Year-End Stock Market Rally Appears on Track

Market Highlights For Investors:

- Economic Growth Rebounding In Second Half

- Corporate Earnings Recession In Rear-View Mirror

- Pockets Of Investor Pessimism Emerge

- Seasonal Trends Offer Tailwind For Stocks; Breadth Still Mixed

New presidential terms are usually filled with policy uncertainty as the promises of the campaign give way to the realities of governing. Although unified Republican control in both houses of Congress and the White House may seem to suggest 2017 will be an exception to this pattern, the timing and scope of specific policy implementation remains subject to the typical Washington D.C. sausage-making process. So rather than speculate on the long-term investment implications of such unknowns, investors may be better served by continuing to follow the message of the weight of the evidence.

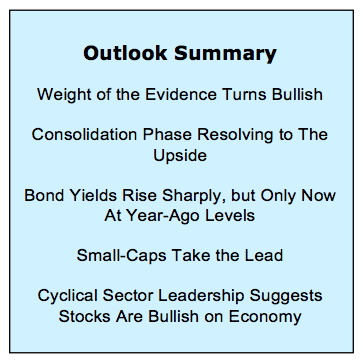

Investing Strategy & Market Outlook Into Year-End

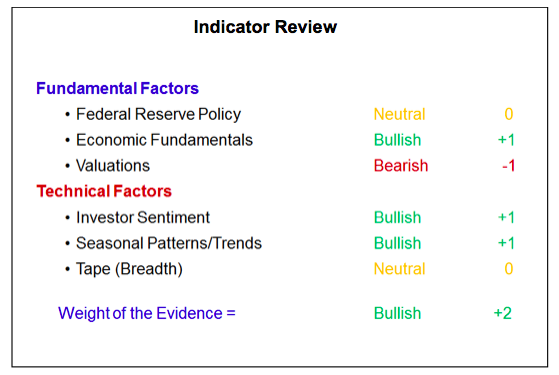

After several months with a neutral message towards stocks and the S&P 500 (INDEXSP:.INX), the weight of the evidence has now turned bullish. Over the past month, market breadth has slipped from bullish to neutral. This has been more than offset by a shift in investor sentiment from excessive optimism to excessive pessimism and a now bullish seasonal tailwind.

While the fundamental factors have not changed in recent months, the theme for 2017 may well be improving growth trends from the economy fueling a rebound in earnings growth (and thereby helping ease valuation concerns). This is not a forecast of potential policy shifts by an incoming presidential administration, but based on the apparent germination of seeds that have already been sown. Now more than ever investors need to steer clear of emotion-based investment decisions and focus on the evidence in hand – and that evidence right now favors a bullish tilt toward stocks.

Federal Reserve policy is still neutral. The market has almost fully priced in a 25 basis point rate hike by the Fed when it meets in December. Treasury yields, which were moving higher prior to the presidential election, have surged in recognition that global stimulus going forward is more likely to come from fiscal policy than from monetary policy. Under this scenario, the path of future rate hikes could actually accelerate somewhat. Combined with rising bond yields, the uptick in inflation seen in 2016 increases the likelihood that the Fed will find itself behind the curve (chasing higher yields and inflation) rather than ahead of the curve (normalizing policy while growth still appears weak). While rates still at historically low levels, there is room for the Fed to pick of the pace of tightening and still not become a headwind for stocks.

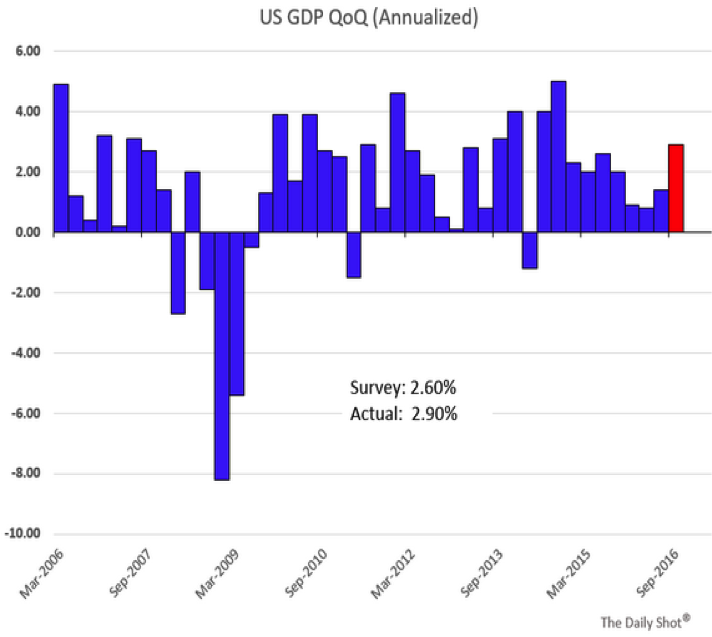

Economic Fundamentals are bullish. One quarter of better-than -xpected economic growth does not itself make a new trend. Nonetheless, the 2.9% GDP growth seen in the third quarter is encouraging on several fronts. It was the best quarter of growth since the third quarter of 2014, fueled by the ending of the year-plus long inventory de-stocking trend and a surge in export growth. The economy continues to emerge from an 18-month long period (from early 2015 to mid-2016) where data on growth consistently fell shy of expectations. Wage growth continues to move higher, reflecting health demand for labor even as the pace of job gains has slowed in 2016 (suggesting the problem is with labor supply). While perhaps not yet ready for harvest, the seeds of a sustained upswing in economic growth appear to already be planted.

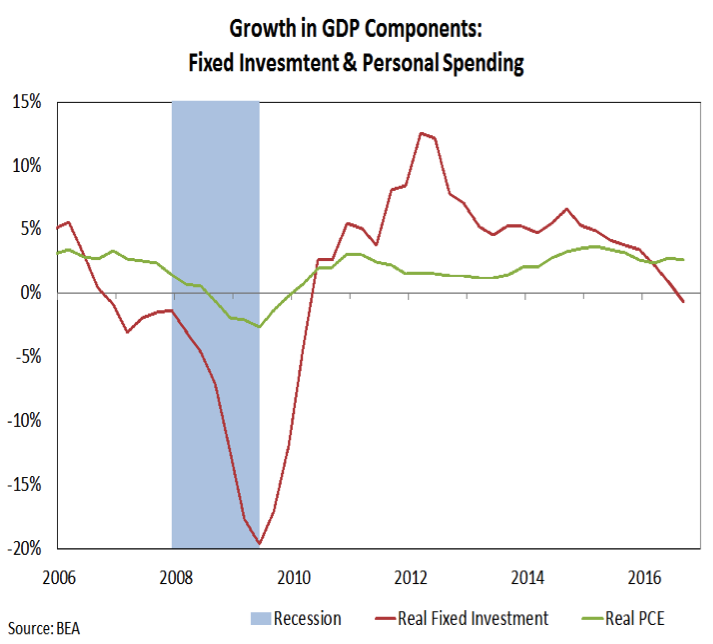

Still missing from the growth equation is a rebound in real fixed investment. Business spending has been restrained by multiple headwinds that each seem to be easing: Continued wage gains have made hiring additional workers more expensive, rising borrowing costs may lead to a renewed focus on organic growth and business confidence is rebounding. Even without the prospects of a more favorable regulatory environment in coming years, business spending could be poised to re-accelerate. This would fuel not only current-quarter GDP growth, but would provide the type capital deepening than many economists believe will help fuel productivity advances. While some are concerned that declines in fixed investment can be harbingers of recession, the best real-time indicators of recession suggest that risk remains extremely low.

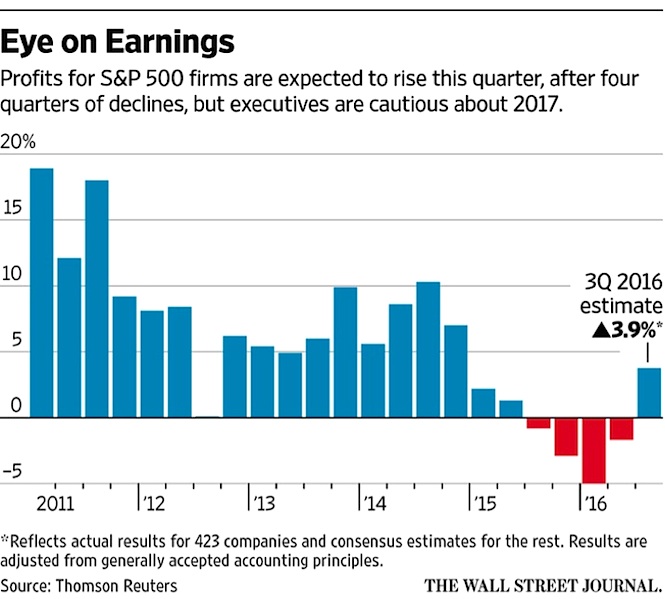

Stock market valuations remain bearish. Stocks range from being just expensive (in the case of broad indexes like the S&P 500) to being extremely expensive (in the case of the crowded low-volatility, high-dividend, defensive equity exposure areas of the market). The good news from a valuation perspective is that after declining for a year, S&P 500 earnings actually expanded in the third quarter. The earnings recession that had been ongoing for basically the past six quarters (earnings grew only marginally in the first two quarters of 2015) reflects the disappointing economic environment from which we appear to be emerging. The better economic growth backdrop could help fuel a continued rebound in earnings growth.

continue reading on the next page…