It was a tale of two markets this week with selling pressure dominating price action on Wednesday and Thursday morning (established a new contract low in March corn futures at $3.62 ½ on 12/17), only to be followed by an aggressive and abrupt recovery late Thursday afternoon. Let’s assess the likely catalysts for both moves…

On Wednesday, March corn futures did indeed breakout of their recent trading range; however it was not in the direction Corn Bulls had been hoping for (at least initially).

For most of December, March corn futures (CH6) had been consolidating between approximately $3.70 and $3.80 cents per bushel with prices testing the upper end of that range on Tuesday afternoon. However March corn futures proved unable to withstand an onslaught of wide-ranging macroeconomic news flashes released on Wednesday and Thursday a.m. that I would argue were largely bearish to commodities in general and corn specifically. Some of those stories included the following:

- On Wednesday the Fed increased the new target range for the federal funds rate up to 0.25 percent to 0.50 percent versus the previous range of 0 to 0.25 percent; with a separate forecast suggesting a preferred rate of 1.375 percent by calendar year end 2016. This uptick was widely anticipated; however I do believe the reality of it becoming “official” still weighed on commodity values on Wednesday with spillover selling present into Thursday morning. What are the corn specific impacts?

It will increase marginally the cost to borrow money for producers, which invariably raises operating expenses and breakeven price assessments. That said I don’t think the nominal rate increase will in any way deter farmers from their current planted corn acreage intentions for 2016. The additional cost per acre is relatively inconsequential.

The bigger issue longer-term is the influence of the rate hike on the U.S. Dollar. In theory increases to the federal funds rate should offer support to the U.S. Dollar. However with the Dollar Index already trading at historically elevated levels (12-year highs); I’m not necessarily endorsing another wave higher as a result of a ¼ point increase in interest rates. That said I would argue that even minor yet consistent rate increases will make it much more difficult for a near-term downward correction in the Dollar Index. This is the underlying problem for Corn Bulls. A strong Dollar invariably makes U.S. corn exports more expensive to world importers. Therefore despite CME corn futures continuing to trade at a significant discount to the average price from 2011 through 2014, the strength of the U.S. Dollar is offsetting a percentage of this price weakness. This is allowing other key corn export origins (i.e. Brazil and Argentina) to still be more competitive to certain destinations in SE Asia.

- Thursday morning the corn market had to digest the new Argentina administration officially eliminating internal capital controls, which had previously largely prohibited citizens and businesses from buying foreign currencies. The immediate reaction was a swift currency devaluation of 30% with the Argentine peso trading at approximately 14 to one U.S. Dollar (versus the previous fixed rate of 9 to 1). What is the U.S. corn impact?

The combination of a federal funds rate increase in the U.S. coupled with a nearly simultaneous sharp devaluation of the Argentine peso couldn’t have come at a worse time for U.S. corn exports, which are already running at just over 23% behind a year ago as of the week ending December 10th, 2015. Argentina, as I’ve reported in the past is currently forecasted to be the 3rd largest world corn exporter for the 2015/16 marketing year. This devaluation puts Argentina in a position to be even more competitive in that market (especially versus the U.S). Furthermore this doesn’t even include the additional advantage created by new Argentine President Marci eliminating the prior administration’s 20% export tax on corn. The incentives are clearly aligned for farmers in Argentina to begin selling stored corn, as well as, consider expanding their planted corn acreage intentions for 2016.

Therefore Corn Bulls didn’t get any help from the Fed or Argentina…

HOWEVER after establishing a new contract low in CH6 Thursday morning at $3.62 ½, March corn futures abruptly experienced an aggressive momentum shift back to higher values, which carried over into Friday’s session. What triggered the quick trend reversal?

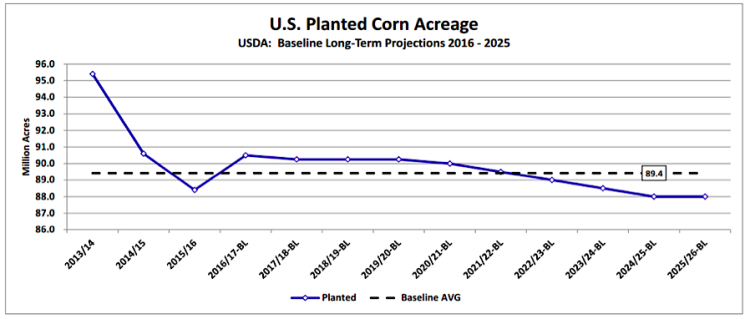

On Thursday just after 11:30 a.m. CST rumors of Informa Economics revised U.S. planted corn acreage forecast for 2016 started making the rounds with sources suggesting Informa had lowered its projection to 88.93 million acres versus its prior estimate of 90.1 million and the USDA’s Baseline projection of 90.5 million. Therefore Informa’s figure was approximately 1.2 to 1.6 million acres below what the market had been anticipating.

Was Informa solely responsible for the recovery?

In my opinion no; however it probably helped neutralize and shift the focus from the negativity and “noise” surrounding the Fed rate increase and Argentina peso devaluation.

continue reading on the next page…