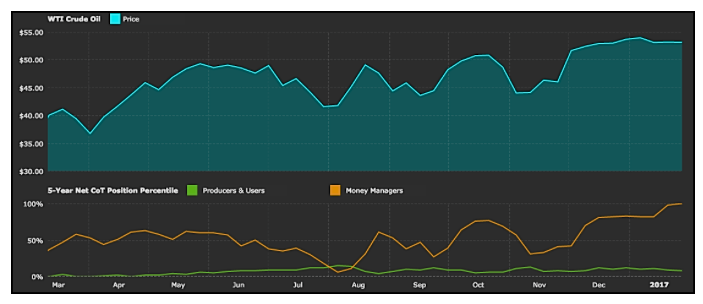

Crude oil has gone nowhere over the past 10 weeks.

We’ve been discussing the potential for a breakout trade in our market recap videos for the past several weeks as we’ve seen it coil up and trade in between this $52 to $54 range.

Yesterday, we finally saw some range expansion to the downside as we broke and closed below this trend-line extending from the January 2017 lows and on an uptick in volume.

We do have some prior horizontal support around this $52 level that could cause some pause in the breakdown, but as it stands, sellers are trying to roll this market off the cliff.

We also know based on the commitment of traders report via www.freecotdata.com that money managers are the longest they’ve been positioned in crude in over a years time.

This means, in general, when everyone is on one side of the boat, it’s probably best not to be right along side of them.

Based on the evidence above, members and I got short crude oil yesterday, February 7th, via $DWT, looking for a continued roll over in crude oil prices towards the December lows. As always, stops are in place in the event buyers come to the rescue.

Check out more of my chart analysis over at The Trade Risk. Good luck out there and thanks for reading.

Twitter: @EvanMedeiros

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.