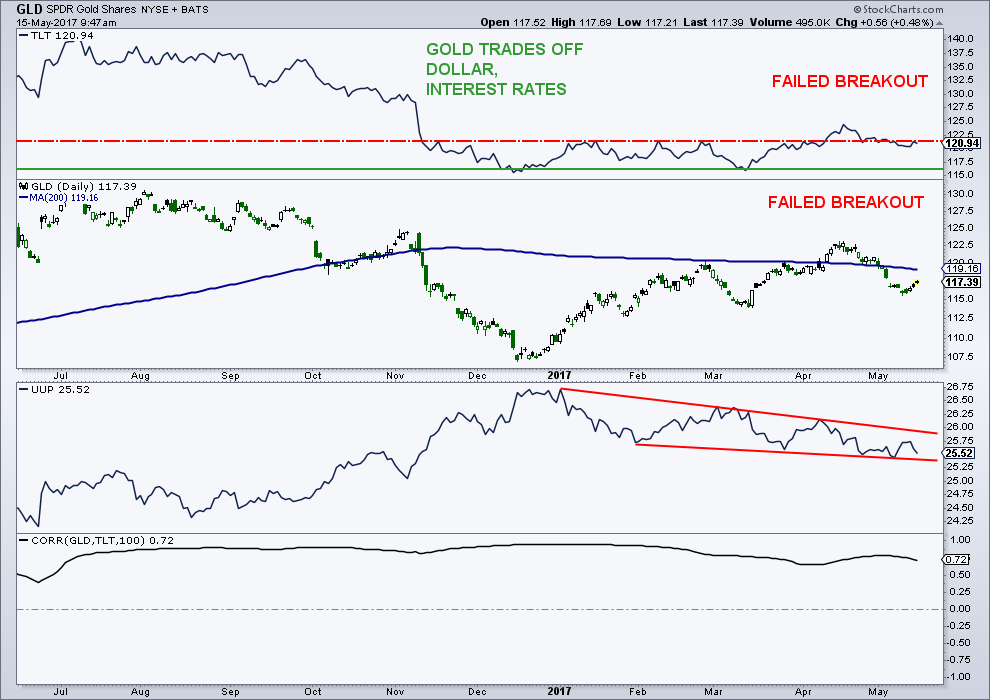

The iShares Gold Trust (GLD) breakout failed and its price is back below the flattish 200-day average. This is not all that surprising, though.

And this has to do with the failed breakout in Treasuries (NASDAQ:TLT). The two asset classes remain highly correlated.

Gold prices via GLD remain above the March lows in the 114 area; however, GLD’s uptrend off the December lows has been busted.

While the US Dollar (NYSEARCA:UUP) has been pulling back since early this year, the decline has been very mild. The COT data is near neutral, which does not inspire a lot of confidence in either a bullish or bearish call. As I said recently, the COT data for silver (SLV) is very bearish, but I missed that short as silver has gotten pummeled of late.

The Bottom Line: I am neutral here on the metals until treasuries and the dollar give us a better signal.

SPDR Gold Shares (GLD) Chart vs TLT and UUP

Feel free to reach out to me at arbetermark@gmail.com for inquiries about my newsletter “On The Mark”.

Thanks for reading.

Twitter: @MarkArbeter

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.