50 or Better

Thanks for reading.

Twitter: @OptionsHawk

The author has a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.