One of the most important takeaways from tracking options trading flow on a daily basis is finding important themes in a days, or week’s activity. Often this is seen when a number of names in a certain sector are seeing bullish/bearish flow, trader’s position in the options market well ahead of sector rotations in the underlying stocks. In rare cases there is a common strategy seen, a signal of how the smart money sees the current environment and the best way to utilize options trading to capitalize on it.

The latter was the case yesterday as seven different stocks saw large purchases of March strangles, expecting moves higher in implied volatility and positioning for these stocks to trade outside a wide range. If history is a guide, I would expect to see this activity continue the next few trading sessions, and likely then see markets put in an intermediate peak.

For historic reference this same occurrence was seen last year on two occasions, and tends to last a few days. Back on October 29th to November 3rd I was highlighting sizable December strangles purchases, mostly in large cap stocks such as Pepsi (PEP), General Mills (GIS), Union Pacific (UNP), Microsoft (MSFT), IBM (IBM), Costco (COST) and Honeywell (HON). Interestingly, November 3rd marked the end of a strong move higher in markets and a 4%+ correction followed.

The other occasion in 2015 was from July 22nd to early August when large September strangles were purchased in large caps such as Medtronic (MDT), CVS (CVS), Pfizer (PFE), Royal Caribbean (RCL), MasterCard (MA), Wells Fargo (WFC), American Express (AXP), Caterpillar (CAT), J&J (JNJ), Dow Chemical (DOW) and JP Morgan (JPM). Once again, after this action finished in early August markets topped out and saw a sharp correction into September, making these trading strategies extremely profitable.

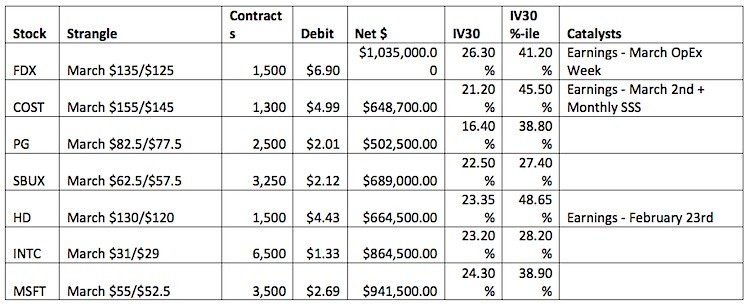

Looking at the names targeted for long strangles today:

The seven names have a few common traits, such as being large caps with liquid options, fairly closely related to consumer strength, and viewed generally as safety blue chip stocks. They include stocks like Costco (COST), Microsoft (MSFT), Starbucks (SBUX), and Home Depot (HD). A few of the stocks on this list still have yet to report earnings, so they have a clear catalyst for a move, while the others do not have a clear catalyst and appear to be more of an overall market view. All of the stocks have relatively low volatility, IV30’s <24.5%, Sigma 1 < Sigma 2 and the 1 year IV30 percentile < 50%. These names are also neither overbought nor oversold with RSI in the 42 to 67 range.

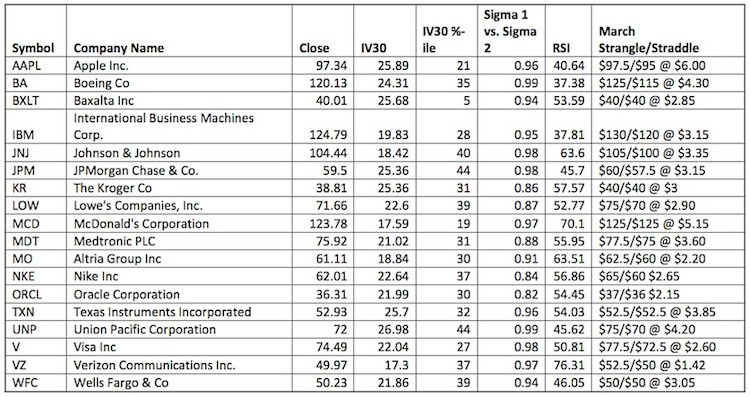

I decided to set up a screen to find similar strangle candidates, and it’s possible these are some of the names that attract large strangle buys for March in coming days. My screen returned 18 names, presented below and I also offered the natural strangle that would be in play, as the ones traded today went around 5.5% to 7% wide (strangle width divided by current price). VZ is the only one that exceeds the RSI requirement, but included it for information purposes.

If you are looking to add a long volatility bias to your portfolio, these names are a good place to start with options trading. Thanks for reading.

Twitter: @OptionsHawk

The author may hold a position in the related security at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.