Evidence Bullish As Stocks And Broader S&P 500 (INDEXSP:.INX) Consolidate Gains

A look at 2Q and beyond for investors.

Highlights:

- Federal Reserve Raises Rates Despite Elevated Uncertainty

- Economic Recovery Not Just ‘Animal Spirits’

- Investor Optimism Retreating From Recent Excesses

- Rally Participation Remains Broad, At Home & Overseas

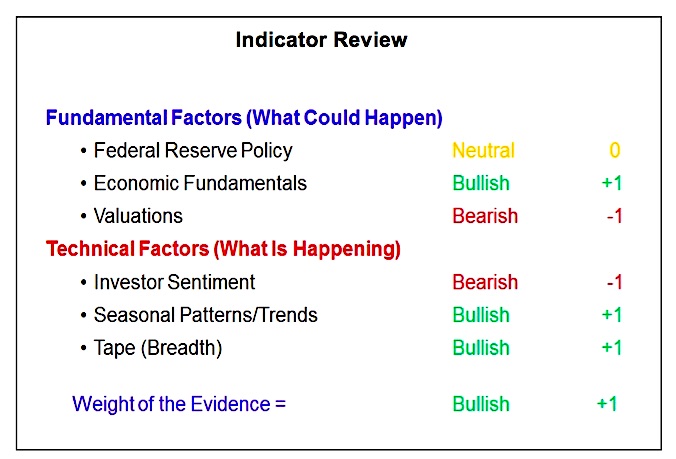

Longer-term breadth and momentum remain supportive for stocks and the weight of the evidence suggests the path of least resistance over the intermediate term remains higher. Nonetheless, near-term risks have risen and stocks could struggle to build on their early-year gains as we move into the second quarter. While investors may see an upswing in volatility, this could come in the context of improving economic fundamentals and an ongoing cyclical bull market for stocks. For investors with a strictly longer-term investment horizon this will likely be little more than noise. For those who take a more nimble approach to the market, it could bring new opportunities. On the positive side, most areas of the market remain in up-trends and rally participation remains broad, at home and, increasingly, overseas.

The resurgence in international stocks comes as the role of diversification and the debate between active and passive approaches to investing crescendos. It does not seem surprising that as the Fed has begun to normalize interest rates, the correlations across various asset classes have begun to recede. As the focus of longer-term stock market support turns away from global monetary policy and toward improving economic and corporate fundamentals, active portfolio management may gain ground relative more passive options. For some investors this may mean using active managers within the context of a diversified portfolio, for others the focus may be using passive investments (like ETF’s) to provide an active tilt toward those areas of the market showing relative leadership.

Federal Reserve policy is still neutral. The FOMC raised its target for the Fed Funds Rate by another 25 basis points in March. This is the third such increase since the Federal Reserve began normalizing short-term interest rates in late 2015. While there is some history of stocks negatively reacting after three rate hikes (hence the adage, three steps and a stumble), given that rates overall still remain at historically low levels, that may not hold in the current situation. Rather, the fact that the Fed is raising rates at a time of elevated uncertainty reflects an underlying confidence in the economy and could be seen as bullish for stocks. Elevated levels of uncertainty itself are bullish for stocks. The path for interest rates for the remainder of the year is likely to be higher, but the pace of tightening remains to be seen.

Economic Fundamentals are bullish. Much has been made of the surge in economic optimism (policy uncertainty notwithstanding) since late 2016. This might lead some to believe that a constructive view on the economy is premised on promised reforms from the President and Congress and without it the so-called animal spirits that have awakened will soon become dormant. Incoming economic data suggests that is not the case. Most areas of the global economy are seeing improving growth and the Chicago Fed National Activity Index (an 85-indicator composite of national economic activity) has moved back above zero, indicating above-trend economic growth). In other words, lost in the discussion of policy uncertainty, is the indication that economic growth turned a corner last year and is already improving.

Valuations remain bearish. It is hard to get around the reality that stocks are expensive by almost any measure. Corporate and economic fundamentals have lagged the stock prices, pushing various valuation measures (Price to Earnings, Price to Sales, and Stock Market Capitalization to GDP) to elevated levels. Fundamentals are, however, starting to improve. Economic growth is re-accelerating and the earnings recession has ended. Last year saw yearly earnings growth turn positive again, and the expectation for 2017 is for further improvement. While the expected pace of earnings growth in 2017 has slowed slightly since the beginning of the year, earnings remain in recovery mode and could soon help relieve some of the pressure on valuations.

continue reading this article on the next page…