Highlights For Investors:

- Surge In Investment Spending Could Signal Secular Shift

- Earnings Rebound Not Yet Relieving Valuation Pressures

- Sentiment Balanced Despite Rising Optimism

- Seasonal Patterns Becoming More Challenging For S&P 500 (INDEXSP:.INX) and broad indices.

Fed Looking Past First-Quarter Disappointments

As we move through the second quarter, global policy uncertainty appears to be easing somewhat and new highs are being made around the world. As the news focus turns from French elections to Italian elections, we are reminded that there will always be another potentially upsetting headline event coming over the horizon. At home, there is tension between the data showing that economic growth slowed in the first quarter (the initial report for first-quarter GDP showed growth of just 0.7%, the slowest pace in three years) and corporate earnings reports that are showing a continued rebound on both the top and bottom line. In this environment, we turn our focus to the Federal Reserve and its projected path of policy normalization (i.e., interest rate hikes) for 2017.

With one rate hike already in the books this year and another two being seen as likely, Fed policy may turn into a headwind for stocks later this year. But for now it remains neutral and the willingness of the Fed to look past disappointing economic data in the first quarter speaks to an underlying confidence in the still-bullish economic fundamentals.

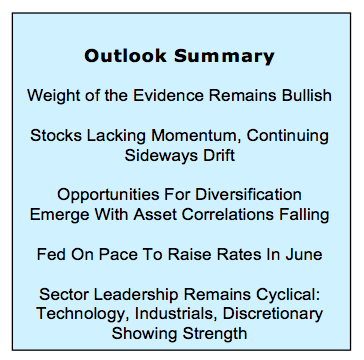

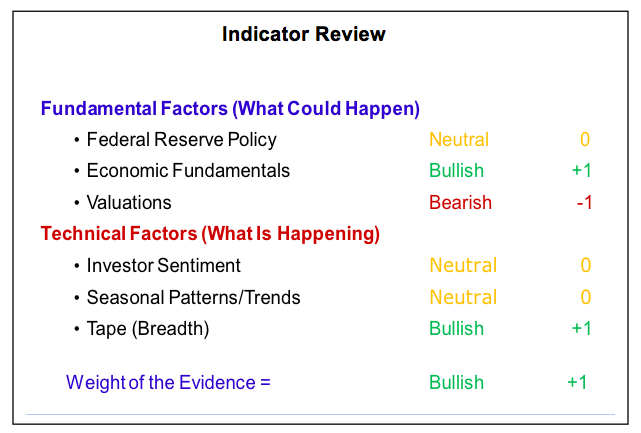

From our perspective, the overall weight of the evidence remains bullish and the path of least resistance for stocks over the intermediate term is higher. Beneath the surface, we have moved sentiment from bearish to neutral and we have dropped seasonal patterns and trends from bullish to neutral. Valuations remain bearish and breadth remains bullish. As we have suggested previously, declining correlations across asset classes could mean renewed benefits from diversification for asset allocators, and opportunities in leadership rotation for tactical investors.

ALSO READ: Is A June Fed Rate Hike Priced In?

Federal Reserve Policy is still neutral. While the Fed has raised rates three times (by a total of 75 basis points) since late 2015, an uptick in inflation during that time period means that real rates (interest rates less inflation) have actually been declining. Both long-term and short-term real rates remain below their long-term averages, suggesting that it would be premature at this point to suggest that the Fed has become unfriendly. If inflation continues to trend higher, the Fed may feel compelled to accelerate the pace of tightening just to avoid falling behind the curve. While this is not expected by the market currently, the Fed has demonstrated its ability to get market expectations in line with its plans in relatively short order.

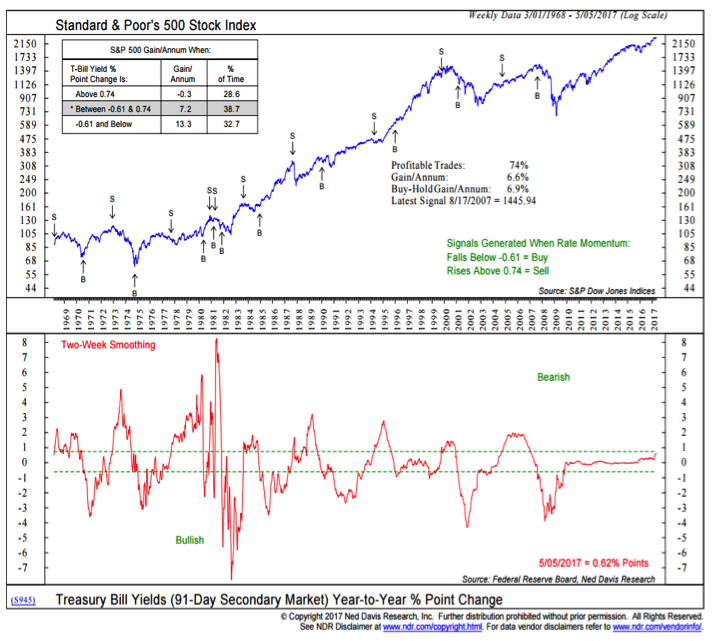

Signaling from the Fed could get a bit more complicated in the second half of 2017 as the focus expands to include not just interest rate hikes (another 25 basis points of tightening at the June fed meeting is already anticipated) but also the potential unwinding of the Fed’s balance sheet. This was expanded dramatically during the financial crisis and has been maintained at an elevated level since. Fed officials have begun talking about reducing the size of the balance sheet sooner rather than later, and at this point beginning of a gradual unwind in late 2017 seems likely. If this is accompanied by additional rate hikes, it may signal that Fed policy has shifted to become a headwind for stocks. We will be watching the yearly change in T-Bill yields for evidence of this shift.

Economic Fundamentals remain bullish. There are two ways of looking at the health of the economy. One can evaluate growth relative to recent and historical trends and one can evaluate the incoming data relative to expectations. After a period of persistent underperformance relative to expectations, the U.S. economy fared much better than expected in the second half of 2016 and into 2017 (seen graphically by the surge in the economic surprise index for the U.S.). As disappointing data for the first quarter has been reported, the economic surprise index has moved back into negative territory. The history of these economic surprise indexes, however, suggests this should not be too surprising. Expectations surged in late 2016 and while not all the data has been disappointing, the economic headlines have been. This actually provides a chance for a re-set of expectations. Furthermore, while data in the U.S. has not lived up to expectations, the rebound in growth being seen in Europe continues to surprise to the upside. From a global perspective, the economy continues to fare better than expected.

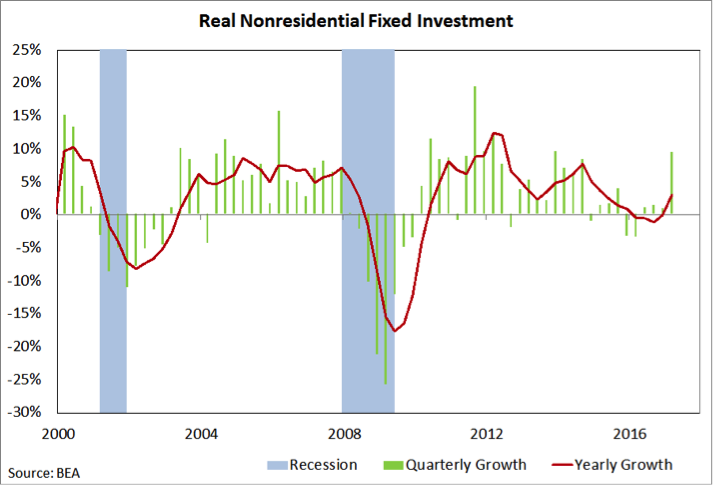

Not all the data in the U.S. has been discouraging. Headline GDP data for the first quarter showed the weakest growth in three years, but real nonresidential fixed investment spending surged nearly 10% in the quarter, the best showing since 2013. This suggests that the surge in business confidence seen at the end of 2016 is being followed with increased capital spending. A continued upswing in investment spending is critical if we are going to see productivity growth rebound. The weak headline GDP data are also at odds with strong labor market data showing still-robust hiring trends and widespread job openings.

Businesses Doing Better… Better trends in the underlying data and still-strong growth overseas are also reflected in corporate earnings reports. Both revenue growth (8%) and earnings growth (13%) for the S&P 500 in the first quarter are showing their best gains since 2011. While some degree of this corporate recovery is based on favorable year-ago comparisons, it is worth noting that nearly 80% of the companies in the S&P 500 that have reported first-quarter earnings have come in with positive earnings surprises, the best since 2010. So far, upside to earnings in the first quarter has come at the expense of expectations for the remainder of the year. If full-year earnings expectations can start to drift higher, it could be strong evidence that a sustainable shift towards better growth has occurred.

Even with the improving earnings backdrop, Valuations remain bearish. Given the divergence between price and fundamentals that has occurred in recent years, it will take more than one or two quarters of strong earnings growth to relieve valuations pressures. It is encouraging, however, that the recovery in earnings is being driven by better top-line results. Importantly, valuations speak to risk and elevated valuations suggest an elevated risk environment (an important point given that many measures of volatility suggest placidity bordering on moribundity). In other words, even as corporate results are improving and stock market volatility has declined, risks remain elevated.

continue reading on the next page…