The end of 2016 was interesting to say the least for investors. The Federal Reserve finally raised rates by a sliver and the markets trended higher. This all occurred while pundits scrambled to interpret how a Donald Trump win will affect their 2017 market outlook for investors.

For the month, the S&P 500 (INDEXSP:.INX) rallied 1.8 percent. At the same time, bonds were hit hard again.

The bond market is now firmly expecting 3 Fed rate hikes in 2017, and the stock market is firmly expecting a large tax stimulus and government spending to happen in 2017. I would not be surprised if both markets are a little disappointed in the months to come – more on that in the Commentary section below.

Stocks & Bonds

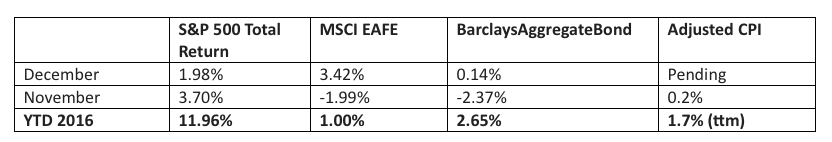

Stocks continued to rally into year end, and the U.S. rebound was joined by many international markets. Meanwhile, bonds tempered their losses. Data continues to show economic expansion in the U.S. There are legitimate critiques of methodology of the U.S. unemployment statistics, but nevertheless, the economy continues to add jobs. Here are the numbers for both December and 2016 overall:

Commodities & Currencies

Crude oil prices rose again in December, fueled by hopes that Russia and OPEC would make good on a plan to curtail production. This has lent optimism to the 2017 market outlook but how this plays out will be important. In 2016, crude oil prices gained about 25%, closing at almost $54 per barrel. Gold prices (NYSEARCA:GLD) declined slightly in December, ending the year with a gain of about 8%. After a poor end to 2016, Gold has rallied to start 2017.

The U.S. Dollar Index (CURRENCY:USD) eked out a small gain in December, and for the year (2016) gained about 3.5%. Many newspapers ascribe this strength to the Trump election. I have not seen any academic study that shows a correlation between international currency valuations and pre-presidential tweets. It is more likely that funds are flowing into the U.S. in anticipation of more rate hikes in 2017.

Economy

The ISM Manufacturing PMI in December came in at 54.7%, showing accelerating growth from the previous month. The non-manufacturing, or services, index came in at 57.2%, the same reading as November. The Commerce Department released its third estimate of third quarter GDP growth, and there was another upward revision to 3.5% estimated annual growth. The National Association of Realtors reports that existing-home sales in November 2016 were 15.4% higher than in November 2015. In addition, the median price increased 6.8% to $234,900. This marks over 4 ½ years of rising median home prices. Distressed sales (foreclosures and short-sales) rose slightly in November, to 6% of the overall market.

Commentary

On December 16th, 2008, the Federal Reserve lowered its reference rate to 0%, which is where it stayed for 7 years. The Federal reserve finally, and cautiously, moved its reference rate from 0% to 0.25% in December 2015, and then again from 0.25% to 0.5% in December 2016. The Fed wanted to ‘normalize’ rates much earlier than 2015, but has been repeatedly stymied not by domestic problems, but by international problems. Since the Lehman moment of 2008, our economic recovery has been slow but relatively steady. Meanwhile, the Euro area has contributed a banking crisis in Italy, continued worries about Grexit, and most recently the Brexit surprise. In South America, Venezuela has entered a period of hyper-inflation, Brazil had a tremendous scandal at Petrobras, and many other economies are struggling with weakening currencies and weak exports. In Asia, China delivered a shock yuan devaluation in 2015, and the Chinese stock market has had at least two mini-crashes in the last few years.

Each of these headlines, regardless of its economic impact, has played a role in staying the hand of the Fed. It seems unlikely to me that the next 12 months will be uneventful – Brexit is on the horizon, China continues to struggle with capital flight, and although oil prices have rebounded slightly, oil exporters around the world are still struggling with low prices. I imagine the Fed will again be forced to raise rates more slowly than it wants – this is a positive for the bond market.

Turning our attention to the stock market, there are strong arguments in both the bear and bull camps alike. The bears can correctly claim that we are overdue for a large correction, that rising interest rates could pull capital from stocks into bonds, and that a strengthening dollar will hurt our GDP and corporate profits. The bulls can correctly claim that P/E ratios remain reasonable by both historical and relative standards, that corporate profits are strong, and that upcoming fiscal stimulus will be positive for both GDP and the stock market.

In the financial world, there is a wonderful solution for those who are both bearish and bullish and uncertain – a diversified portfolio. I do not know if 2017 will be a year of calm and economic growth, or if a large problem will materialize, or if the year will be a muddled mess of some positive and some negatives. I do know that a diversified portfolio, properly built, can turn a stock market correction into an opportunity to buy, and also ensures that you participate in any rally. A diversified portfolio says I can’t be 100% year-in and year-out, so I just want to be right about the direction over a long period of time.

So I am bullish/bearish/neutral on the stock market over the next 12 months, in case you want to know how I really feel J I continue to favor companies that are less dependent on GDP growth for their success – they have a technological or other competitive advantage that should help them do well, whether GDP is positive or negative 2%. And I continue to maintain a healthy allocation to conservative bonds, always ready to buy more stocks at a discount when the newspaper headlines deliver bad news.

Thanks for reading.

This material was prepared by Greg Naylor, and all views within are expressly his. This information should not be construed as investment, tax or legal advice and may not be relied upon for the purpose of avoiding any Federal tax liability. This is not a solicitation or recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. The S&P500, MSCI EAFE and Barclays Aggregate Bond Index are indexes. It is not possible to invest directly in an index. The information is based on sources believed to be reliable, but its accuracy is not guaranteed.

Investing involves risks and investors may incur a profit or a loss. Past performance is not an indication of future results. There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio in any given market environment. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Listed entities are not affiliated.

Data Sources:

- www.standardandpoors.com – S&P 500 information

- www.msci.com – MSCI EAFE information

- www.barcap.com – Barclays Aggregate Bond information

- www.bloomberg.com – U.S. Dollar & commodities performance

- www.realtor.org – Housing market data

- www.bea.gov – GDP numbers

- www.bls.gov – CPI and unemployment numbers

- www.commerce.gov – Consumer spending data

- www.napm.org – PMI numbers

- www.bigcharts.com – NYMEX crude prices, gold and other commodities

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.