I am 51 years old and for most of my life I haven’t really had any hobbies. Over the last year, though, I have discovered that I really enjoy sailing. The power of the wind is incredible and the thought that sails can be used to harness that wind and transfer the energy into forward propulsion seems almost magical.

One big difference riding in a sailboat versus a motorboat is that sailboats lean over as the sails catch the wind. This is known as ‘keeling’. Initially, it feels quite dangerous as the boat starts to roll to the side 45 degrees! It is very unnerving for a lot of people—like my wife! She prefers keeping her feet firmly planted on terra firma. Keeling reduces the drag and helps the boat start to skate across the water. Of course the wind doesn’t always stay constant so the degree of keeling keeps changing.

Well, I feel like I’ve been rambling so let me say something about the financial markets… As you know, I’ve continued to keep my accounts positioned in US Treasury bonds and/or defensive positions that do well in a slowing economy like utilities and/or municipal bonds. The stock market has rebounded some over the last six to eight weeks or so and many of the financial networks are declaring that a new uptrend has started.

But the economic reality tells a very different story. Growth continues to slow.

So the question is whether we hold our present course or do we change our heading and move a significant portion of the accounts back into the stock market? Using a sailboat analogy has the wind shifted direction or, instead, are we just feeling the effect of a gust?

Until we start to see underlying economic growth strengthening in rate of change terms, I expect to maintain the current heading. The goal during these times is to hang on to your treasure and try to pick up some dividends/growth as we can. At the risk of a mixed metaphor, there are times when the potential for a storm is such that a sailboat needs to head into a safe harbor and wait for the storm to pass. That’s my goal right now—we moved out of equities near the high so that we can focus on preserving that wealth so we can then buy back into equities after the storm passes through—and hopefully at lower prices.

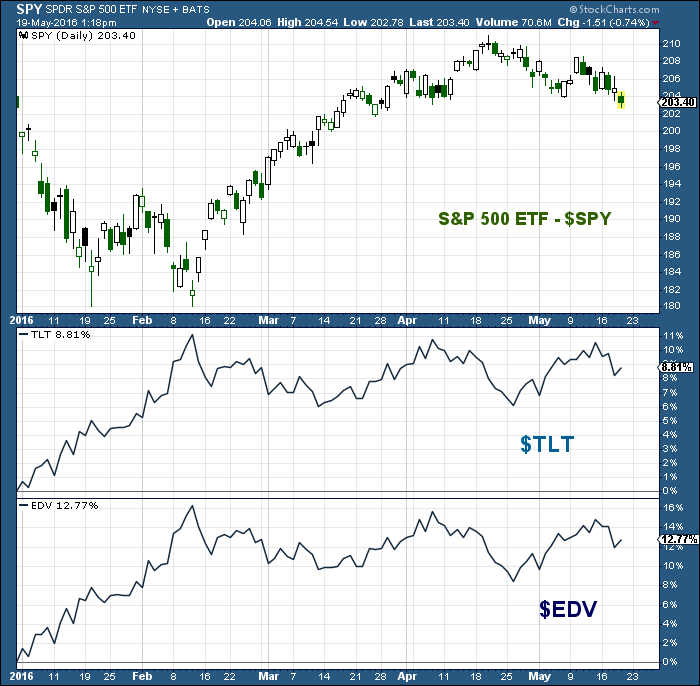

In the meantime, US Treasury bonds continue to out-perform the S&P 500 on both a year-to-date and 1-year basis. Look at this year-to-date chart of the S&P 500 versus EDV (long-term duration US Treasury Bonds ETF) and TLT (the 20+ year US Treasury Bonds ETF):

Overall, my goal is to protect the wealth of myself and my clients, while at the same time focusing on earning a positive return even in tough markets like this one. That may not sound like much, but recently I heard a statistic that only 6% of large cap funds are positive year-to-date! And with several of the major global stock market indexes moving back toward correction territory, this position still seems appropriate. Sometimes slow and steady does win the race… Thanks for reading.

More from Jeff: Stocks Sputter: Is The Fed Pushing On A String?

Twitter: @JeffVoudrie

The author holds positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.