The S&P 500 Index (INDEXSP:.INX) worked off the damage from last Friday’s -2.45% session and finished last week higher by +0.53%. The bounce higher occurred precisely at the prior 2015 all time highs. And this is all happening days before the much anticipated Federal Reserve policy decision on interest rates this coming Wednesday.

Despite the near-term pickup in volatility and range, there are a number of individual stocks that not only bounced back this week, but also broke out above resistance and took out the prior week’s highs. And I love looking for and trading breakout stocks.

Breakouts from tight ranges are my favorite setups to trade for continuation within established trends. And they tend to be even more powerful when they occur on the longer term weekly charts.

The following setups are from my watch list. They highlight some of my favorite potential breakout stocks over the intermediate term.

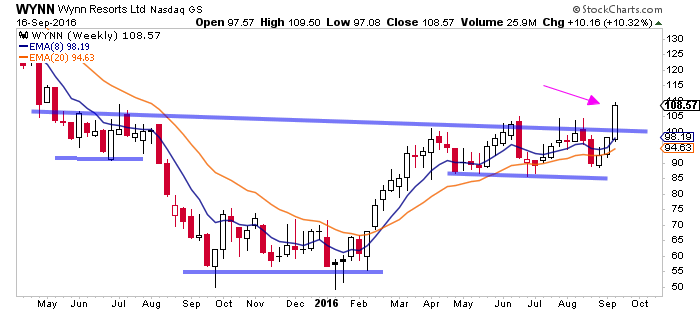

Wynn Resorts, Limited (NASDAQ:WYNN)

WYNN had a powerful 10%+ move this week to new YTD highs setting in motion this inverted head and shoulders pattern as it surged above prior 100 resistance.

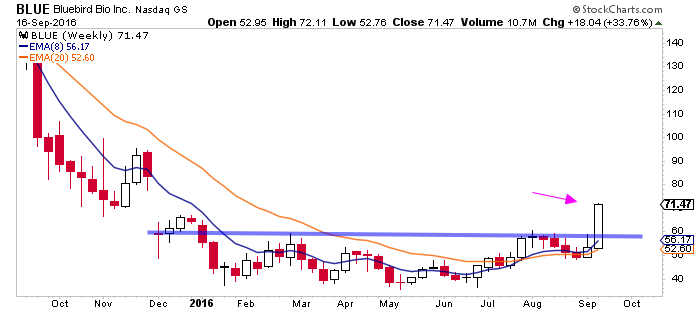

Bluebird Bio Inc. (NASDAQ:BLUE)

BLUE has been beaten up for a couple of years now, but this week we saw the entire biotech sector shine and Bluebird was no exception. It’s a speculative name, but this surged 33% this week to new YTD highs.

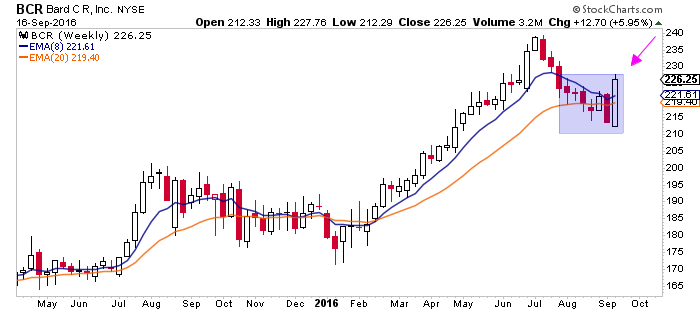

C R Bard Inc. (NYSE:BCR)

BCR put in an impressive engulfing bar that covered the past 5 weeks of trading. BCR has been in a strong long term uptrend and after spending the past several months pulling back, it looks like it finally could be ready to get moving to the upside again.

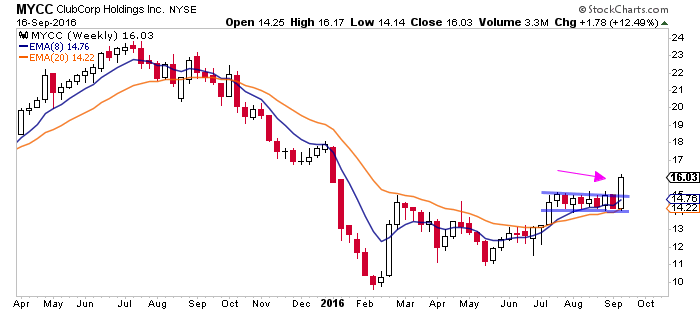

ClubCorp Holdings (MYCC)

MYCC is a younger name that has only been public for a few years now but it had an explosive move higher out of this very tight 1 dollar range. I like it for higher prices over the intermediate term.

I hope these setups give you some ideas for next week, as always thanks for reading and good luck out there. You can check out more of my work at The Trade Risk.

Twitter: @EvanMedeiros

The author does not have a position in any mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.