Buybacks To Be Put On Hold

Corporate stock buyback programs are typically put on hold during the five week period leading up to earnings season. With the meat of the earnings season coming in April, the buyback blackout period will begin soon. As a reference point, last year Alcoa reported earnings on April 8; this year Alcoa is due to report earnings on April 11. The text below comes from a March 23, 2015 (roughly a year ago) Bloomberg article:

“Blackout periods are on radar screens now because of valuations, the length of the bull market, and the consensus that buybacks have been a major part of the bull market,” Schlanger, head of equities for the Americas at Barclays, said by phone. “With the S&P up around 2,100, people are going to be more attuned to possible fractures or previous areas of support changing than they were at 1,400.”

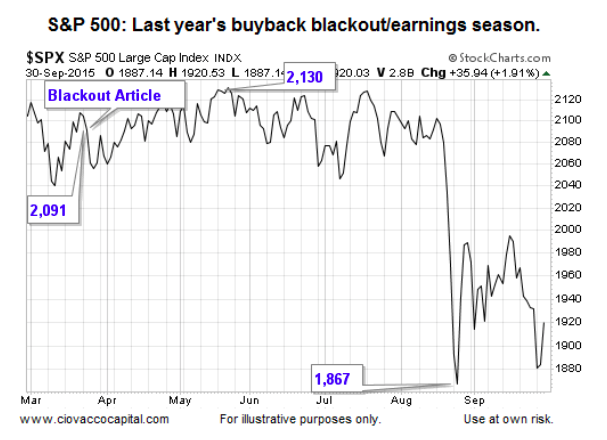

What Happened Last Year during and after the Buyback Blackout Period?

The chart below highlights the date of publication for Bloomberg’s 2015 buyback article. Respecting the chart below represents anecdotal evidence at best, stocks had trouble tacking on gains in 2015 during both the buyback blackout period and earnings season.

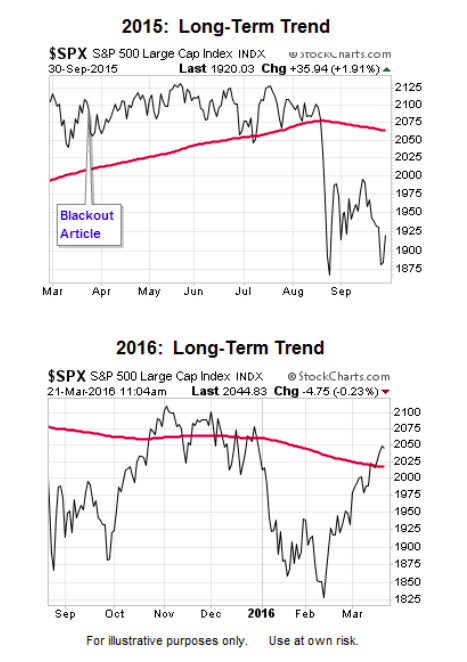

S&P 500’s Trend 2015 vs. 2016

Is the S&P 500 in better or worse shape as we head into 2016’s blackout/earnings period? The slope of the 200-day moving average in 2015 heading into the buyback blackout period was bullish. In 2016, the S&P 500’s 200-day has a negative or bearish slope. From a fundamental perspective, earnings expectations are lower today vs. March 2015.

This week’s stock market video examines the question:

Stocks have staged an impressive five-week rally, but how relevant is the move thus far in the context of longer-term trends?

Buybacks’ Psychological Impact

Given buybacks make up a small percentage of all shares bought on the major U.S. stock indexes, their impact and importance is debatable. It is probably fair to say the psychological impact of buybacks outweighs the supply and demand impact. However, right, wrong, or indifferent, if market participants believe the buyback blackout period is relevant, it may alter behavior. Markets are not always rational organisms.

Given buybacks make up a small percentage of all shares bought on the major U.S. stock indexes, their impact and importance is debatable. It is probably fair to say the psychological impact of buybacks outweighs the supply and demand impact. However, right, wrong, or indifferent, if market participants believe the buyback blackout period is relevant, it may alter behavior. Markets are not always rational organisms.

Investment Implications: The Weight Of The Evidence

If the bulls can push stocks higher this week, evidence related to the longer-term outlook will begin to improve at a much faster rate. While improvement has occurred over the last five weeks, the magnitude of the shift has been relatively tame thus far. Therefore, our market model has not yet called for a shift to our mix of stocks, bonds, currencies, and commodities.

Thanks for reading.

Further reading from Chris: “Stocks Battling Weak Earnings and Technicals“

Twitter: @CiovaccoCapital

Read more from Chris on the CCM blog.

Author or his funds have long positions in related securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.