December 29, 2016 – Stock Market Futures Overview

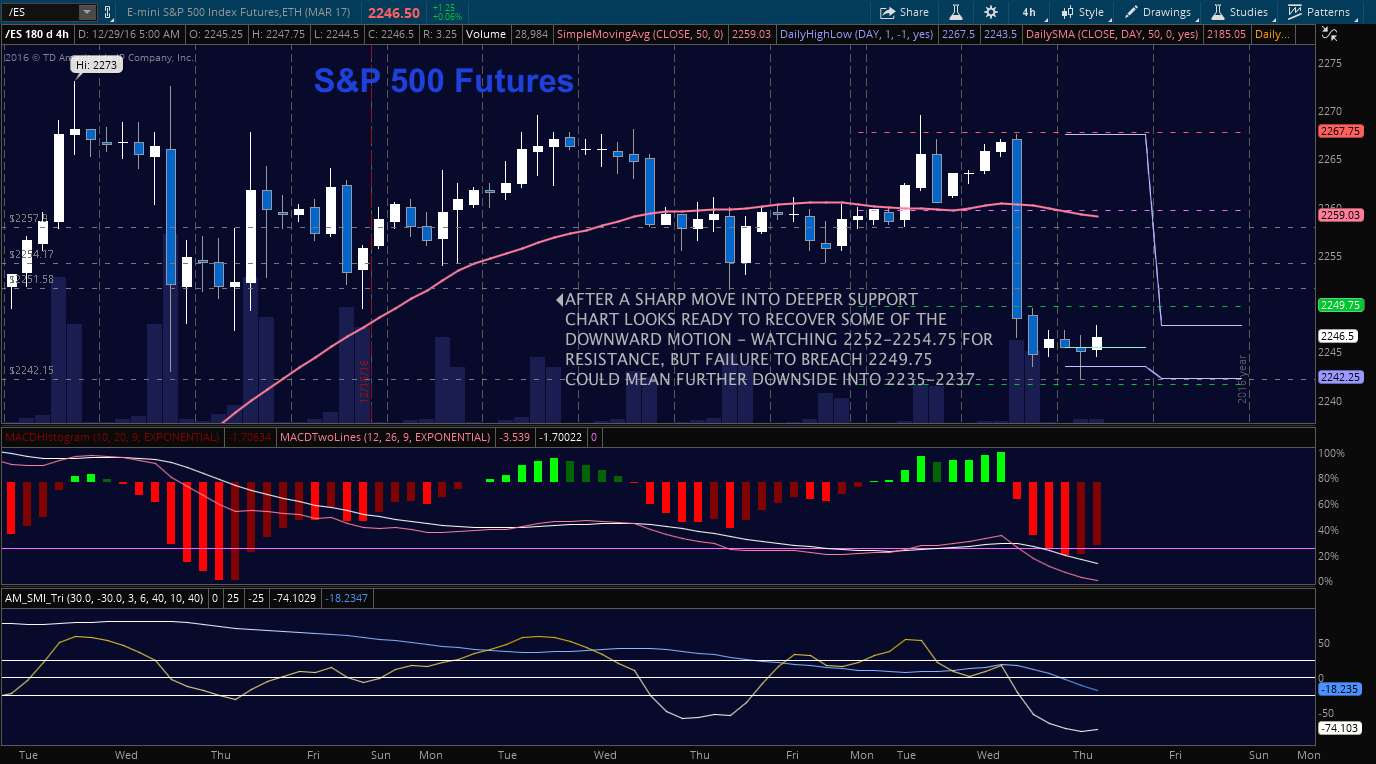

After a big push to resistance, the S&P 500 (INDEXSP:.INX) and other stock market indices drifted into support. The S&P 500 futures drifted below our 2250.50 on Wednesday. The key for yesterday is to note that support was shifted into 2260.50, and once it broke, all the sellers came into the fray. This morning, that number holds as resistance for futures. Volume continues to be light. The support levels below 2250.50 are 2245.5 and 2242.25. It appears that we are attempting a bounce, but the patterns are weak. In order for price action to hold higher, we need to breach and hold 2252, else sellers will hold primary power.

The lines in the sand for buyers to hold will be 2247-2250. Below that, sellers are in primary control. Resistance sits near 2254-2257.

See today’s economic calendar with a rundown of releases.

TODAY’S RANGE OF MOTION

E-mini S&P 500 Futures Trading Chart For December 29

Upside trades – Two options for entry–

Positive retest of continuation level -2252.5 (careful here – a retest is required)

Positive retest of support level– 2242.25

Opening targets ranges for non-members -2247, 2249.75, 2254.75, 2260.50, 2263.5, 2266.5, 2269.25, 2271.25, 2272.75, 2275.50, 2278.25 and 2282.50

Downside trades – Two options for entry–

Failed retest of resistance level -2254

Failed retest of support level– 2245.5

Opening target ranges –2257.75, 2254.5, 2251.5, 2249.50, 2246.50, 2242.75, 2238.75, 2234.75, 2231.50, 2227.75, 2224.25, and 2224.25

Nasdaq Futures

The NQ_F also sits at a bounce zone after the move lower yesterday. Momentum is now mixed, but as long as buyers can hold the support at 4920-4924, we should see a test of 4941. Sellers are in control as long as prices hold below 4940

Upside trades – Two options

Positive retest of continuation level -4930.50 (needs confirmation)

Positive retest of support level– 4924.50 (also needs confirmation)

Opening target ranges –4927.50, 4930.50, 4936.75, 4940.75, 4947.75, 4952.75, 4959, 4962.25, 4966.75, 4973.25, 4978.5, 4988.25, 4994, 4997, and 5002.25

Downside trades- Two options

Failed retest of resistance level -4930 (careful here – negative divergence needs to be present)

Failed retest of support level– 4917.75 (watch for support bounces as the lows continue to be higher)

Opening target ranges –4952.75, 4948, 4943.5, 4936.5, 4931.50, 4927.75, 4923.75, 4917.75, 4914.25, 4909.50, 4905.75, 4897.75

Oil –WTI Crude

WTI crude is range bound into the EIA report today. The current range of motion sits between 53.03 and 54.5. On longer time frames, the chart appears to be bullish – holding support over the past few days, but failing to breach resistance. Uncertainty is present and for me, this means I am looking at prices to engage on weekly time frames, not in the choppy mess where we currently reside.

Upside trades – Two options

Positive retest of continuation level -54.2 (needs a retest)

Positive retest of support level– 53.12

Opening target ranges for non-members –53.37, 53.64, 53.8, 53.94, 54.04, 54.35, 54.5, 54.77, 54.9, and 55.4

Downside trades- Two options

Failed retest of resistance level -53.9

Failed retest of support level– 53.6 (needs a failed retest)

Opening target ranges for non-members –53.7, 53.37, 53.2, 53.03, 52.81, 52.64, 52.32, 52.09, 51.85, 51.57, 51.32, 51.08, 50.27, 50.13, 49.87, 49.6, 49.27, 49.05, and 48.92

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.