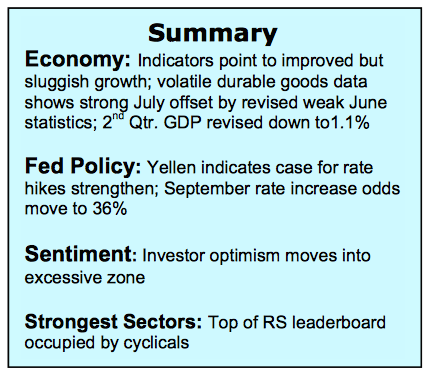

The equity markets declined last week, with the S&P 500 (INDEXSP:.INX) falling 0.7%. The selling was triggered by Federal Reserve Chair Janet Yellen boosting expectations for an interest rate hike at the Jackson Hole Symposium. As a result, the odds of a September interest rate hike doubled to 36%. Looking further out, the possibility of a December interest rate increase jumping to 64%.

Although an interest rate hike directly in front of an election is not unprecedented, it appears unlikely given the current political environment.

Nevertheless, the stock market enters a new week in an overbought condition following the 9% rally since Brexit, and also a difficult period historically as September and October often find the equity markets on the defensive. This week the center of attention will be on Friday’s Employment Report. Consensus estimates are that the U.S. economy generated 200,000 new jobs with the unemployment rate dropping to 4.8%.

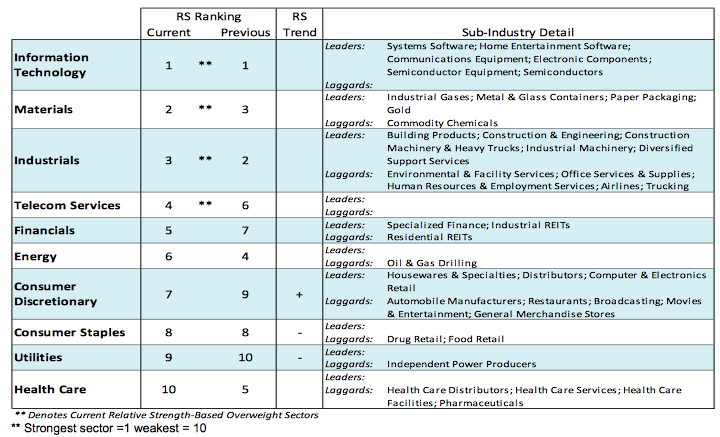

Defensive sectors within the S&P 500 have already corrected 5% to 7% and are expected to lag given the improving prospect of interest rates rising before year-end. The strongest areas of the market include information technology and cyclical areas such as industrials and materials. The financial sector, which has lagged most of the year, climbed in the relative strength ranking last week on the back of potentially higher interest rates that favor lending institutions.

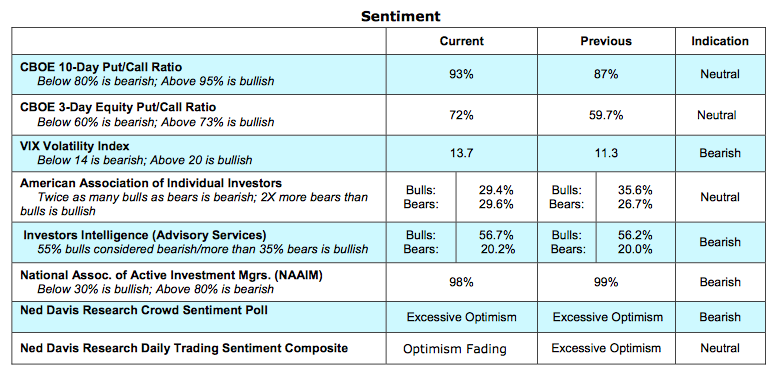

The technical indicators showed further deterioration last week, most notably in the area of investor psychology. Investor sentiment that was unusually pessimistic in February and mid-June, has come full circle with optimism now considered excessive. The latest report from Investors Intelligence, which tracks the advice of Wall Street letter writers, shows the bullish camp rising to 57% from 56% the previous week with the bears at just 20%. The spread between bulls and bears is the widest since February 2015. Equally worrisome is the report from the National Association of Active Investment Managers that shows an allocation to stocks above 90% for four weeks in a row. At the June low, 200 points down on the S&P 500, the allocation was just 25%.

The powerful momentum surge in July has been replaced by nearly a month of sidewise movement in the S&P 500. The loss of momentum, combined with the latest sentiment readings, is problematic for stocks near term. Market breadth remains a positive but here too there has been deterioration with the new high list failing to expand at the recent high. Longer term, breadth remains bullish given that 83% of the industry groups within the S&P 500 are in uptrends, which indicates that most areas are in harmony with the averages. Support for the S&P 500 is considered to be in the vicinity of 2100 to 2130.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.