Market Inflections on the Great British Pound

Note that this article was co-written with Larry Footer.

Buy fear and sell greed! How many times have we heard this age old axiom parroted back and forth by pundits and pontificators? It sure sounds easy – but how does one measure things like fear and greed?

At Market Inflections we employ an algorithm developed by a company called Parallax Financial Research which has an uncanny ability to indentify when trends are most likely to begin and end.

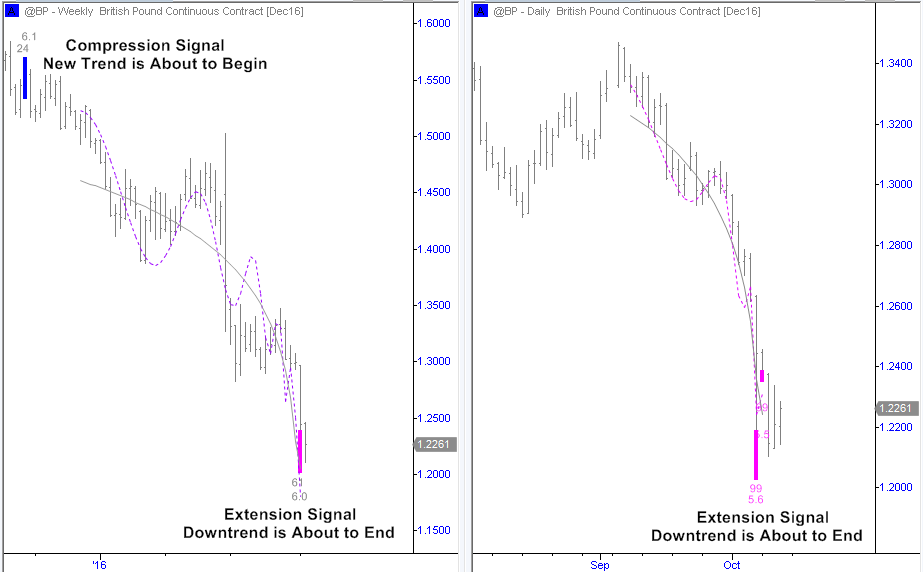

Last week, we noted in our weekly update that this algorithm (which we call Euclid) generated what we call an extension signal on the Great British Pound. This suggests that the current British Pound downtrend is about to come to an end:

In late 2015, Euclid generated a weekly scale compression signal on the (not so) Great British Pound Futures Contract. In January 2016, the currency broke below Euclid’s support level at 1.5100 confirming a new British Pound downtrend had begun and would last for the next 6 to 9 months. Since that time, the Pound has dropped more than 20%. This week, Euclid generated notable bottom signals on the daily and weekly charts of the British Pound Futures Contract which are statistically significant through mid-2017.

In this week’s ExtremeTrading Signals Service weekly report, our conclusion was to “Look for a close above 1.2773 to confirm a change in trend on the daily chart.”

If you would like to read more about what our trading algorithms are saying about other securities such as the S&P 500, Dow, Russell 2000, Gold Miners ETF (GDX), Biotechnology ETF (IBB), etc., then we encourage you to download a complimentary copy of this week’s ExtremeTrading Signals Service report here.

Thanks for reading.

Twitter: @interestratearb @larryfooter

The author may have positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.