It is hard to remember a year that started with as much doom and gloom as 2016.

U.S. stock market indices limped into the year after much nerve-racking volatility in the second half of 2015. The new year started with a broad market sell-off. And within the first few weeks many sectors (energy, materials, emerging markets, healthcare, financials, etc.) were already in bear market territory. As well, the VIX Volatility Index (INDEXCBOE:VIX) was surging and the S&P 500 Index (INDEXSP:.INX) was digging a deep hole.

As always, concerns about the state of the global economy were many and sounded very worrisome:

— Crude Oil was going to $10 or lower according to some loud pundits, and the resulting carnage to energy companies’ earnings and debt was to create a wave of bankruptcies that would also take down the financial system “a la 2008”

— The Chinese “house of cards economy” (actual phrase used by someone) would collapse and all the emerging markets would sink with it into the Pacific Ocean

— US stock market valuations remained in the stratosphere. Combined with the fact that US corporate earnings were negative for several quarters in a row, the moment of reckoning seemed near

— Bonds offered a no-win scenario. The global economy was doomed according to some because of the increasingly negative bond yields and the deflationary spiral. Others worried about a sudden spike in yields and collapse in bond prices caused by the US Fed, a perceived lack of bond liquidity, or both

In addition, there were concerns about the circus that is the perpetual US presidential election cycle, rumblings about some obscure British referendum, and, of course, how can anyone forget ISIS?

Nine Month Scorecard

Given the seeming gathering of the perfect financial storm, it is no wonder a bear market was on everyone’s mind in January, including our own. If you peruse our website you will see an article posted on February 1 asking: “Is This The Start of a Bear Market?”

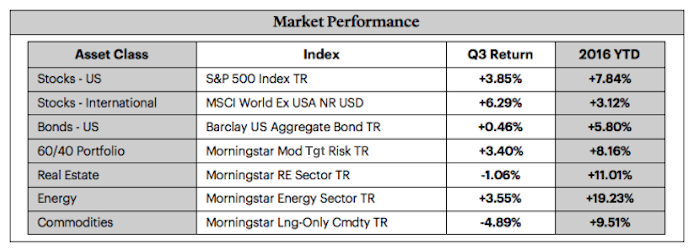

Now that three quarters of 2016 are behind us it is clear that the concerns were either severely overblown or simply bunk as you can see from the tables that follow.

All major asset classes have had a decidedly strong year. US stock market valuations did not stand in the way of the S&P 500 advancing nearly +8%.

Furthermore, and despite the continuous threat of the Fed tightening, US bond prices have risen almost +6%.

As often happens, previous years’ most hated asset classes were this year’s best performers: Energy is up over +19%, while the emerging markets are up around +17% YTD.

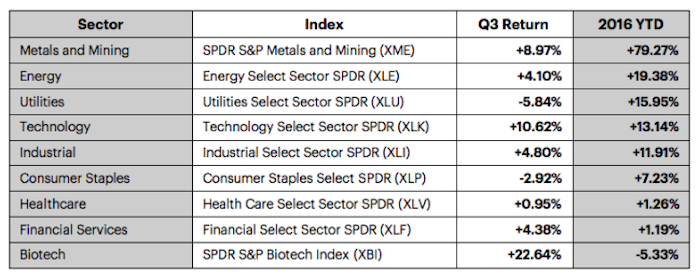

US equity sector breakdown further reinforces the nearly universal strength.

All of the “major” sectors (biotech is not included as it is part of healthcare) are positive on a year-to-date basis and five out of eight are sporting solid double-digit gains.

The metal and mining sector continues its epic mean reversion. After losing roughly -85% of value in the last 5 years, this sector is up almost +80% YTD but still nowhere near its all-time highs.

In terms of quarter-specific performance, Q3 was especially kind to technology (+10.6%) and biotech stocks (+22.6%). Biotech performance is especially noteworthy as it came against a strong headwind of public outcry against certain obscene pricing practices.

During the same period the worst performing sectors were defensive: utilities and staples.

The above may be a signal that the pervasive “risk-off” mode that characterized much of the year may be continuing to lift as we head into Q4.

So, How Did You Do?

In our February article, penned at the nadir of collective pessimism, we commented that the best course of action for any long-term investor was three-fold:

- Have a Plan

- Stick to It (through thick and thin, please)

- Turn off TV/iPhone (i.e. ignore news, headlines, and short-term market fluctuations)

None of this is groundbreaking advice, of course, but for some reason it remains extremely difficult for many to comply.

If you could muster the necessary composure and patience to do it you have every reason to feel triumphant at this time.

On the other hand, if you were scared out of the market in January, February, or after the Brexit vote in June, you have little to show for letting your emotions take over. Put another way, with emphasis:

If you have no investing plan or, worse, your plan relies on reacting to or trying to predict markets’ reaction to events then you are putting your financial future in serious jeopardy

Please keep the above statement in mind as the media is currently jam packed with articles about how “spooky” the financial markets can be in the month of October.

As an example here is a few lines from a Wall Street Journal article published earlier today (October 2, 2016):

“Jittery Investors Are Pulling Back“ – “Some investors are reducing their holdings of popular stock and bond investments, reflecting concerns that high valuations may make them vulnerable to cooling sentiment during the historically volatile month of October.”

Q4 and Beyond

As always, the future is impossible to predict. It is full of uncertain, unknowable, and downright scary things lurking out there.

For this reason, we don’t give much credence to forecasts and prognostication, including our own.

To reiterate, your success as a long-term investor does not and should never depend on your ability to predict the future. Please remember this as you read the paragraphs that follow.

In our opinion, the most significant near-term catalyst for the US equity markets will be the upcoming earnings season. Earnings expectations are predictably subdued, but if history is any guide, the reported earnings will likely to prove better than expected and won’t prove a major threat to market returns.

The state of the US economy remains unchanged. Yes, the economy remains stuck in a frustrating and long low growth phase. However, as long as “growth” is part of it, it is difficult to justify a recession or a bear market.

The US Fed continues to be more bark than bite. While many individual Fed board members may openly talk in the press about the need for immediate interest rate hike, the Fed’s actions have been a lot less hawkish and the actual path of interest rate hikes very gradual.

Perhaps the best clue regarding the likely path of the markets can be gleaned from the markets themselves.

At a high level, price structure of equity markets is unequivocally bullish. Despite the early year weakness, the S&P 500 is now in a technical uptrend above a rising 200 dma trendline. As most technical analysts will tell you this is about as bullish as it gets.

Given the above, it is our opinion that the path of least resistance for equity markets remains up for the time being. If there is indeed any Halloween-season volatility, it will prove to be transitory and we are likely to see further gains into year’s end.

Thanks for reading.

Twitter: @KastelCapital

The author or his clients may hold positions in various securities that are mentioned in this article at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.