As mentioned in my last two posts, I am long several stocks with 50% allocations for each as of today.

Those stocks are Merck (NYSE:MRK), Halliburton (NYSE:HAL), 20+ Year Treasury Bond ETF (NASDAQ:TLT), Baxter International (NYSE:BAX), Abbott Labs (NYSE:ABT) and JetBlue Airways (NASDAQ:JBLU).

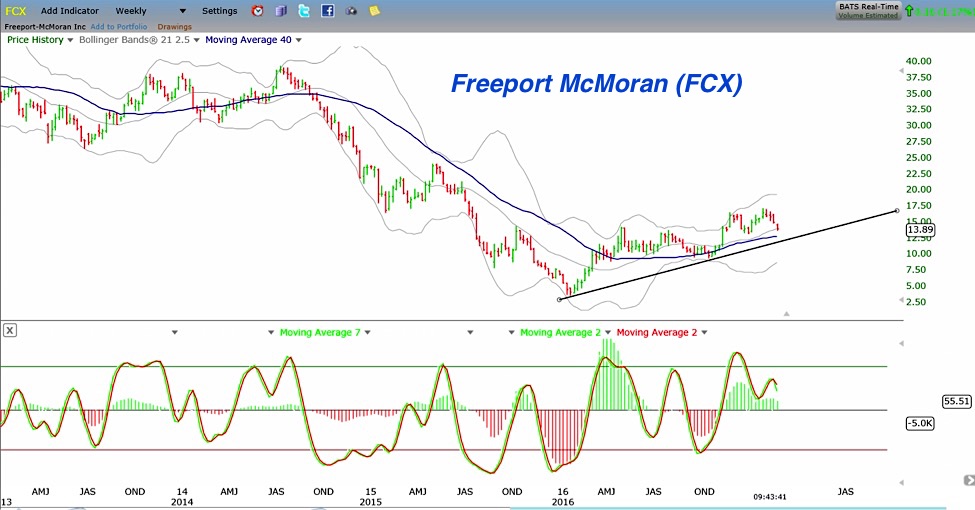

On Jan 30th I had been long Freeport McMoran (NYSE:FCX) although that has been closed since as posted on my twitter feed @cjmendes.

I am still leery to add to these positions as my analysis still points to a market that is precariously overbought and thinning by the day. I am of the opinion we will get a fairly sharp pullback in the days or weeks ahead which will be a good buying opportunity into a very select group of stocks.

Nonetheless the stocks in the portfolio have performed well.

Merck (MRK) My cost basis here is $61.06 and as of this writing it sits at $65.53

I like this sector quite a bit and I think a broad market pullback will reset this group for another major leg higher.

Halliburton (HAL) My cost basis on this one is $53.37 and it sits at $54.10 today. I am on the fence on this one and keeping a tight leash. It’s up nicely today but has been an underperformer over the past several weeks. I may very well liquidate this one as soon as today. Have limited amount of funds to allocate to positions and I think there are better opportunities elsewhere.

JetBlue (JBLU) My cost on this stock is $19.42 and it sits at $20.09 today. I am disappointed with the set up here. Take a look at my histogram below. When it fails topush through intogreen on price spikes it more often than not portends a move in the opposite direction. Liquidating full position today.

Freeport McMoran (FCX) I sold this position on Feb 10th at $16.46. It sits today at $13.84. This stock has been hijacked by daytraders…

iShares 20+ Year Treasury Bond ETF (TLT) My cost basis is $119.10 and it sits today at $120.45. This is a classic basing pattern and building accumulation as indicated by my histogram. Will be adding to this one soon.

Abbott Labs (ABT) My cost on this one is $38.26 and it sits today at $45.00. Love the sector, love the name. Reaching some lofty levels and a pullback is likely.

Baxter International (BAX) My cost is $44.38 and it sits at $50.27 today. This one has also been a great winner although I am disappointed with the lack of follow through on the histogram. Watching for now.

Markets are reaching extreme levels here within a very short timeframe. A Lot of market friendly news seems to be priced in and the tepid participation portends to a market with a quick trigger finger on the sell button should a catalyst emerge.

The VIX also points to a market that is complacent and therefore vulnerable to sharp pullbacks. Protection is very cheap in the form of puts and I suggest traders begin to evaluate using them here.

Sentiment sit at extreme bullish levels and a certain giddiness has developed among the perma bull crowd that typically comes along at important market inflection points.

My take, do your own research and reach your own conclusions!

Twitter: @CJMendes

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.