Select commodities have done well this year, especially those in the Energy and Precious Metals space. These heavyweights have done enough to push the Thompson/Reuters Commodity Index higher this year.

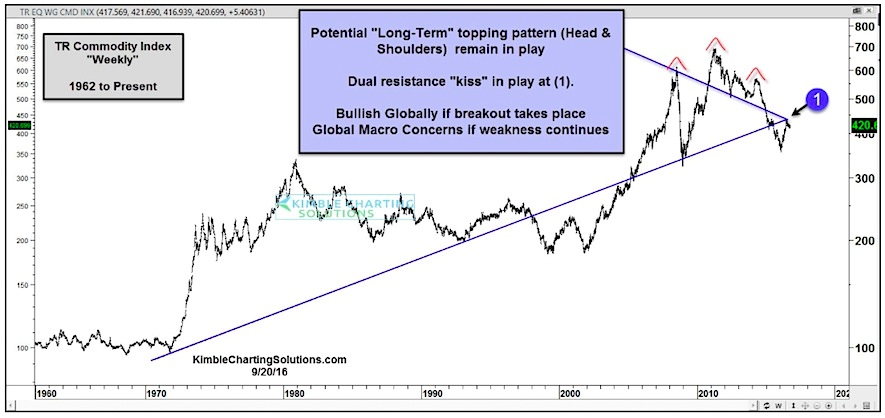

The rally has brought the index back up to an important level: A test of a key long-term support line that was broken last year. That support is now resistance.

The chart of the Commodity Index (below) has nearly 6 decades of price data and highlights an important test.

From a very high level, it’s clear that there is a very ominous “large” head and shoulders topping pattern on the commodity index. This pattern has taken years to form, and is rare in size and stature. This pattern does not mean that a rally cannot take place… or even a pretty good one. But for that to happen, it must first re-take the dual resistance line marked at point (1).

What happens here appears to be pretty important for commodities and related economic assets (including equities). This is especially true when one considers that Central banks around the world are desperately trying to inflate the global economy.

So even if you are not interested in investing in commodities, I humbly believe that we can learn a lot about the global economy (and the market’s appetite for risk assets) by watching how this pattern resolves.

Commodity Index (1960-Present)

Thanks for reading.

Twitter: @KimbleCharting

The author may have positions in related securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.