The following is a recap of The COT Report (Commitment Of Traders) released by the CFTC (Commodity Futures Trading Commission) looking at COT futures data and positions of non-commercial holdings. This recap and analysis uses COT futures data through March 15 (released March 18). Note that the change in COT futures data is week-over-week.

10-Year Treasury Note: Major central banks are in a race as to who can ‘shock and awe’ the markets the most.

On January 29th, Haruhiko Kuroda, Bank of Japan governor, pulled a ‘negative interest rate policy’ rabbit out of his ‘insanely unconventional monetary policy’ hat – taking everyone by surprise.

Then on March 10th, Mario Draghi, European Central Bank president, literally went all in, with a variety of stimulus measures. Markets were expecting some handouts, but Mr. Draghi delivered much more.

This week, it was Janet Yellen’s, Fed chair, turn.

In the middle of last December, when the Fed raised the fed funds rate for the first time in nine years, the FOMC dot plot forecasted four more hikes this year. Three months later, members are now expecting two. In the press conference, Ms. Yellen’s hawkish-to-dovish transformation was palpable.

If she is to be graded by markets’ reaction in the short term, she succeeded. Wednesday through Friday this week, the S&P 500 rose 1.7 percent, and the dollar index dropped two percent on Wednesday and Thursday.

Long-term is anyone’s guess. The Fed is increasingly painting itself into a corner, beholden to the market. For an entity that is married to the virtues of wealth effect, it is having to find newer reasons not to hike. This week, it once again dwelt on risks abroad.

Makes one wonder how long before it will find reasons to add more stimulus.

Albert Einstein is credited with saying “The definition of insanity is doing the same thing over and over again, but expecting different results”. Although there is no hard evidence he actually said it. Whoever said it, the quote applies so well to the Fed, and, of course, the ECB and the BoJ.

COT Futures Data: Currently net long 65.1k, down 3k.

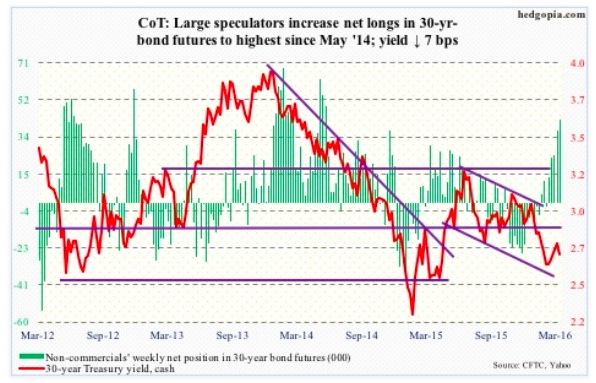

30-Year Treasury Bond: Major economic releases next week are as follows.

Existing home sales for February are published on Monday. January was essentially unchanged month-over-month to a seasonally adjusted annual rate of 5.47 million units, and not that far away from the cycle high 5.48 million last July.

Pending home sales, which tend to lead existing home sales, fell 2.7 points m/m in January to 106. The cycle high of 111.2 was reached last April.

February’s new home sales are due out on Wednesday. January was down 9.2 percent to 494,000 units (SAAR). Still, the 12-month running average was a healthy 500,000, down slightly from the cycle high 503,000 in December.

The advance report on durable goods for February is scheduled for Thursday. Orders for non-defense capital good ex-aircraft – proxy for business capital expenditures – rose 3.9 percent in January to $69 billion (SAAR). Orders have declined year-over-year for 12 straight months. February last year was $67.4 billion; orders remained in the low $70-billion range for months before that. This raises the odds of y/y growth in at least the next few months.

On Friday, the final estimate for fourth-quarter GDP is published. As per the second estimate, real GDP grew one percent – lower than post-Great Recession average of 2.1 percent and substantially below long-term average of 3.2 percent going back to 2Q47.

Also on Friday, corporate profits for the fourth quarter come out. We already know from the Fed’s Z.1 release that profits before tax adjusted for inventory and depreciation fell 10.5 percent y/y to $1.91 trillion (SAAR). Profits peaked at $2.16 trillion in 3Q14.

Five FOMC members are scheduled to speak during weekdays.

COT Futures Data: Currently net long 42.3k, up 5.5k.

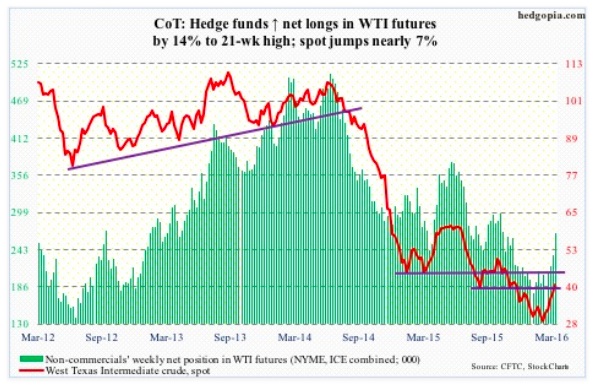

Crude Oil: Spot West Texas Intermediate crude oil broke out of first $38 and then $40. A couple of things helped.

First, until Tuesday, spot WTI was unchanged for the week. Then came the FOMC statement, and the resulting dollar slump. This was a big tailwind for commodities, including oil.

Second, market continues to focus on the positives.

In the week ended March 11th, gasoline stocks dropped another 747,000 barrels to 249.7 million barrels. In the past month, stocks have shrunk by nine million barrels, although from a record high.

Distillate stocks, too, fell – by 1.1 million barrels to 161.3 million barrels.

Crude oil imports fell by 355,000 barrels per day to 7.7 mb/d. Crude oilimports have fallen by 599 b/d in the past couple of weeks.

And, crude oil production fell by 10,000 b/d to 9.1 mb/d. Production reached a record 9.61 mb/d in the June 5th (2015) week.

Refinery utilization fell one-tenth of a percent to 89 – a slight negative.

The biggest negative came in the form of crude oil stocks, which rose by another 1.3 million barrels to a record 523.2 million barrels. Inventory is now up nearly 41 million barrels in the past 10 weeks. Traders for now have decided to completely ignore this data point.

There is increasing optimism that the April 17th meeting in Doha among producers from within and outside OPEC results in output freeze.

Mid-February, Saudi Arabia and fellow OPEC members Qatar and Venezuela agreed with Russia, non-OPEC, to freeze output at January levels. Iran is not going along. Rather, it increased production by 187,800 b/d to 3.13 mb/d last month. Likewise, Saudi Arabia’s output stood at 10.23 mb/d in January. They are all trying to increase production – just in case there is a deal to freeze output.

On Friday, spot WTI was less than a percent away from testing the 200-day moving average, and was rejected. Potentially an important reversal near-term.

In the meantime, the SPDR Energy ETF (XLE) tagged its 200-DMA on both Thursday and Friday, and looks tired.

Non-commercials continue to add net longs – now at 21-week high.

COT Futures Data: Currently net long 267.4k, up 33.2k.

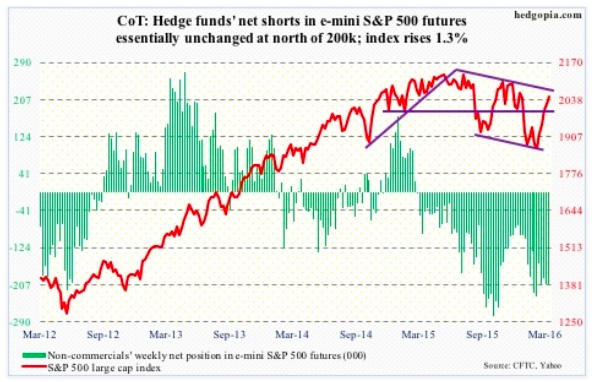

E-mini S&P 500: Some signs of FOMO (fear of missing out) are showing up. Buy-the-dips is persistent, and has worked so far. Most indicators are at extreme complacent readings.

The percent of S&P 500 stocks above 50-day moving average rose to over 93 percent. On January 20th, this dropped below 10, to nine. From one extreme to another! We know how that ended for the bears. And we know how this is going to end for the bulls.

In the week ended Wednesday last week, $4.6 billion moved into U.S.-based equity funds – first inflows in 10 weeks. Turns out it was just a one-hit wonder. This week, there were $2.1 billion in outflows (courtesy of Lipper). With this, since the week ended February 10th, nearly $10 billion has been withdrawn. (The S&P 500 bottomed on February 11th.)

The Lipper data also shows that $35.9 billion left money-market funds this week. This jibes with the ICI data showing a decline of nearly $40 billion in money-market funds in the same week. Not much made it into stocks, as Lipper shows.

That said, the SPDR S&P 500 ETF (SPY) has been attracting funds of late – $3.1 billion in the week ended Wednesday, and $2.4 billion since the S&P 500 broke out of 1950 on March 1st (courtesy of ETF.com).

This week, the S&P 500 took care of 200-DMA, as well as 2040. Momentum is intact, but reversal risk is very high.

COT Futures Data: Currently net short 205.9k, up 290.

continue reading on the next page…