This post was written by Craig Basinger of Richardson GMP.

There is no question Exchange Traded Funds (ETFs) have exploded in popularity. They offer many benefits to investors and their merits are well known. There is also rising evidence ETFs are changing the structure of the markets and how investors behave.

And perhaps driving the market’s herding mentality…

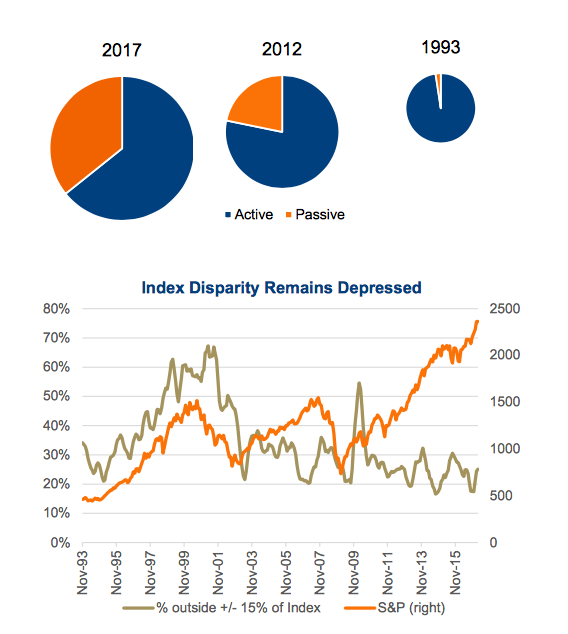

Just to show how the popularity of ETFs or passive indexing has risen, the three pies show how passive funds/ETFs have been gaining market share over the years. In 1993, passive indexing strategies made up 2.4% of total assets. Now, they have reached 36%. There are studies that indicate over 28% of volume on the U.S. exchanges is ETF driven.

As the daily net flows for an ETF drive the market makers to execute basket trades for the ETF, there is evidence this is suppressing disparity in performance from one company to the next. It is more blanket buying or selling, indiscriminate and based solely on the targeted index composition. If most of the flows are in the ETFs that track the main indices, then flows trigger broad based buying or selling. We have certainly seen a drop in index disparity (2nd chart above), meaning the variance between index member price performance has been historically low for years. Many believe this is attributable to the rise of ETFs and more money invested in index products.

We will revisit this market structure changes in later editions. For this report, we wanted to see if ETF investors suffer from some of the herd like behavior evident in the mutual fund world. There have been many studies that highlight return chasing in the mutual fund industry. A new small fund generates some solid returns and once it has a three or five year number, begins to attract more and more assets. Then the performance normalizes. The result, the fund still has good performance numbers but it really does not match the average fund holders experience since so many joined the fund later.

Dalbar, a Boston based financial firm that does some amazing things, has been measuring investor returns compared to average fund returns and index returns for years. Well, if you thought fees mattered (and they do), the timing of investor purchases matters a lot more. They have found average investor performance lags the index by about 2 to 4% per year, although it does vary from year to year. According to the latest report over the past 20 years, the S&P 500 has had an annualized return of 8.2% while dollar weighted investor returns were 4.7%. This lag would include fees, but clearly there is something bigger at work – namely the timing of investor purchases and redemptions.

ALSO READ: 2017 M&A Activity: Factors & Implications

Mentally it is easy to justify buying funds that have outperformed as a quest to find superior managers or the most talented. Clearly, a superior manager would become evident in performance numbers over time (maybe even Mr. Danoff according to all the billboards around town). Unfortunately, the norm is a reversion to the mean and often following outperformance comes underperformance. You know that disclaimer you always see on anything with historical performance that says “past performance is not indicative of future returns”. It isn’t just to cover someone’s behind, it is because many academic studies have indicated it to be true.

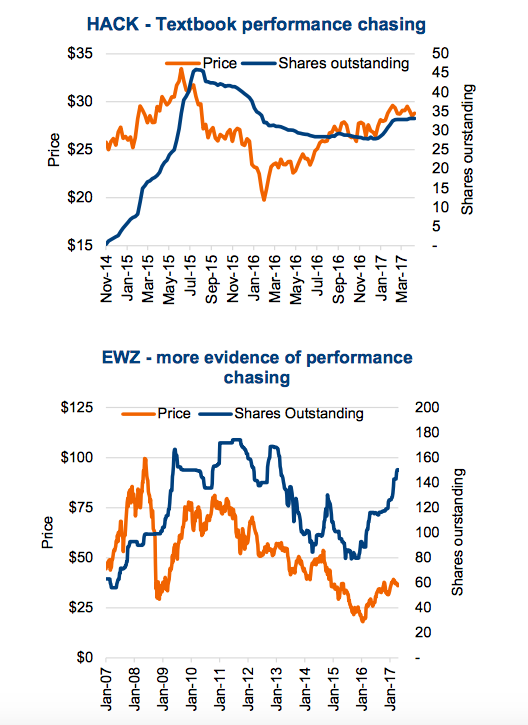

Still, past performance should certainly be an input into fund selection, along with a host of other factors. But what about with ETFs? If investors chase the performance of ETFs, they clearly are not believing the manager is talented, it is an ETF that tracks an index. If there is performance chasing in ETFs, it is likely more pure performance chasing as in a sector or index has done well so it is gathering more money.

The Brazil ETF (EWZ) and further evidence of performance chasing

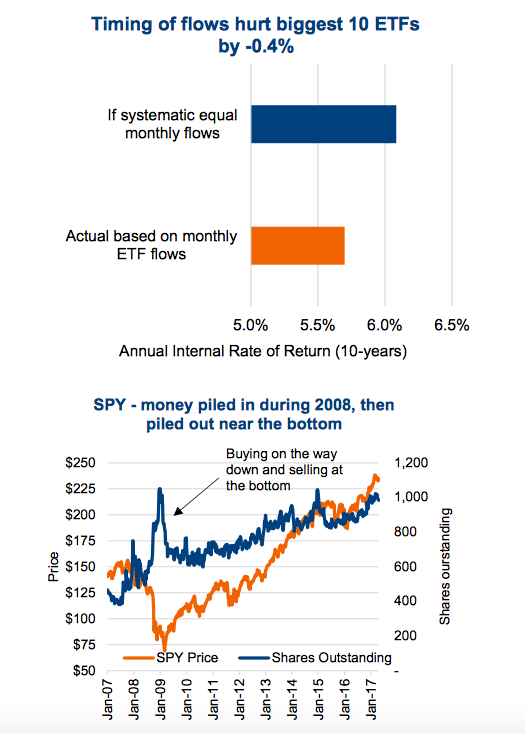

For the 10 biggest ETFs, we calculated an IRR based on the timing of monthly flows in and out of the ETF. We compared that to an IRR assuming equal monthly flows over the 10-year period. The difference being the value added or lost based on the timing of the purchases/sales. The average for the 10 ETFs was a -0.4% annual drag on performance due to the timing of investor buys/sells. Not too bad, but certainly adds support for those accumulating wealth to implement a systematic buying plan.

The big hits from the timing of flows did occur during more volatile markets, as investors often didn’t do the right thing. A combination of holding on too long (selling too late) or not getting back in once things improve. Looking at the S&P 500 ETF (NYSEARCA:SPY) in the lower chart above, money continued to flow in during the market decline, then redeemed out near the bottom.

Outside the big ETFs, we certainly see more performance chasing. While blatant out of sample picking, the next charts are HACK and EWZ (NYSEARCA:EWZ). The HACK ETF is cyber security (NYSEARCA:HACK), which clearly got a ton of attention out of the gate, then fizzled. While the ETF has done OK, based on when investor purchased, most did not. We also see spikes in shares outstanding of EWZ following strong price performance. Notably after the recent up swing.

Investment Implications

The rise of passive investing, mainly via ETFs, appears to be changing the structure of the markets. This could be suppressing individual company variance and making the market more macro driven. As more money flows into passive ETFs, this structural change would likely continue to rise over time. At some point this could be a big enough driver to create greater opportunities for more fundamental research to add value. Perhaps opportunities to take advantage of blanket basket driven price moves. Not sure if we are there yet, but it is likely coming.

The timing of investor purchases and sales of ETFs does appear to follow similar patterns as mutual funds, namely performance chasing. Even in the broad market ETFs there is evidence that investor market timing is a drag on performance. Once again more evidence investor behavior and timing of purchases/sales impedes long term performance.

Thanks for reading. Charts are sourced to Bloomberg unless otherwise noted.

Twitter: @sobata416 @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.