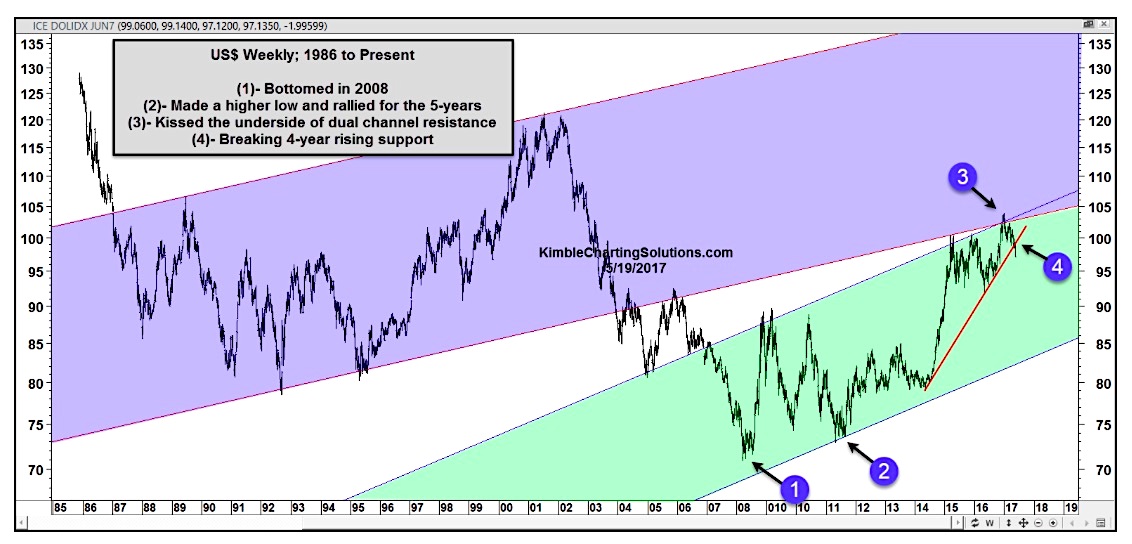

The US Dollar (CURRENCY:USD) has shown strength versus the Euro (CURRENCY:EUR) since 2008, with the “meat” of that strength coming in the last 3 to 4 years. This strength worked as a headwind for precious metals, emerging markets, and at times, the domestic economy.

But that market dynamic is at a crossroads… and may be nearing a turning point.

A currency “shift” here would have short- to intermediate-term consequences for various assets across investors portfolios. So investors need to stay tuned. This could also usher in some volatility, as traders look to re-align their currency hedges and interests.

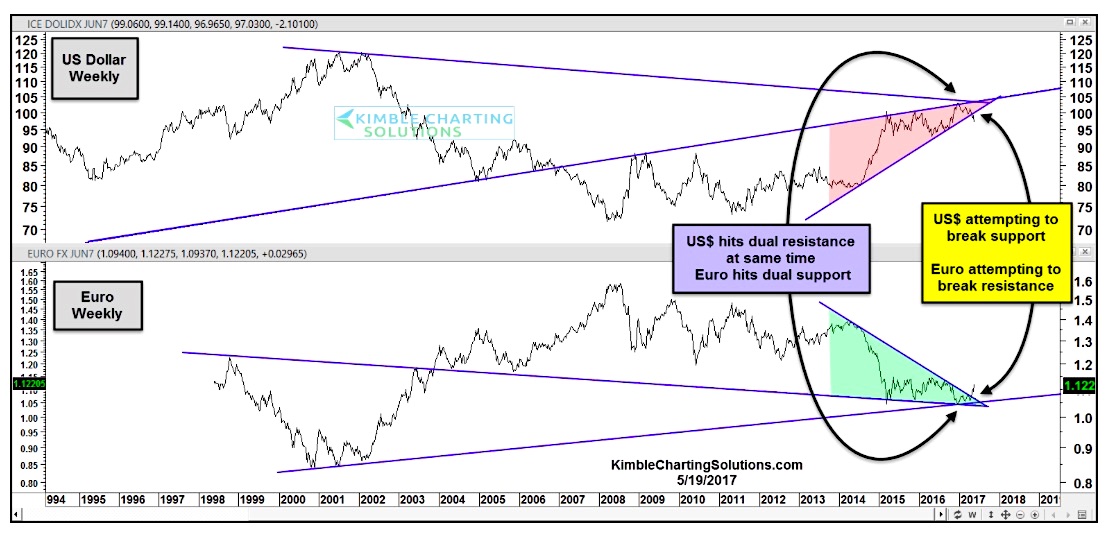

As you can see in the chart below, the US Dollar hit dual resistance at the same time that the Euro hit dual support. And currently the Dollar is attempting to break a key rising support trend line. This comes at the same time that the Euro is attempting to breakout over key downtrend price resistance.

Could these reversal patterns mark a turning point in the global markets for traders?

Another look at the US Dollar chart shows how the recent break of 4-year rising price support followed a “kiss” of the underside of 800 pound resistance at point (3) – 10 year channel resistance.

Thanks for reading and have a great week!

Twitter: @KimbleCharting

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.