Focus Shifts to Economic Fundamentals

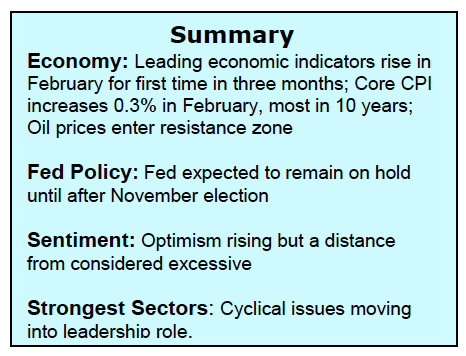

The popular averages suffered the first downtick in six weeks last week with the damage limited to less than 1.00%. Stocks entered the holiday-shortened period sitting on top of a huge 12% gain since February 11 that pushed stocks into a technically overbought condition. We have been consolidating gains and are now watching economic fundamentals more closely.

Although the consolidation phase that began last week could continue into April, we anticipate the rally in the stock market will eventually resume in the second quarter.

Future gains, however, will likely depend on a positive transition from a market dependent on central bank policy to a stock market reflecting improving economic fundamentals and stronger profit visibility in the second half of the year. Fourth-quarter GDP was revised upward last week but corporate profits for the period fell more than 8.0% and more than 5.0% for all of 2015. Forward estimates are that profits will grow 10% in the second half of 2016. Although profit forecasts have proven unreliable the past two years, year-over-year comparisons will be much easier thereby offering a measure of credence to the consensus outlook. Friday’s employment report will be closely followed for indications that the labor markets remain strong. Consensus estimates are that the economy created 200,000 new jobs in March.

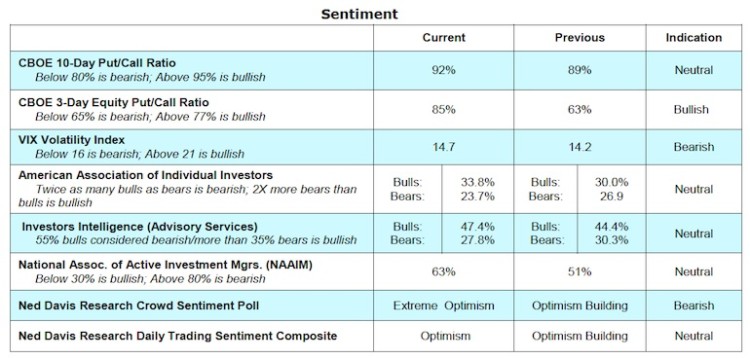

Very near term, the combination of an overbought condition and profit reporting season just ahead is likely to extend the consolidation phase. The February/March rally has carried the popular averages into areas that, for the past two years, attracted increased selling (1975 using the S&P 500 and 17,000 on the Dow Industrials). Stock market volume contracted last week and a significant increase in volume is likely required to overcome the overhead supply. Excessive investor pessimism that fueled the late first-quarter rally is no long present. The sentiment indicators that were bullish on balance five weeks ago have moved to neutral. This can be seen in the latest report from Investors Intelligence (II), which tracks the advice of Wall Street letter writers, showing the most bulls since last summer. As a result we expect the equity markets to remain in a trading range with the risk to 2000 on the S&P 500 and the reward to 2075.

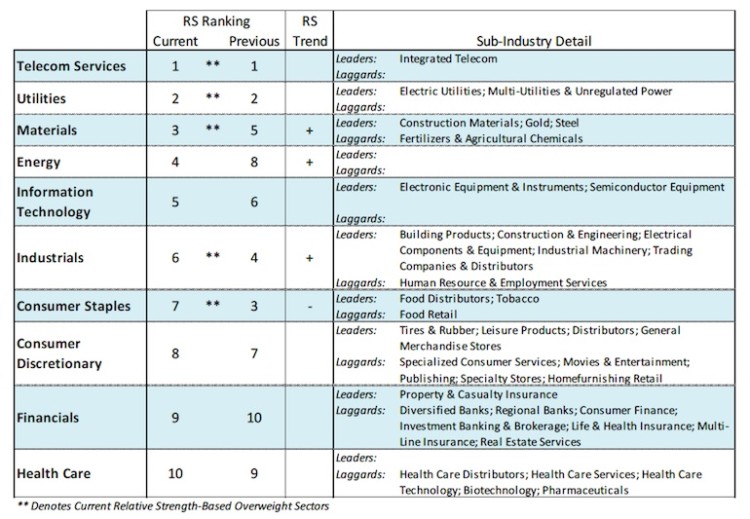

Looking further out, the performance by the broad market in the first quarter has been impressive and much stronger than that experienced off the September low last year. Currently, 82% of NYSE issues are trading above their 10-week moving average. Only 58% of NYSE issues, however, are trading above their 30-week moving average, which needs to improve to 75% to signal a new leg up in the bull market is underway. Since most bull markets are global in scope, the fact that foreign markets are now in gear with Wall Street gives further conviction that the path of least resistance will continue to be to the upside. We are also encouraged by the fact that the rally has expanded beyond defensive sectors to cyclical.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.