CME CORN AND SOYBEAN FUTURES WEEKLY REVIEW:

Corn and soybean futures prices continued their freefall this week with this summer’s much anticipated La Niña weather event proving to be a complete bust. U.S. corn is silking already at 56% as of July 17th versus 47% in 2015 and the 5-year average of 46%. And with no signs of an extended period of hot and dry conditions on the horizon, Money Managers have continued to aggressively exit previously held corn and soybean long positions. Time is simply running out on the weather to have a potentially negative production impact on either U.S. corn or soybean crops in 2016. One can see the collapse in price on futures charts, as well as the NYSE traded ETFs (NYSEARCA:CORN and NYSEARCA:SOYB).

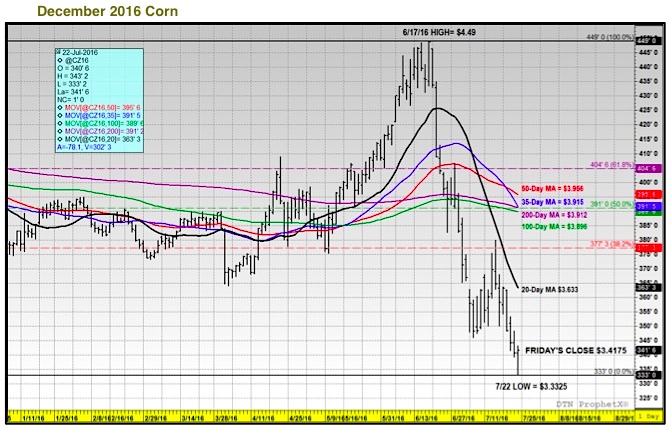

Why are December and November soybean futures continuing to trend lower despite CZ6 already trading more than a $1.00 below its 6/17 day high of $4.49 and SX6 more than $2.00 below its 6/13 day high of $11.86 ¼?

The entire rally in both commodities from April into mid-June was predicated almost entirely on pure weather conjecture. Money managers were taking a calculated bet that the U.S. would experience a return to below-trend yields in corn and soybeans in 2016. Furthermore the combination of a possible La Niña, along with both December corn and November soybean futures already trading at or below breakeven cost of production in early March, made this Bullish wager all the more in enticing and relatively risk free to the downside. It was never about S&D related market fundamentals. 2016/17 carryin stocks and planted acreage estimates were always adequate, if not surplus, relative to recent crop years. Therefore what the markets are experiencing currently is simply a reflection of where both corn and soybean futures probably should have been trading based on the trend-line yields estimates the USDA applied in its initial 2016/17 U.S. corn and soybean forecasts back in the May 2016 WASDE report.

Where will the markets stabilize on this break?

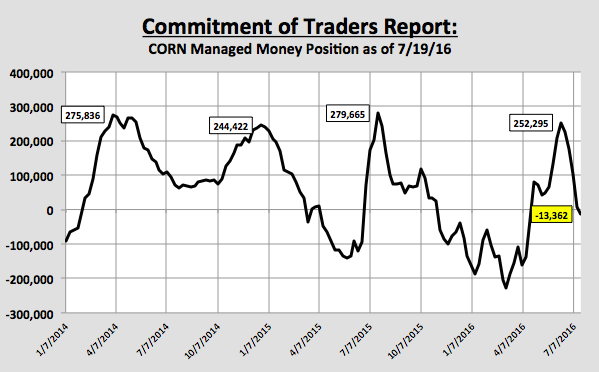

I think December corn futures are closer than November soybeans to finding an intermediate bottom. Friday CZ6 carved out yet another new contract, day low of $3.33 ¼. Meanwhile, September corn futures traded down to $3.26 ¾, which is the lowest the front month contract has traded since October 6th, 2014. Additionally Friday’s Commitment of Traders report showed Money Managers now carrying a net short corn position of -13,362 contracts as of Tuesday’s close. Therefore what was an impressive net long Managed Money position in excess of +250,000 contracts on 6/14 has now been completely neutralized. I’ve mentioned before that in 2014 (the current analog year to 2016), the harvest low in December corn futures was $3.19, which wasn’t established until October 1st. Given CZ6 has now traded to within approximately 14-cents per bushel of that low, more than 2-months in advance of 2014, I’d be surprised if the Money pushed corn futures much lower at this time irrespective of the negative fundamental outlook.

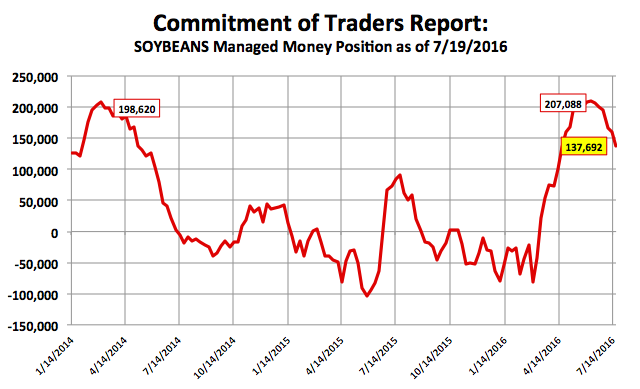

November soybeans are a slightly different story. Conversely, Friday’s Commitment of Traders report showed Money Managers still carrying a sizable net long position of +137,692 contracts, down just -21,714 contracts week-on-week. This would suggest they still have much more to sell to neutralize their long position exposures, which is hard to fathom given SX6 has already broken more than $2.00 per bushel in value since peaking on 6/13. Technically (see page 4 for chart view), SX6 needs to hold the 61.8% Fibonacci retracement, which is $9.893 per bushel. Therefore during Friday’s session, I don’t think it was a coincidence that SX6 tried to battle back on the close to finish within a penny of that key support level (7/22 SX6 close = $9.88 ¼). If on Monday SX6 fails to close convincingly back over $9.89, the next downside target would be the 200-day moving average at $9.531. Can SX6 trade lower than that? Absolutely, let’s not forget whereas CZ6 has already carved out a new contract low on this move, SX6’s contract low is $8.68 from March 2nd.

What’s likely to prevent a sizable upward recovery in either market heading into August?

Good-to-excellent crop ratings in corn and soybeans remain remarkably strong, and with no visible weather threat suggesting those ratings are in danger of moving lower anytime soon, sustaining even minor rallies from current price levels should prove difficult. As of the week ending June 17th, 2016, the U.S. soybean crop was rated 71% good-to-excellent versus just 62% a year ago. Why is the ratings comparison to last year so important? The current record U.S. soybean yield of 48 bpa was achieved in 2015/16. Therefore this year’s soybean crop is currently rated 9% better than last year’s record yield producing growing season. And yet in July, the USDA was still only estimating the 2016/17 U.S. soybean yield at 46.7 bpa. Therefore if the USDA raises the yield in August to a minimum of 48 bpa, total U.S. soybean production would increase to approximately 3,984 million bushels. This type of production increase would move the 2016/17 U.S. soybean carryout up to nearly 400 million bushels.

In corn, the U.S. crop was rated 76% good-to-excellent, equal to 2014’s good-to-excellent rating on 7/20/14 (2014’s growing season is synonymous with the current record U.S. corn yield of 171 bushels per acre). A closer look at the top 5 U.S. corn producing states shows Illinois’s corn crop rated 80% good-to-excellent (versus 81% in 2014), Indiana rated 74% good-to-excellent (versus 76% in 2014), Iowa rated 81% good-to-excellent (versus 77% in 2014), Minnesota rated 82% good-to-excellent (versus 64% in 2014), and Nebraska rated 80% good-to-excellent (versus 76% in 2014). That’s incredible…there’s no Bullish way to spin those ratings. Additionally I can’t create much of a counter-argument to the widespread belief that the U.S. corn yield will also be raised in the August 2016 WASDE report. A 2 bpa increase to the national corn yield in August would increase U.S. corn production by approximately 180 million bushels and push the 2016/17 U.S. corn carryout over 2.260 billion bushels (largest since 1987/88).

The Bulls will continue to try and shift the focus back to strong export demand; however the reality is until the market senses that U.S. corn and soybean yield and production potential has peaked, Money Managers will likely be extremely hesitant to reestablish fresh longs. Furthermore with the USDA already projecting record total U.S. corn and soybean demand for 2016/17; I’m not sure how much more they can raise those usage estimates to offset future yield and production increases. The probability is high then that both U.S. corn and soybean ending stocks will be increased in both the August and September WASDE reports. If either the U.S. corn or soybean yield ultimately prove to not be as good as advertised, those adjustments won’t likely be reflected until real harvest data can be assessed in the October 2016 WASDE report.

Thanks for reading.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

Data References:

- USDA United States Department of Ag

- EIA Energy Information Association

- NASS National Agricultural Statistics Service