Just last December, Federal Reserve Chairwoman Janet Yellen announced that they were raising interest rates by 25 basis points because the economy was doing well. She also telegraphed (through their ‘dot plot’) that there would be additional 25 basis point increases at each of their meetings over the next two years.

The market didn’t like that and bond yields actually went down on the news (pushing US Treasuries higher); and the stock market dropped roughly 12% between the announcement and February 11th.

Last Wednesday, the Federal Reserve blinked. They decided that the economy wasn’t strong enough to sustain another 25 basis point increase right now. Moreover, they (in the updated ‘dot plot’) signaled that the trajectory of any increases in the future would be slower and longer.

The stock market rallied on the Federal Reserve’s news of no interest rate hike on Wednesday. The stock market has been rebounding the last month ‘off the lows’ set on February 11th. Even after surging for over 3 weeks though, it is only back to where it was at the beginning of the year.

During the Yellen news conference I turned on the TV and saw on a business channel a floor broker ecstatically proclaiming everyone should be buying stocks!

Really?

We should be buying stocks when the economy is losing steam? Keep in mind that floor brokers make money when people buy stocks.

The data doesn’t lie. And I believe it is telling us that we are in a global slowdown. And the U.S. economy (still one of the strongest in the world) is also slowing down. Corporate profits, labor, income, consumer consumption, consumer confidence and consumer credit are all declining. Industrial production (the backbone of any economy) is ACCELERATING to the DOWNSIDE. Housing is slowing with builder confidence at a 9 month low. Costco recently announced same store sales month over month of 0% (no growth). Tiffany’s is warning of sales declines. Inventories are high and rising.

So the Federal Reserve changed course this week and admitted that the economy isn’t doing as well as the previously thought it was. And the Wall Street System cheers it as a time to rush into stocks—we’re off to the races! They are playing the same tune they have been since 2003 when the Fed cut rates to ‘spur’ growth—remember the punch bowl?

I disagree. The truth is that there isn’t ANY central bank around the world that has been successful in spurring actual underlying growth even after extraordinary measures including buying not only government bonds of their country, but CORPORATE bonds as well. Still, their economies barely remain afloat.

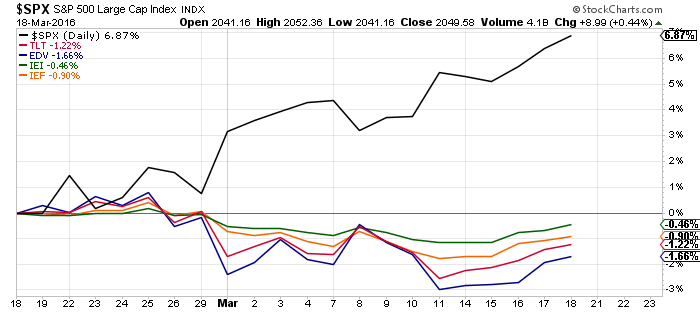

As the stock market moved higher the last month I have been adding to the short positions because the underlying economic data continues to weaken, not strengthen. In other words, I have been wrong the last 3 weeks because as the stock market has ‘surged’ the US Treasury bonds in my client’s accounts have drifted lower as you can see in this chart:

The S&P 500 has surged 6.87% in the past month whereas the US Treasuries are down about 1%. The worst position I have on right now is being short WTI crude oil! I am also down in the positions where I am short the financials, the Russell 2000, the S&P 500 and junk bonds. There is some pain there, but the accounts are still doing well because the positions in municipal bonds, in utilities like Consolidated Edison and Southern Companies and the Utilities Sector are offsetting the weakness in the losing positions.

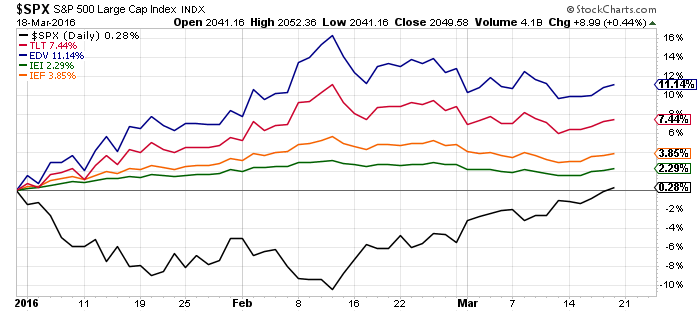

If we zoom out on the above chart and look at it year-to-date we will see that US Treasury bonds continue to out-perform stocks both in terms of performance and the ability to sleep at night (less volatility in bonds than in stocks). The blue link represents the S&P 500 which has finally turned positive year-to-date at 0.28% whereas TLT is up 7.44%, EDV is up 11.14%, IEI is up 2.29% and IEF is up 3.85%.

Although the last few weeks haven’t been as good to bond positions, I expect to generally maintain a positioning based on a slowing economy with the expectations that interest rates and stocks will continue to trend down over the next 3-6 months.

Thanks for reading.

Twitter: @JeffVoudrie

The author holds positions U.S. Treasuries securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.