There are still trees in these woods, but the bulls have got to be feeling a bit better after the latest rally. After another press lower and undercut of the lows, the latest rally has added some much needed.

But there aren’t any free rides, and no one knows for sure if a stock market bottom is in. Understanding that, we have work to do.

So there’s no better way to get caught up on all the market action than by reading “Top Trading Links” and taking in the best of the financial blogosphere.. Enjoy, there are great reads littered throughout.

TRADING INSIGHTS

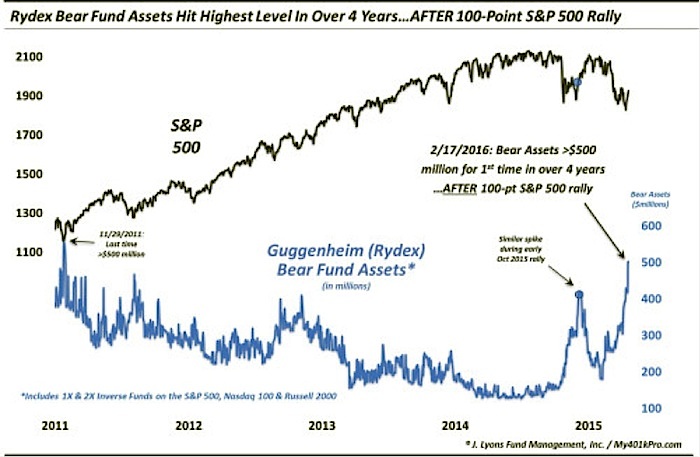

We’re seeing a signal similar to what we saw at the October lows – Dana Lyons

Biotech Stocks look ripe for a counter trend rally – Tom Pizzuti & Kurt Hulse

A technical road map for the Yen – Tom Bruni

A look at the U.S. Dollar’s point and figure chart – Karl Snyder

Testing a Trend Following Approach in the Futures Markets – Adam Grimes

Three Essential Ingredients of Effective Trading Processes – Brett Steenbarger

How to use relative strength during market corrections – Joe Fahmy

Is more evidence and higher conviction a good thing? – Mark Rzepczynski

We’re seeing a huge spike in Gold volatility. What does it mean? – Paban Raj Pandey

INVESTING INSIGHTS

We CAN have a bear market without a recession – David Fabian

By the way, there was 2%+ annualized inflation readings in January’s CPI – Bill McBride

The Ticking Timebomb in China – Kyle Bass

Why the President isn’t all that important – George Friedman

Lessons learned about investing from Carl Icahn – Tren Griffin

OTHER NEWS, RESEARCH, AND IDEAS

The missing link of artificial intelligence – MIT Tech Review

How to work from anywhere – Ben Carlson

What might happen to savers’ deposits if the Fed raised rates – Wesley Gray

SolarCity plans to use Tesla batteries – Bloomberg

Futuristic oddities from the wide world of wearable tech – Dominic Basulto

Could the Eurozone handle negative interest rates? – Ambrose Evans-Pritchard

Thanks for reading and check back next week for another edition of “Top Trading Links”.

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.