It seems the term Fear Index gets thrown around a lot these days, but what do people actually mean by that? Most people are referring to the VIX Index which is a market volatility index created by the Chicago Board Options Exchange (CBOE) that reflects the markets expectations for volatility over the next 30 days. It is calculated by looking at the implied volatilities of numerous S&P 500 puts and calls. In order to calculate the 30 day volatility, the CBOE has to use options from 2 expiry months and blend them.

The CBOE has a whitepaper on their website that details exactly how it is calculated, but basically when uncertainty about future stock market prices is on the rise (fear), the VIX Volatility Index will rise. There is an old saying that goes “When the VIX is low it’s time to go, when the VIX is high it’s time to buy.”

Generally speaking, market shocks such as last week’s Bexit vote can provide a great buying opportunity when fear takes a sudden and sharp rise. A high VIX can also be a fantastic time to start opening option positions that involve net selling such as iron condors and covered calls.

Mark Sebastian and Jim Cramer certainly think last week’s move was overdone and that this latest rally has some legs.

Monday’s 1.8 percent drop in the S&P 500 actually resulted in a lower VIX indicating that the level of panic was diminishing (a potential reversal indicator). According to Sebastian, that is a very rare occurrence and a sign that a bottom was nearing.

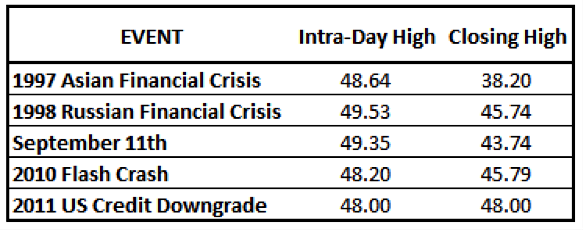

It remains to be seen whether the recent VIX spike to 27 will mark an intermediate term high. In the overall scheme of things, 27 is a lot lower than some other major geopolitical events. Take a look:

Paying attention to the VIX Index and how it is behaving in relation to the major indices can be one way to gain an edge in your trading.

Thanks for reading.

Twitter: @OptiontradinIQ

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.