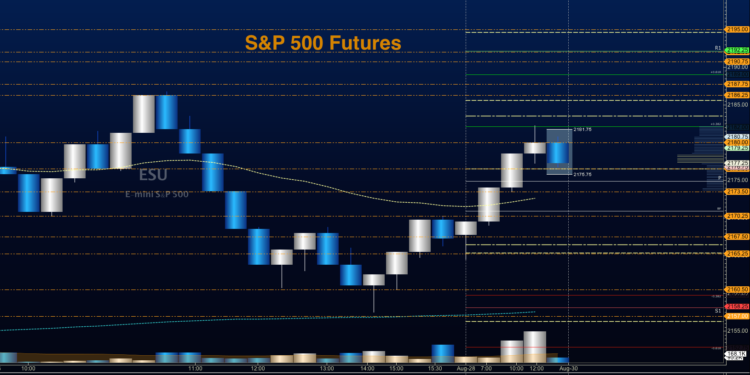

S&P 500 futures are trading a bit lower on Tuesday morning as traders heed the upper and lower boundaries of the recent price range.

The S&P 500 Index (INDEXSP:.INX) moved higher yesterday, pushing the index toward the upper part of the range. But overnight movement on S&P 500 futures finds us fading into congestion regions near 2177. Range bound activity is likely to continue into the latter part of the week. Price support levels hold near 2167.5, with 2165.25 below that. Price resistance sits near 2182.5, with 2186.5 above that. Expansion upward still looks likely, but we face strong overhead supply.

See today’s economic calendar with a rundown of releases.

RANGE OF TODAY’S MOTION

S&P 500 Futures Trading Outlook For August 30

Upside trades on S&P 500 futures – Favorable setups sit on the positive retest of 2181.5, or a positive retest of the bounce off 2170.5 with upward momentum. If we spike downward into 2162.5, it should prove out as a bounce zone, as well. I use the 30min to 1hr chart for the breach and retest mechanic. Targets from 2170.5 are 2172.25, 2175.25, 2177.75, 2181.5, 2183.5, 2186.5, 2189, if we expand, we may stretch above into 2192 and 2194.75. Tight spaces between levels show that the chart is quite congested through the ranges.

Downside trades on S&P 500 futures – Favorable setups sit below the failed retest of 2174.5, or at the failed retest of 2177.5 with negative divergence. We could also see a bounce into 2186.5. An aggressive short could be staged there if divergence is negative. Retracement into lower levels from 2177.5 gives us the targets 2175.5, 2170, 2167.5, 2165.5, 2163.25, 2160.5, 2158.5, and 2154.75, if sellers take over.

If you’re interested in watching these trades go live, join us in the live trading room from 9am to 11:30am each trading day.

Nasdaq Futures (NQ_F)

The NQ_F is bouncing off support Range bound trading seems very likely here, as well. Support levels are congested between 4777.5 and 4780.5, with a potential stretch back into 4768.25. Resistance sits between 4799.75-4807.5, with a congestion level below these regions sitting near 4794-4798.

Upside trades on Nasdaq futures – Favorable setups sit on the positive retest of 4787.5, or a positive retest of 4781.5 with positive momentum. I use the 30min to 1hr chart for the breach and retest mechanic. Targets from 4781.5 are 4785, 4787.5, 4789, 4791.5, 4794.5, 4801.5, 4806.25, 4815.5, 4821.5, 4824.25, and 4829, if buyers hold the rally north.

Downside trades on Nasdaq futures – Favorable setups sit below the failed retest of 4781, or at the failed retest of 4792 with negative divergence. Retracement into lower levels from 4792 gives us the targets 4789.5, 4787.5, 4785, 4780.75, 4777.75, 4772.5, 4768.5, 4764.5, and 4760.5 to 4753.5, if sellers resume control.

Crude Oil

With the API report after the close today, oil holds support levels but is having trouble breaching levels of overhead supply near 47.45 – this will be a watermark level to watch today. Currently support holds at 46.6, and below there, 46.04. Resistance sits near 47.46, with 47.79 above that.

Trading ranges on crude oil futures should hold between 46.6 and 48.09 today.

Upside trades on crude oil can be staged on the positive retest of 47.12, or at a positive retest off 46.9 with positive momentum. I often use the 30min to 1hr chart for the breach and retest mechanic. Targets from 46.9 are 47.12, 47.26, 47.45, 47.6, 47.74, 47.96, and the chance that we see 48.09 to 48.33, if buyers power forward.

Downside trades on crude oil can be staged on the failed retest of 46.88, or at the failed retest of 47.43 with negative divergence. Targets from 47.43 are 47.26, 47.15, 46.9, 46.81, 46.66, 46.46, 46.28, 46.07, 45.98, and 45.81 to 45.57, if sellers push buyers out of the way.

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.