October was a mildly interesting month, as both bonds and stocks sold off moderately. Usually these asset classes move in opposite directions. The S&P 500 (INDEXSP:.INX) “total” return for October was -1.82%.

Wall Street showed its hand, as stocks sold off on news of the FBI investigation of Clinton’s emails, before rebounding strongly after the investigation was dismissed.

Stocks & Bonds

Bonds sold off somewhat on fears of a fed rate increase in December. At the same time, stocks sold off due to pre-election jitters. So we had the somewhat uncommon situation where both stocks and bonds declined. History shows that ultimately one of the two asset classes usually changes course. Perhaps a Trump victory will see some upside as his tax cuts will likely fuel outsized corporate profits and consequently stock gains – but we’ll see. There isn’t much certainty in anything right now…

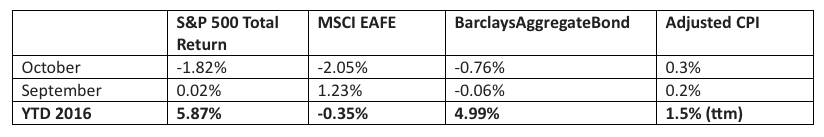

Here is last month by the numbers:

Commodities & Currencies

Oil prices softened somewhat in October, as OPEC’s talk about production cuts has run into a stalemate at the negotiating table. In addition, supply continues to increase in various corners of the world, adding to the mixed picture for oil prices. Year-to-date, oil is up almost 10% after giving up about 3% in October. Gold (NYSEARCA:GLD) declined just over 3% in October, as U.S. Treasury futures markets are increasingly convinced that the Fed will raise rates again in December. As bond yields rise, generally gold becomes less attractive, since it’s yield is always 0%.

The U.S. dollar jumped just over 3% in October, aided by the hope of a fed increase, and for the year is now essentially flat.

Economy

The ISM Manufacturing PMI in October came in at 51.9%, a bit of a relief as it continues the positive numbers of September, and puts a little more distance from the surprisingly negative number from August. The non-manufacturing, or services, index came in at 54.8%, a slower reading than the previous month, but strongly in positive territory. The Commerce Department released its advance estimate of third quarter GDP growth, matching Wall Street estimates at 2.9%. The number was aided by a return of business investment, and also by much stronger farm exports, especially soybeans. This is the best reading of the year, after the first and second quarters came in at 0.8% and 1.4% respectively. The National Association of Realtors reports that existing-home sales in September 2016 were 0.6% higher than in September 2015. In addition, the median price increased 5.6% to $234,200. This marks over 4 ½ years of rising median home prices. Distressed sales (foreclosures and short-sales) fell to a new record low of 4% of the market in September. The National Association of Realtors started tracking this number in October 2008, at the height of the housing crisis. This new record low certainly is certainly good news for the health of the housing economy.

Market Commentary

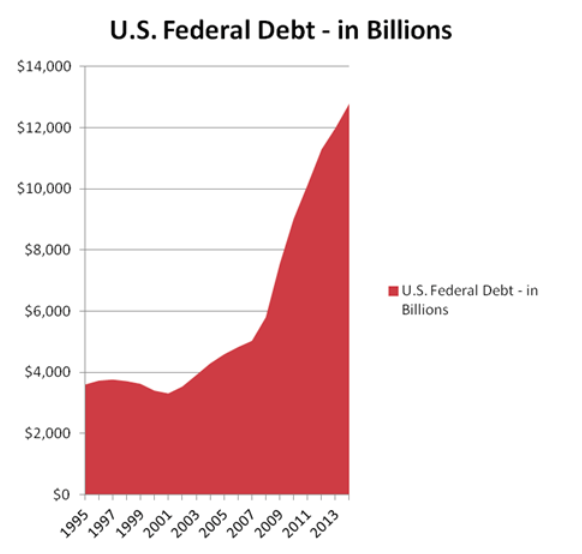

Since today is election day, let’s glance at our government’s financial records. If you look at the following 20-year chart on the national debt, you would not be impressed with President Obama’s 8-year track record. Under his tenure, the debt outstanding more than doubled from $5.8 Trillion to $13.2 Trillion.

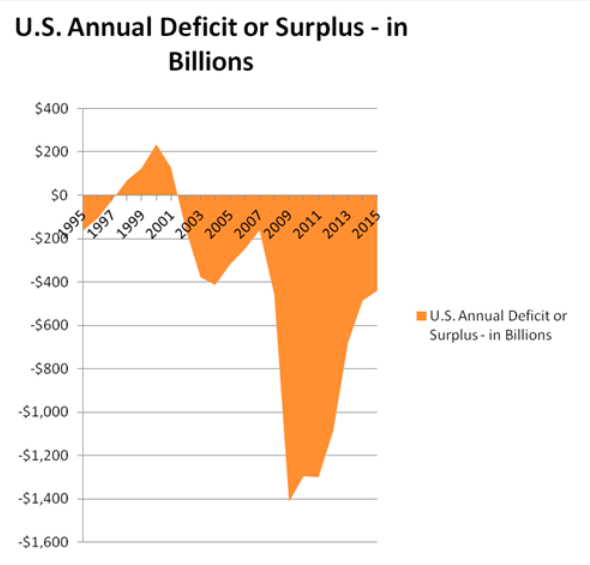

There is another way to look at this data, of course. His first year in office, President Obama inherited a $1.412 Trillion deficit, the largest in history in dollar terms. Keep in mind, federal revenue and expenditures for his first year in office were set under the previous administration. Last year, in 2015, the federal deficit was $438 Billion, representing a 66% reduction from his first year. The chart below tracks the annual deficit or surplus over the last 20 years, and clearly shows the large but quickly-shrinking deficits under President Obama.

So an Obama critic can rightly say ‘he drove up the debt to unprecedented levels.’ And an Obama defender can also rightly say ‘he inherited a huge financial mess, but he righted the ship.’ Many financial pundits focus on the crisis of 2008, and how that affected federal spending under President Obama.

But there is another, much stronger, force at work. The ‘pension plan’ – i.e. Social Security, Medicare and Medicaid, has become the #1 job of the U.S. government. In 1995, federal pension plan spending was $817 Billion, just over 53% of total federal spending of $1.515 Trillion. In 2015, federal pension plan spending was $2.554 Trillion, almost 70% of total federal spending of $3.688 Trillion. In other words, while federal spending more than doubled in 20 years, pension plan spending actually tripled. As the stress on the federal budget increases as more baby boomers retire, the 30% of federal spending that is non-pension plan has been squeezed. Indeed, under President Obama, non-pension spending fell from $1.237 Trillion in 2009 to $1.167 Trillion in 2015. This was likely against his wishes, and was a result of the sequester compromise forced on him by a Republican House in 2012.

From an investment perspective, federal budget predictability is actually increasing, since the pension plan is on autopilot. This is in contrast to the ever-unpredictable political rhetoric. Neither Trump nor Clinton have talked about changing the 70% of federal spending that is the pension plan – so at least 70% of the status quo will be preserved under the next president. Defense spending is over half of the remaining 30%. So most of federal discussion is around the remaining 10-15% of total government spending – the justice department, statistics bureaus, education, the environment etc. A Clinton presidency might result in slight new stimulus for this 10-15% of the federal government, although she would face an uphill battle against a conservative House. A Trump presidency might cut taxes somewhat, providing a small boost to the economy, but nothing significant or lasting.

So we continue to look for investments that can stand on their own, and we continue to recommend our clients stay with patient portfolios, regardless of which way the wind blows this election cycle. Thanks for reading.

This material was prepared by Greg Naylor, and all views within are expressly his. This information should not be construed as investment, tax or legal advice and may not be relied upon for the purpose of avoiding any Federal tax liability. This is not a solicitation or recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. The S&P500, MSCI EAFE and Barclays Aggregate Bond Index are indexes. It is not possible to invest directly in an index. The information is based on sources believed to be reliable, but its accuracy is not guaranteed.

Investing involves risks and investors may incur a profit or a loss. Past performance is not an indication of future results. There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio in any given market environment. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Listed entities are not affiliated.

Data Sources:

- www.standardandpoors.com – S&P 500 information

- www.msci.com – MSCI EAFE information

- www.barcap.com – Barclays Aggregate Bond information

- www.bloomberg.com – U.S. Dollar & commodities performance

- www.realtor.org – Housing market data

- www.bea.gov – GDP numbers

- www.bls.gov – CPI and unemployment numbers

- www.commerce.gov – Consumer spending data

- www.napm.org – PMI numbers

- www.bigcharts.com – NYMEX crude prices, gold and other commodities

- www.federalreserve.org – historical data on 10-year Treasury note

- www.bigcharts.com – chart illustrating index returns

- www.cbo.gov – all government debt and deficit figures

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.