Falling oil prices, China growth fears, submerging markets, Brexit and Italian banks. All of those risks have one thing in common: They have not derailed the US economy. Despite concerns about a recession, it continues to grow at a steady pace. According to the Atlanta Fed, real GDP is expected to grow by 0.7% in Q1 2016. That is not a great number; however, the series is extremely volatile.

It would not be surprising to see growth rebound to 2% or more in the coming quarters. And this could help solidify the positioning of the US Dollar.

Global investors are counting on the US because of lackluster growth elsewhere. Europe is doing fine; however, deflation remains a concern and bank credit growth is turning down. Japan continues to fall in and out of recession. In the emerging markets world, the BRICs are crumbling. Brazil & Russia are suffering due to falling commodity prices while China continues to decelerate. Going forward, rate differentials, relative economic strength and divergent monetary policies should provide support for the US Dollar (USD).

Sentiment & Positioning

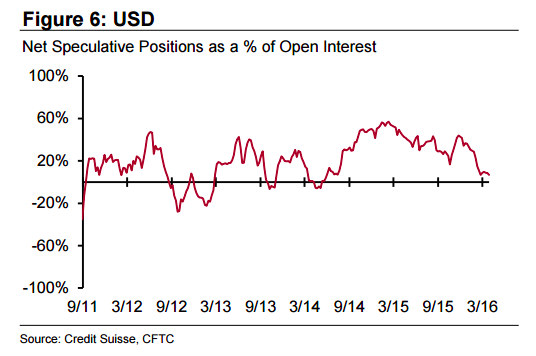

With all that said, as of March 29, the net speculative long position in the USD was 7% of open interest, the lowest it has been since Q2’14. This indicates that speculators are the least bullish they have been in nearly two years.

The US Dollar Index is sitting at 94.62, just above a critical support zone at 93-94. Meanwhile, the Trade-Weighted US Dollar Index has pulled back ~3.4% from its high on Jan20’16. It is hard to tell that long USD is a consensus trade because investors have lost their conviction.

FX, Rates & Monetary Policy

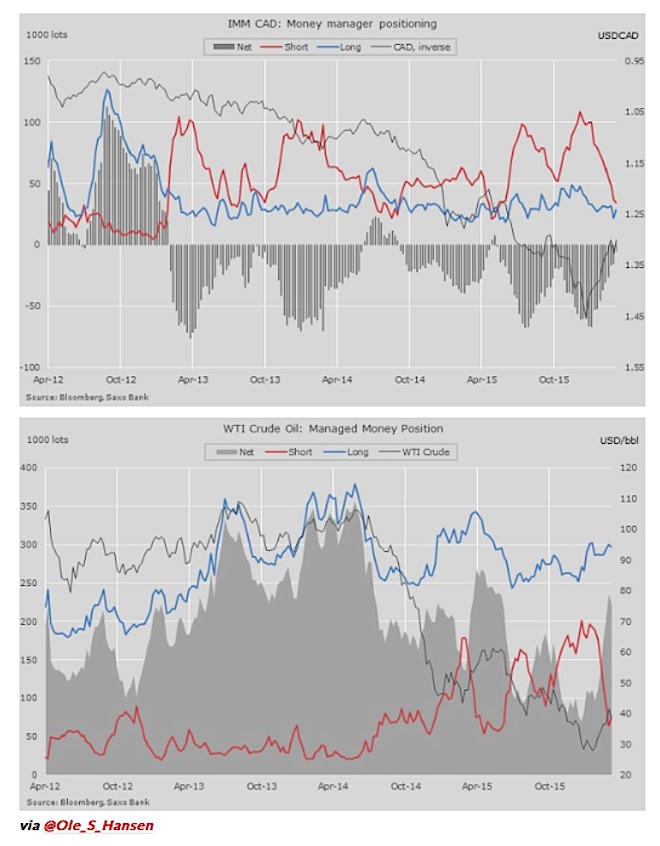

USDCAD: Has fallen to 1.3011 from a high of 1.4692 on Jan20’16. This is a direct result of the relief rally in oil, which has risen to $36.79 from a low of $26.05 on Feb11’16. These moves have not been driven by improving fundamentals. Rather, they are mostly attributable to short covering.

Rate differentials (see the following chart), relative economic strength and divergent monetary policies should support USDCAD in the near term. Also, it is unlikely that the bear market in commodities is over.

continue reading on the next page…