Welcome to the economic circus that is the Federal Reserve. Here’s a recap of sentiment surrounding Federal Reserve meetings over the last several months…

- The Federal Reserve goes Hawkish (raises interest rates) in December.

- The Federal Reserve goes Dovish (might be lowering interest rates) in March/April

- The Federal Reserve goes Hawkish in May…

Of course that news of them going Hawkish in May was based on minutes that are several weeks old and the recent economic data that has been released since then continues to show an economy that is slowing. And yes, it is possible that the Fed reverses course again and swings back to Dovish in June! Or not! Who knows!

So just to recap for those keeping score at home, in a span of six months the Federal Reserve has gone from hawkish to dovish to hawkish to dovish. I think the only thing that they’ve lost is there credibility!

Is the Federal Reserve attempting to micro manage the economy on a monthly basis? ….using imperfect economic data that is reported on a lag?

So how can we manage money in the midst of this back and forth?

Supposedly, a dovish Federal Reserve is positive for stocks whereas a hawkish Federal Reserve is bad for stocks. So over the last six months, as a money manager, was I supposed to be flip-flopping my portfolio from stocks to bonds back to stocks back to bonds and back to stocks?

I don’t think so!

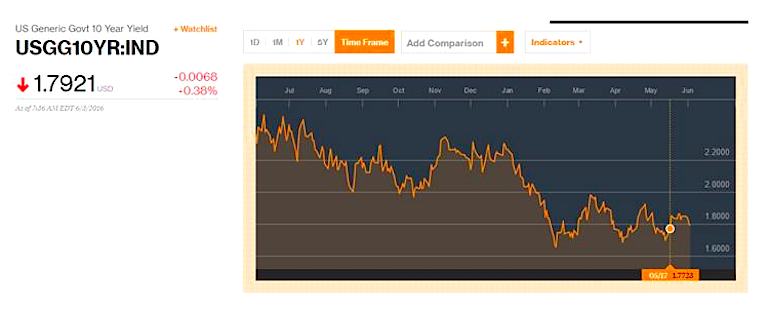

The funny thing is that in the midst of all of this Fed uncertainty, the bond market (based on the 10-year US Treasury) hasn’t moved much at all. Take a look and this chart of the 10-year yields. When the Federal Reserve goes Hawkish and talks about raising interest rates the yield on the 10-year should spike higher; when the Federal Reserve goes dovish it should plunge lower. During the last six months, though, the yield curve hasn’t moved that much at all:

It dropped below 2% shortly after the Fed announced it was raising rates in December—yes, they said they would raise interest rates and the yields went down! And the 10-year has stayed below 2% since then despite the hawkish/dovish changes.

What should that tell us? How should we navigate this?

More from Jeff: Sell In May? Why Investors Are Sailing Into Rougher Waters

I believe the key is to focus on the underlying economic data by measuring whether the economy in general is getting stronger or weaker. And the research that I use shows that globally growth continues to trend lower. The data doesn’t go in a straight line, but the trend of that line is consistent. So, in the midst of uncertainty, I have chosen to sell some of my positions like utilities to lock in some gains and to raise cash amidst uncertainty. I still have not sold off bonds in general because bonds yields should continue to track the economic data.

I will continue to track the Fed and the economic data closely and will adjust my portfolio (and provide updates here) as warranted.

Thanks for reading.

Twitter: @JeffVoudrie

The author holds positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.