Option Strategy of the Week:

Massive Risk Reversal in Energy ETF (XLE) Sets up Great Risk/Reward

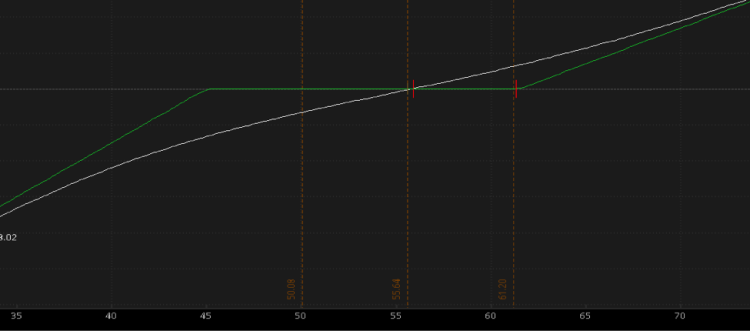

A massive trade observed today in the Energy ETF (XLE) with the June $61.50 calls being bought to open in a range from $1.81 to $2.03 and the June $45 puts being sold to open in the $1.34 to $1.46 range, the risk reversal being done at a 2X3 ratio for 30,000 calls bought and 45,000 puts sold.

The structure of the trade is shown below:

The net of the trade is taking in a credit, so the only risk is being put 4.5M shares of XLE at the $45 level, which would equate to a $200M+ position, so clearly a large institutional trade. The $45 choice for the put strike is interesting as the major measured move target from the chart shown below, a massive top pattern that broke at $70.

If the XLE can continue the recovery that started this week, the trade stands to make a large profit as the calls rise in value and the puts fall.

From a technical perspective, crude oil put in a strong hammer reversal candle on the weekly chart after hitting $27.56 lows mid-week and closing the week above $32. It sets up for a near-term retest of the $35 breakdown, while a move to 6 month trend resistance aligns with the falling 20 week MA at $41.

The top holdings in the Energy Sector ETF (XLE) include XOM, CVX, SLB, VLO, EOG, OXY, COP, PXD, TSO, and PSX in order of weighting, the top 3 accounting for over 40% weighting.

The XLE has a total of 42 holdings with a negative 3-5 year EPS growth outlook, Price/Book at 1.33X and Price/Earnings FY16 at 17.2X, and offering around a 4% dividend yield. The fundamental outlook for Energy remains weak as estimates are coming down sharply as E&P budgets are being slashed, and in the coming weeks these names will all be reporting earnings to give further insight for 2016. Data continues to suggest a worrisome outlook for crude oil prices as supply is rising after all of the US oil production the last few years coupled with OPEC not slowing production as it competes with Iran, as Oil is becoming a geopolitical instrument. On the other side demand as come into question as global growth concerns mount, notably in China, but saw some alleviation this week on global stimulus forecasts.

continue reading on the next page…